12 Signs You Are Good With Money

Most of us walk around wondering if we’re actually crushing it financially or just pretending while our bank account silently judges us.

I’ve been there, staring at my budget spreadsheet at 2 AM, questioning every life choice that led me to buy that third pair of shoes I didn’t need.

Here’s the thing though: knowing whether you’re good with money isn’t always obvious. You might be doing way better than you think, or maybe you’ve got some blind spots you haven’t noticed yet. Either way, I’m here to help you figure it out.

So grab your coffee, and let’s talk about the real signs that show you’re actually winning at this whole money thing. Trust me, by the end of this, you’ll know exactly where you stand.

What Does It Mean To Be Good With Money?

Before we jump into the signs, let’s clear something up. Being good with money doesn’t mean you’re rolling in cash or living like a minimalist monk who eats rice and beans every day. Nope.

Being good with money simply means you’re making smart choices that move you forward financially. You’re spending intentionally, saving consistently, and planning for the future without losing your mind in the process.

It means you’ve got control over your finances instead of letting your finances control you.

Think of it like this: you’re the driver, not the passenger. You’re making deliberate decisions about where your money goes, and you’re building a safety net that lets you sleep peacefully at night. That’s what we’re aiming for here.

How To Know If You’re Good With Money: Top 12 Signs

Alright, let’s get into the good stuff. Here are twelve solid signs that prove you’re handling your money like a boss. See how many boxes you can check off.

1. You Have A Steady Flow Of Income

This one might seem obvious, but hear me out. Having a steady income isn’t just about getting a paycheck every two weeks. It’s about knowing that money is consistently coming in to cover your bills and then some.

I remember when I first started freelancing. My income was all over the place, like a financial roller coaster I didn’t buy a ticket for.

Some months were great, others had me eating instant noodles and pretending it was a lifestyle choice. But once I figured out how to create consistent income streams, everything changed.

Whether you’re working a 9-to-5, running your own business, or juggling side hustles, the key is consistency. When you’ve got reliable income flowing in, you can actually plan ahead instead of just reacting to whatever financial crisis pops up next.

The best part? Steady income gives you the foundation to build wealth. You can save more confidently, invest regularly, and work toward those big financial goals without constantly worrying about where next month’s rent is coming from.

2. You Have A Good Spending Pattern

Let me ask you something: do you know where your money goes each month? And I mean really know, not just a vague idea that involves “stuff” and “things.”

Having a good spending pattern means you’re living within your means. You’re not maxing out credit cards to fund a lifestyle you can’t actually afford. You’re making conscious choices about what deserves your hard-earned cash and what doesn’t.

I used to be terrible at this. My spending pattern looked like a toddler drew it with crayons. Random purchases here, impulse buys there, and somehow I’d reach the end of the month wondering where everything went. Sound familiar?

But here’s what changed for me: I started tracking every single expense for one month. Yeah, it was annoying. But it was also eye-opening. Turns out, I was spending way too much on takeout and subscriptions I forgot I had.

When you’ve got your spending under control, you’re not constantly stressed about money. You know what you can afford, you stick to it, and you don’t wake up with buyer’s remorse after every shopping trip. That’s the sweet spot.

3. You Save Money Regularly

Saving money isn’t sexy. Nobody’s out here bragging about their savings account at parties (and if they are, maybe find new parties). But you know what is sexy? Financial security. Peace of mind. Options.

If you’re consistently putting money aside, even if it’s just a small amount, that’s one of the clearest signs you’re good with money. It shows you understand delayed gratification and you’re thinking beyond just today.

I’ll be honest, when I first started working, saving felt impossible. After rent, groceries, and all my other expenses, there was barely anything left. But I started small, just $50 a month. Then $100. Then I automated it so I wouldn’t even see the money before it went into savings.

Fast forward a few years, and that habit completely changed my financial situation. Suddenly I had money for emergencies, for opportunities, for things I actually cared about instead of random impulse purchases.

