16 Things You Should Never Do With Your Money

Managing money isn’t something most of us learned in school. We figured it out the hard way, through trial, error, and maybe a few painful bank account notifications.

But here’s the thing, some money mistakes can seriously mess up your financial future, and honestly, they’re totally avoidable.

I’ve spent years studying personal finance (yes, I have the degrees to prove it), but more importantly, I’ve lived through some of these mistakes myself. Today, I’m sharing the exact things you should never do with your money if you want to build real wealth and financial security.

Think of this as your friend giving you the honest advice nobody else will. Ready? Let’s get into it.

16 Things You Should Never Do With Your Money

Here’s the truth bomb: knowing what NOT to do with your money is just as important as knowing what to do. These 16 mistakes can quietly sabotage your financial goals, so let’s make sure you’re not falling into these traps.

1. Live Beyond Your Means

This one’s huge, and I see it everywhere. Living beyond your means basically means spending more money than you actually make. Sounds obvious, right? Yet so many people do it without even realizing.

It starts innocently enough. You swipe your credit card for that fancy dinner, grab the latest gadget on a payment plan, or lease a car that eats up half your paycheck. Before you know it, you’re drowning in debt and wondering where all your money went.

Here’s what happens when you consistently spend more than you earn: debt piles up, interest charges multiply, your credit score tanks, and suddenly you’re stuck in a cycle that’s incredibly hard to break. I’ve seen people work two jobs just to maintain a lifestyle they can’t actually afford. That’s not living; that’s financial prison.

The fix? Track every single dollar. I mean it. Use apps like Mint or YNAB to see exactly where your money goes each month. You’ll be shocked at how much those small purchases add up.

Create a realistic budget that prioritizes your needs first, then your wants. And here’s the kicker: if you can’t pay cash for it (except for a house or education), you probably shouldn’t buy it. Period.

2. Ignore Emergency Savings

Not having an emergency fund is like walking a tightrope without a safety net. Sure, you might make it across, but one wrong step and you’re toast.

Life happens. Your car breaks down. You get sick and miss work. The water heater explodes. These aren’t “if” situations; they’re “when” situations. And if you don’t have emergency savings, you’ll be forced to use high-interest credit cards or, worse, payday loans that charge insane rates.

I learned this lesson the hard way when my laptop died right before a major work deadline. No emergency fund meant I had to charge it and spent the next six months paying it off with interest. Never again.

Your goal? Save three to six months of living expenses in a separate, easily accessible savings account. Start small if you need to. Even $500 can prevent a minor inconvenience from becoming a full-blown crisis.

Set up automatic transfers from your checking to your savings account every payday. You won’t even miss the money, and before you know it, you’ll have a solid cushion. Trust me, the peace of mind alone is worth it.

3. Co-Sign Loans Without Caution

Oh boy, this one gets messy fast. Co-signing a loan might seem like a kind gesture to help out a friend or family member, but it’s one of the riskiest things you should never do with your money without serious thought.

Here’s what co-signing actually means: you’re legally promising to pay back the entire loan if the other person doesn’t. And guess what? If they miss payments, your credit score takes the hit too. You could end up paying for a car you don’t drive or a house you don’t live in.

I’ve seen relationships destroyed over co-signed loans. The borrower stops paying, the co-signer gets stuck with the bill, and suddenly Thanksgiving dinner is super awkward.

Before you even consider co-signing: Ask yourself if you can afford to pay the entire loan yourself. Because that’s what might happen. Check the person’s credit history and financial situation honestly. And have a written agreement about expectations and payment plans.

FYI, most financial experts (myself included) recommend just saying no to co-signing. There are other ways to help people without putting your own financial future at risk.

4. Make Emotional Purchases

Ever had a bad day and decided retail therapy was the answer? Yeah, we’ve all been there. But emotional spending is a sneaky habit that can wreck your budget faster than you can say “but it was on sale!”

Emotional purchases happen when you buy stuff to cope with feelings rather than actual needs. You’re stressed, so you order takeout. You’re bored, so you browse online stores. You’re trying to impress someone, so you drop cash on things you can’t afford.

The problem? That temporary high fades quickly, but the credit card bill sticks around. Plus, you end up with a house full of stuff you don’t need or even really want.

Here’s my strategy: Implement the 24-hour rule. If you want to buy something that’s not essential, wait 24 hours. If you still want it after a day, and it fits your budget, go for it. Most of the time, though, the urge passes.

Also, identify your emotional spending triggers. Do you shop when you’re lonely? Stressed? Comparing yourself to others on social media? Once you know your triggers, you can find healthier (and cheaper) ways to deal with those feelings.