Whether you’re saving for retirement, a house, your kid’s education, or just a rainy day, the act of saving itself proves you’re playing the long game. And that’s exactly what financially savvy people do.

4. You Plan For Retirement

Okay, I know retirement sounds like something your parents worry about, not you. But here’s a reality check: future you is going to be really grateful (or really annoyed) depending on what present you does right now.

Planning for retirement early is one of those things that separates people who are good with money from people who are just winging it. And honestly? The earlier you start, the easier it is.

When I got my first real job, I was so excited about finally having money that retirement was the last thing on my mind.

But a mentor sat me down and explained compound interest in a way that actually made sense. Basically, the money you invest now has decades to grow, which means you don’t have to stress as much later.

So I started contributing to my 401(k), even though it was just 5% of my paycheck. It didn’t feel like much at the time, but over the years, watching that account grow became seriously motivating.

If you’re already putting money toward retirement, give yourself a pat on the back. If you haven’t started yet, today’s a great day to begin. Open that retirement account, set up automatic contributions, and let time do the heavy lifting for you.

5. You Are Prepared For Emergency Costs

Life has a funny way of throwing curveballs right when you least expect them. Your car breaks down. Your laptop dies. Your dog eats something weird and needs an emergency vet visit. (True story, by the way.)

Being prepared for these moments is a massive sign you’re good with money. And the way you prepare? An emergency fund.

I can’t stress this enough: an emergency fund is not optional. It’s the financial equivalent of wearing a seatbelt. You hope you never need it, but you’ll be really glad it’s there when things go sideways.

Most experts recommend saving 3-6 months’ worth of expenses. I know that sounds like a lot, but you don’t have to do it overnight. Start with $500, then $1,000, and keep building from there.

Having an emergency fund means you won’t have to reach for a credit card when life happens. You’ll have cash ready to handle whatever comes your way, and that kind of security is priceless. Trust me, the first time you use your emergency fund instead of going into debt, you’ll feel like a financial superhero.

6. You Budget Your Income

Budgeting gets a bad rap. People think it’s restrictive or boring, like putting your money on a diet. But here’s the truth: a budget is actually freedom.

When you have a budget, you’re telling your money where to go instead of wondering where it went. You’re making intentional decisions about your priorities, and you’re way less likely to overspend or forget about important expenses.

I resisted budgeting for years because I thought it would be too complicated or time-consuming. Then I finally gave it a shot, and honestly? It was a game-changer. Suddenly I could see exactly what was coming in and going out, and I could make adjustments before problems happened.

There are tons of budgeting methods out there. The 50/30/20 rule, zero-based budgeting, envelope method, whatever works for your brain. The important thing is just having some kind of system.

If you’re already budgeting, you’re ahead of most people. If you’re not, start simple. Track your income and expenses for one month, then create categories and set limits. You can always adjust as you go.

7. You Are A Step Closer To Your Financial Goals

Here’s a question: what are your financial goals? And more importantly, are you actually working toward them, or are they just nice ideas floating around in your head?

One of the clearest signs you’re good with money is that you’re making measurable progress toward your goals. Maybe you’re saving for a house and you’ve already got 20% of your down payment.

Maybe you’re working on paying off debt and you’ve knocked out two credit cards. Maybe you’re building your investment portfolio and it’s growing steadily.

Whatever your goals are, seeing yourself get closer to them is incredibly motivating. It proves that your efforts are paying off and that you’re not just treading water financially.

I set a goal a few years ago to save $10,000 for a trip I’d been dreaming about. Every month, I put money aside, and I tracked my progress. Watching that number climb was addictive in the best way.

When I finally hit that goal, the sense of accomplishment was almost as good as the trip itself. (Almost.)

Take a moment to recognize your progress, no matter how small it seems. You’re building momentum, and that’s what creates lasting financial success.

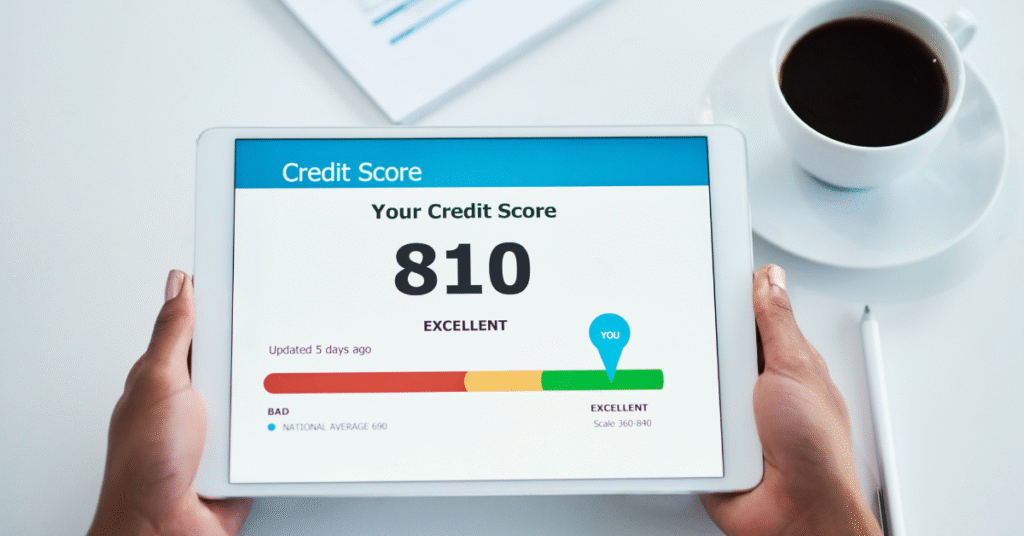

8. You Have A Good Credit Report

Your credit report might not be something you think about every day, but it matters more than you might realize. It affects whether you can get a loan, what interest rates you’ll pay, and sometimes even whether you can rent an apartment or get certain jobs.

Having a good credit score is a sign that you’re managing your debts responsibly. You’re paying bills on time, you’re not maxing out credit cards, and you’re showing lenders that you’re trustworthy.

I didn’t pay much attention to my credit score when I was younger, and I definitely made some mistakes that came back to haunt me. Late payments here, maxed-out cards there, and suddenly my score was lower than I wanted it to be.

But once I started being intentional about it, things improved. I set up automatic payments so I’d never miss a due date. I kept my credit utilization low. I checked my credit report regularly to make sure there weren’t any errors.

If your credit score is in good shape, that’s excellent. If it needs work, don’t panic. There are concrete steps you can take to improve it over time. Pay your bills on time, reduce your debt, and be patient. Your future self will thank you when you’re applying for a mortgage or car loan.

9. You Do Not Have Any Credit Card Debt

Let’s talk about credit cards for a second. They’re useful tools when used responsibly, but they can also be financial quicksand if you’re not careful.

If you’re living without credit card debt, that’s a huge sign you’re good with money. It means you’re either not using credit cards at all, or you’re paying them off in full every month so you’re not getting hit with interest charges.

Credit card debt is sneaky. It starts small, maybe just a balance you’ll “pay off next month.” But then next month comes, and you add a little more, and before you know it, you’re paying hundreds of dollars in interest every year on stuff you probably don’t even remember buying.

I’ve been there. I once carried a balance for way too long, and watching the interest pile up was painful. When I finally committed to paying it off and staying out of credit card debt, it felt like a weight lifted off my shoulders.

If you don’t have credit card debt, keep it that way. If you do, make a plan to pay it off as quickly as possible. Use the avalanche method (highest interest first) or the snowball method (smallest balance first), whichever keeps you motivated. And once it’s gone, do everything you can to stay debt-free.

10. You Invest Your Money

Saving money is great, but if you really want to build wealth, you need to invest. Investing is how you make your money work for you instead of just sitting there losing value to inflation.

If you’re already investing, even if it’s just a little bit, that’s a strong sign you’re good with money. It shows you understand that wealth-building requires more than just a savings account.