5. Neglect Retirement Planning

Retirement feels like a million years away when you’re young, right? Wrong. This is one of the biggest things you should never do with your money: putting off retirement savings.

Here’s the brutal truth: Social Security probably won’t be enough to live on. Company pensions are basically extinct. If you want a comfortable retirement, you need to save for it yourself, starting NOW.

The magic ingredient? Compound interest. When you invest early, your money has decades to grow. A 25-year-old who invests $200 a month will have way more at retirement than a 40-year-old investing $500 a month, even though the older person contributed more money. Time is your biggest asset.

Take action today: If your employer offers a 401(k) match, contribute at least enough to get the full match. That’s literally free money. Open a Roth IRA and set up automatic monthly contributions.

Even $50 a month makes a difference. The key is consistency. Start small if you need to, but start. Your 65-year-old self will thank you profusely.

6. Fall For “Too Good To Be True” Deals

If something sounds too good to be true, it probably is. I know, I know, you’ve heard this a thousand times. But people still fall for scams every single day.

These come in all flavors: investment opportunities promising guaranteed returns, multilevel marketing schemes, cryptocurrency scams, phishing emails claiming you won a prize, and “financial gurus” selling get-rich-quick courses.

Here’s the reality: legitimate investments carry risk. Real wealth is built slowly over time. Anyone promising you’ll double your money overnight is either lying or running a scam.

I almost fell for a “business opportunity” in my twenties that required a $5,000 upfront investment with promises of $10,000 monthly returns. Thank goodness I did my research first and discovered it was a pyramid scheme that had been shut down in three other states.

Protect yourself: Research everything thoroughly. Check the SEC website for registered investment advisors. Read reviews from multiple sources. If someone’s pressuring you to decide quickly, that’s a massive red flag. Walk away.

Remember: protecting your money is just as important as growing it.

7. Rely Solely On Credit Cards

Credit cards aren’t evil, but treating them like an extension of your income? That’s a recipe for disaster.

Using credit cards for everyday expenses when you can’t pay the balance in full each month means you’re essentially taking out a high-interest loan for groceries and gas. Those interest charges add up shockingly fast, turning a $50 purchase into $75 or more.

I’ve worked with people paying $300+ monthly in credit card interest alone. That’s $3,600 a year going straight to the bank for nothing. Imagine what you could do with that money instead.

The smart approach? Use credit cards strategically for rewards and fraud protection, but pay the full balance every month. If you can’t pay it off, don’t charge it.

If you’re already in credit card debt, stop using the cards immediately. Create a payoff plan using either the debt snowball method (paying off smallest balances first) or the debt avalanche method (tackling highest interest rates first).

Need help? Check out this comparison to decide which strategy works best for you.

8. Skip Financial Education

Nobody’s born knowing how to manage money. It’s a skill you learn, and skipping your financial education is like trying to build a house without knowing how to use a hammer.

Financial literacy gives you the power to make informed decisions about budgeting, investing, taxes, insurance, and retirement. Without it, you’re vulnerable to bad advice, predatory lending, and costly mistakes that could’ve been easily avoided.

Think about it: we spend years learning algebra (when was the last time you used that?), but most schools don’t teach basic budgeting or how credit cards work. Wild, right?

Here’s how to educate yourself: Read books like “The Total Money Makeover” by Dave Ramsey or “I Will Teach You to Be Rich” by Ramit Sethi. Listen to podcasts like “The Dave Ramsey Show” or “ChooseFI.”

Take free online courses from platforms like Khan Academy. Follow reputable personal finance blogs and YouTube channels.

The investment you make in your financial education pays dividends for life. Literally.

9. Overlook Insurance Needs

Insurance feels like a waste of money until you desperately need it. Then it’s the best money you ever spent.

Skipping insurance coverage is one of those things you should never do with your money because one accident, illness, or disaster can wipe out years of savings in an instant.

I’ve seen families lose their homes because they didn’t have adequate homeowners insurance. I’ve watched people declare bankruptcy over medical bills because they skipped health insurance to save a few hundred bucks a month.

Essential insurance types: Health insurance (non-negotiable), auto insurance (required by law in most places), homeowners or renters insurance (protects your stuff and liability), life insurance (if anyone depends on your income), and disability insurance (your ability to earn income is your biggest asset).

Yes, insurance costs money. But it’s a safety net that protects everything else you’re working to build. Review your coverage annually to make sure it still matches your needs. Life changes, and your insurance should change with it.

10. Spend To Impress Others

Keeping up with the Joneses is exhausting and expensive. And guess what? The Joneses are probably broke too.

Spending money to impress others, whether it’s designer clothes, fancy cars, or lavish vacations you post on Instagram, is a fast track to financial stress. You’re literally trading your financial security for the approval of people who, honestly, aren’t thinking about you as much as you think they are.

Social media has made this worse. Everyone’s posting their highlight reel, making it seem like they’re living their best life 24/7. But you’re not seeing the credit card debt, the stress, or the financial reality behind those perfect photos.

Here’s a secret from my years in finance: truly wealthy people often don’t look wealthy. They drive reliable cars, live in modest homes, and spend way less than they earn. They’re focused on building real wealth, not the appearance of wealth.

Shift your mindset: Define success on your own terms, not society’s. Align your spending with your values and goals, not what impresses others. The confidence that comes from financial security beats any designer label.

11. Delay Investing

“I’ll start investing when I have more money” is one of the most expensive lies people tell themselves.

Delaying investing, even by just a few years, costs you tens or even hundreds of thousands of dollars in potential growth. Thanks to compound interest, time is literally money when it comes to investing.

Let me break this down: If you invest $200 monthly starting at age 25 with an average 8% return, you’ll have about $700,000 by age 65. Wait until 35 to start? You’ll have around $300,000. That ten-year delay cost you $400,000. Ouch.

Many people avoid investing because it seems complicated or risky. But leaving your money in a regular savings account is actually riskier in the long run because inflation slowly eats away at your purchasing power.

Start simple: Open an account with Vanguard or Fidelity. Invest in low-cost index funds that track the overall market. Set up automatic monthly contributions, even if it’s just $50.

You don’t need to be an expert or have thousands of dollars. You just need to start. The best time to invest was yesterday. The second best time is today.

12. Put All Eggs In One Basket

Concentrating all your money in one investment is gambling, not investing. And it’s definitely one of the things you should never do with your money.

Maybe you’re super confident in a single stock. Maybe you think real estate is the only way to build wealth. Maybe you’ve heard crypto is the future. Whatever it is, putting all your money in one place exposes you to massive risk.

If that one investment tanks (and it can), you lose everything. No do-overs. No second chances. Just gone.

Diversification is your protection against this risk. By spreading your money across different types of investments (stocks, bonds, real estate, international markets), you reduce the impact of any single investment performing poorly.

Think of it like this: If you have ten investments and one fails, you lose 10% of your portfolio. If you have one investment and it fails, you lose 100%. Pretty simple math.

A well-diversified portfolio might include domestic stocks, international stocks, bonds, real estate investment trusts (REITs), and maybe some alternative investments. Index funds and ETFs make diversification easy and affordable for regular investors.

13. Neglect Credit Reports

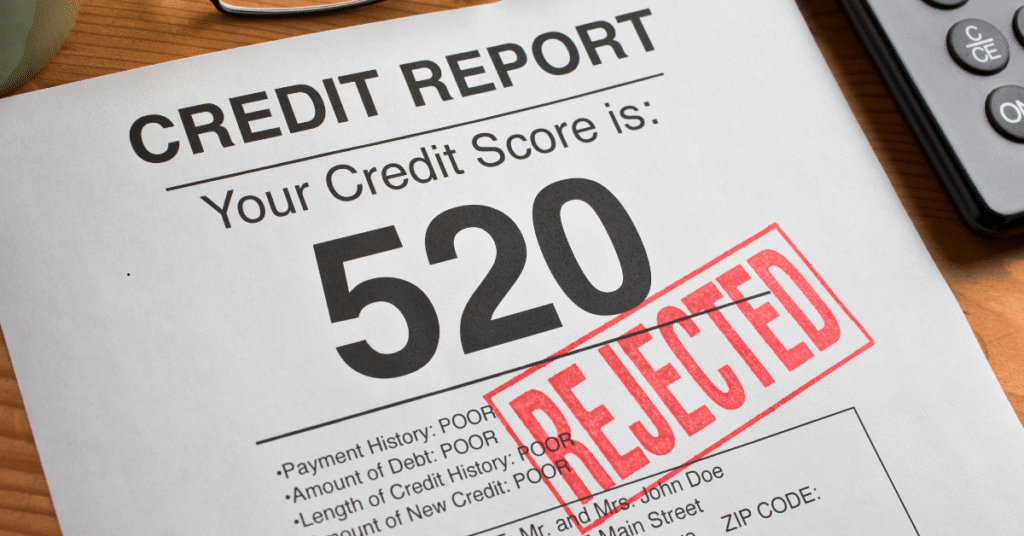

Your credit report is like your financial report card, and ignoring it is a huge mistake.

This three-digit number (your credit score) affects your ability to get loans, rent apartments, and sometimes even land jobs. It determines the interest rates you’ll pay on mortgages, car loans, and credit cards. A good score can save you tens of thousands of dollars over your lifetime.