I was intimidated by investing at first. It seemed complicated, risky, and like something only rich people did. But once I started learning about it, I realized it’s actually not that scary. You don’t need thousands of dollars to start, and you don’t need to be a financial genius.

There are so many options now. You can invest in index funds, ETFs, real estate investment trusts (REITs), or even individual stocks if that’s your thing. Apps like Robinhood, Acorns, and Betterment have made it easier than ever to get started with small amounts.

The key is to start early and be consistent. Even small, regular investments can grow significantly over time thanks to compound returns. Don’t let fear or lack of knowledge hold you back. Do some research, start small, and learn as you go.

11. You Are Willing To Learn About Finances

Here’s something I’ve noticed: people who are good with money are curious about money. They read articles (like this one!), listen to podcasts, watch videos, and actively try to improve their financial knowledge.

Financial literacy isn’t something most of us learn in school, which is ridiculous considering how important it is. So if you’re taking the time to educate yourself, that’s a massive sign you’re on the right track.

I’ve learned so much from books, podcasts, and blogs over the years. Some of my favorites include “The Psychology of Money” by Morgan Housel, “Your Money or Your Life” by Vicki Robin, and podcasts like “The Dave Ramsey Show” and “ChooseFI.” Each one gave me new perspectives and practical strategies I could actually use.

The more you learn, the better decisions you’ll make. You’ll understand concepts like compound interest, tax advantages, asset allocation, and risk management. You’ll be able to spot opportunities and avoid common pitfalls.

Keep feeding your brain with financial knowledge. Follow personal finance experts on social media, join online communities, take free courses. The investment you make in your financial education will pay dividends for the rest of your life. (See what I did there?)

12. You Are Willing To Discuss Money

Money is one of those topics people avoid like it’s contagious. We’ll talk about almost anything else, but money? That’s somehow taboo. But here’s the thing: being willing to have open, honest conversations about money is a sign of financial maturity.

Whether it’s with your partner, your family, or even your friends, talking about money helps you get clear on your goals, expectations, and challenges. It prevents misunderstandings and helps everyone get on the same page.

I make it a point to have regular money conversations with my spouse. We talk about our budget, our goals, what’s working, and what’s not. Are these conversations always fun? Nope. But they’re necessary, and they’ve saved us from a lot of potential conflicts and financial mistakes.

If you have kids, talking to them about money is even more important. Teaching them about saving, spending wisely, and making smart financial choices will set them up for success later in life.

Don’t let money be a taboo topic in your household. The more openly you can discuss it, the better decisions you’ll make together. Start with simple questions: What are our financial priorities? What are we working toward? What concerns do we have? You’ll be surprised how much clarity these conversations can bring.

Final Thoughts

So there you have it. Twelve solid signs that prove you’re handling your money like a pro. Let’s quickly recap what we covered:

- You have a steady flow of income that covers your needs

- Your spending patterns are intentional and within your means

- You’re consistently saving money for future goals

- You’re planning and contributing toward retirement

- You’ve built an emergency fund for unexpected expenses

- You use a budget to manage your income effectively

- You’re making measurable progress toward your financial goals

- Your credit report shows responsible financial behavior

- You’re living without credit card debt

- You’re investing your money to build wealth

- You’re actively learning about personal finance

- You’re comfortable discussing money with the important people in your life

Here’s the truth: you don’t have to check every single box to be good with money. If you’re doing even half of these things, you’re already way ahead of most people. And if you’re not doing as many as you’d like? That’s okay too. Now you know what to work on.

Financial wellness isn’t about perfection. It’s about progress. It’s about making better choices today than you did yesterday, and setting yourself up for a more secure tomorrow.

Take a moment to acknowledge what you’re already doing well. Seriously, give yourself some credit. Then pick one or two areas where you want to improve and focus on those. Small, consistent steps will get you further than trying to overhaul everything at once.

Remember, your relationship with money is a journey, not a destination. There will be setbacks and mistakes along the way (we all have them), but as long as you keep learning and adjusting, you’ll be just fine.

Now go forth and continue being awesome with your money. You’ve got this! 🙂