But here’s the problem: credit reports often contain errors. Identity theft happens. Old debts that should’ve been removed stick around. And if you’re not checking, you won’t know until you apply for a loan and get rejected.

I discovered a fraudulent credit card on my report during a routine check. Someone had opened an account in my name and racked up $3,000 in charges. Because I caught it early, I was able to dispute it and prevent serious damage to my credit.

Take action: Check your credit report from all three bureaus (Equifax, Experian, and TransUnion) at least once a year. You can do this free at AnnualCreditReport.com.

Review every line carefully. Dispute any errors immediately. Monitor your credit regularly using free services like Credit Karma or Credit Sesame.

14. Ignore Debt Repayment

Ignoring your debt won’t make it go away. In fact, it makes it grow. Interest compounds, fees add up, and suddenly that $5,000 debt is $8,000.

Making only minimum payments on credit cards is particularly brutal. A $3,000 balance at 18% interest with minimum payments will take you over 10 years to pay off and cost you nearly $3,000 in interest. You’ll pay double what you originally borrowed!

Debt creates stress, limits your options, and prevents you from building wealth. Every dollar going to interest is a dollar that can’t be invested or saved for your goals.

Create a debt payoff strategy: List all your debts with balances, interest rates, and minimum payments. Choose either the debt snowball method (paying smallest balances first for psychological wins) or the debt avalanche method (paying highest interest rates first to save money).

Throw every extra dollar at your debt. Cancel subscriptions you don’t use. Sell stuff you don’t need. Pick up a side hustle. Getting out of debt requires intensity and focus, but freedom on the other side is absolutely worth it.

Consider debt consolidation or balance transfer cards if you qualify for better rates, but only if you’re committed to not adding new debt.

15. Avoid Budgeting

“Budgets are restrictive and boring.” I hear this all the time, and honestly, it drives me crazy. You know what’s actually restrictive? Being broke and stressed about money all the time.

A budget isn’t about limiting your life; it’s about taking control of your money so you can spend on what matters most to you. It’s a plan that tells your money where to go instead of wondering where it went.

Without a budget, you’re flying blind. You have no idea if you’re overspending, where you could cut back, or how much you can actually afford to save or invest. It’s like trying to lose weight without ever tracking what you eat.

Creating a budget is easier than you think: Track your income and expenses for a month to see your baseline. Categorize your spending (housing, food, transportation, entertainment, etc.). Allocate your income to these categories based on your priorities and goals.

Use the 50/30/20 rule as a starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Adjust as needed for your situation.

Apps like EveryDollar or PocketGuard make budgeting simple. Review and adjust your budget monthly. It’s not set in stone; it’s a flexible tool that evolves with your life.

16. Invest Without Understanding

Jumping into investments without understanding what you’re doing is like performing surgery after watching a YouTube video. Sure, you might get lucky, but you’ll probably make a mess.

I’ve seen people lose thousands in crypto because they bought at the peak without understanding market cycles. I’ve watched folks invest in individual stocks based on hot tips from friends, only to watch their money evaporate. I’ve met people who invested in real estate without understanding the local market or calculating actual returns.

Investing without knowledge makes you vulnerable to scams, bad advice, and emotional decisions that destroy wealth instead of building it.

Before investing a single dollar: Understand basic investment concepts like risk tolerance, asset allocation, diversification, and compound interest. Learn about different investment vehicles (stocks, bonds, mutual funds, ETFs, real estate) and how they work.

Know the fees you’re paying because high fees eat into your returns significantly over time. Understand tax implications of different investment accounts (traditional IRA vs. Roth IRA, for example).

Read books, take courses, or work with a fee-only financial advisor who acts as a fiduciary (meaning they’re legally required to act in your best interest). NAPFA is a good resource for finding fee-only advisors.

Investing is one of the best ways to build wealth, but education must come first. Knowledge protects your money and helps it grow.

Final Thoughts

Look, managing money doesn’t have to be complicated, but it does require intentionality. These 16 things you should never do with your money aren’t just random tips; they’re the difference between financial stress and financial freedom.

I’ve seen people transform their entire financial lives by simply avoiding these common mistakes. It’s not about perfection. You’ll still make mistakes (we all do), but avoiding these big ones will save you years of struggle and thousands of dollars.

Start with one area where you know you’re slipping. Maybe you don’t have an emergency fund, or you’ve been putting off retirement savings, or you’re making emotional purchases you regret. Pick one thing and commit to fixing it this month.

Financial security is built one smart decision at a time. It’s the daily choices, the small disciplines, and the commitment to learning that create lasting wealth. You’ve got this.

Now stop reading and take action. Your future self is counting on you. 🙂