15 Signs That You’re Financially Healthy

You’ve been wondering if you’re actually doing okay with money, right? Maybe you see people flashing their fancy cars on Instagram and start second-guessing your own financial situation. Or perhaps you’re just curious whether your money habits are setting you up for success or disaster.

Here’s the thing: financial health isn’t about driving a Tesla or having a million-dollar mansion. It’s about feeling secure, sleeping well at night, and knowing you can handle whatever life throws at you.

Think of it like physical health, you don’t need to be an Olympic athlete to be healthy, you just need to take care of yourself consistently.

I’ve spent years studying personal finance (yeah, I actually have degrees in this stuff), and I’ve noticed that truly financially healthy people share some common traits. These aren’t about being wealthy, they’re about being smart, prepared, and in control.

So grab your coffee, and let’s talk about the 15 signs you are financially healthy. By the end of this, you’ll know exactly where you stand and what you might need to work on. No judgment here, just real talk about money.

What Does Financial Health Really Mean?

Before we jump into the signs, let’s clear something up. Financial health has nothing to do with how much money you make. I’ve met people earning six figures who are one paycheck away from disaster, and I’ve met modest earners who have their finances locked down tight.

Financial health is about control, stability, and peace of mind. It’s having a plan, sticking to it, and building a life where money works for you instead of you constantly stressing about money. It’s being able to say “yes” to opportunities without panicking about your bank account.

Think of it this way: would you rather earn $200,000 and spend $210,000, or earn $60,000 and spend $45,000? The second person is way healthier financially, even though they earn less. That’s what we’re talking about here.

15 Clear Signs You Are Financially Healthy

Alright, let’s get into the good stuff. These are the markers that separate people who have their financial act together from those who are just winging it (no shame if that’s you right now, we’ve all been there).

1. Money Doesn’t Keep You Up At Night

You know that 3 AM anxiety where you’re lying awake calculating whether you can afford your bills? Yeah, financially healthy people don’t do that.

If you can go to bed without your stomach churning about money, that’s a massive win. It means you’ve got things under control enough that finances aren’t dominating your mental space. You’re not constantly checking your bank balance with dread or avoiding looking at your credit card statement.

Now, does this mean you never think about money? Of course not. But there’s a difference between thoughtfully planning your finances and losing sleep over them. One is productive, the other is just exhausting.

When I finally reached this point myself, it felt like someone lifted a weight off my chest. Suddenly I had mental energy for other things, like actually enjoying my life instead of constantly worrying about dollars and cents.

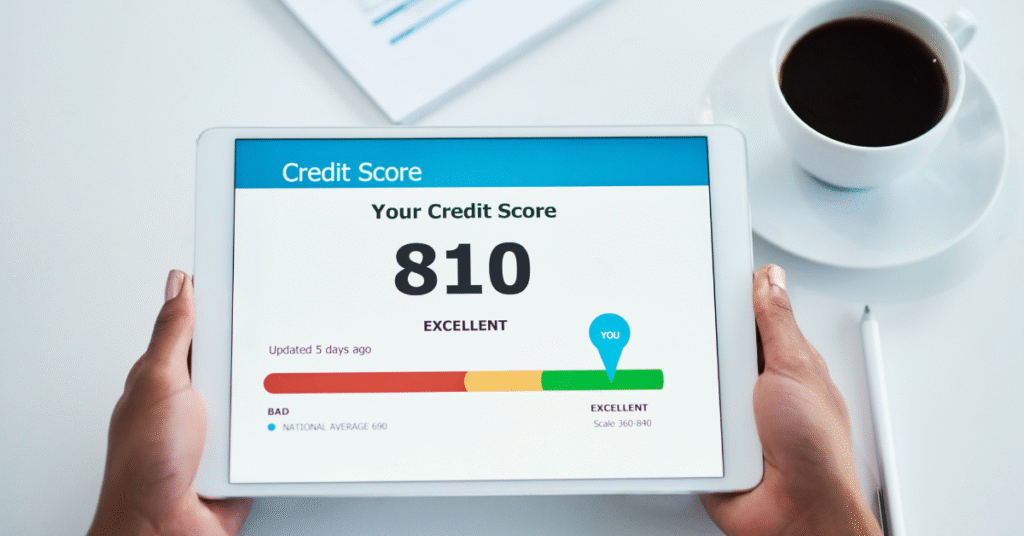

2. Your Credit Score Is In Good Shape

Let’s talk credit scores for a second. If yours is sitting at 670 or above, give yourself a pat on the back. That’s considered good, and it opens doors you might not even realize exist yet.

A solid credit score means lenders trust you. It means you’ve been paying your bills on time, keeping your debt manageable, and generally being responsible with borrowed money.

The practical benefits? Lower interest rates on everything from car loans to mortgages, easier apartment approvals, and sometimes even better job prospects.

I remember when my credit score finally broke into the “good” range after some rough years. Suddenly, credit card companies were offering me reasonable rates instead of those predatory 25% APR deals. It was like joining a secret club I didn’t know existed.

If your score isn’t where you want it yet, don’t panic. Pay bills on time, keep credit card balances low, and avoid opening a bunch of new accounts. Your score will climb, it just takes consistency and patience.

3. Emergencies Don’t Equal Disasters

Pop quiz: if your car broke down tomorrow and needed a $1,000 repair, would you be okay? What about a $2,000 medical bill? Or losing your job for three months?

This is where emergency funds come in, and they’re one of the biggest signs you are financially healthy. Most experts recommend having three to six months of expenses saved up. That might sound impossible if you’re starting from zero, but it’s absolutely achievable with time.

Here’s why this matters so much: life happens. Cars break, people get sick, companies downsize. When you have an emergency fund, these situations go from catastrophic to merely annoying. You handle them and move on instead of spiraling into debt.

Start small if you need to. Even $500 in an emergency fund puts you ahead of nearly half of Americans (seriously, the statistics are depressing). Then build from there, $50 at a time if that’s what works for your budget.

4. Your Income Is Reliable And Consistent

Financial health needs a foundation, and that foundation is steady income. Notice I didn’t say “high income” but rather “steady income.” There’s a huge difference.

When your income is predictable, you can plan. You can budget accurately, set realistic savings goals, and make commitments without crossing your fingers that money will magically appear. This stability is worth more than occasional windfalls that disappear as quickly as they came.

Now, I’m a big believer in multiple income streams (we’ll get to that later), but at least one of those streams should be reliable. Whether it’s a steady job, a consistent freelance client, or rental income, you need something you can count on month after month.

If your income is all over the place right now, think about ways to stabilize it. Can you negotiate a salary instead of hourly pay? Find retainer clients instead of one-off gigs? Build passive income sources? Stability might not be sexy, but it sure helps you sleep better.

5. Bills Get Paid On Time, Every Single Time

This one seems obvious, but you’d be surprised how many people treat due dates as suggestions rather than deadlines. If you’re consistently paying every bill on or before the due date, you’re doing better than you might think.

Why does this matter beyond avoiding late fees? Because it shows you have cash flow under control. You’re not scrambling at the end of the month, playing games with which bill to pay first. You’ve got enough cushion that everything gets handled without drama.

Plus, on-time payments are the single biggest factor in your credit score. They account for about 35% of your score, so this habit literally pays dividends over time.

Pro tip: automate whatever you can. Set up automatic payments for regular bills so you never miss a due date. Just make sure you’re monitoring your accounts so you don’t get hit with overdraft fees. Technology should make this easier, not harder.

6. You Have Sufficient Long-Term Savings & Assets

Here’s where we separate the financially healthy from the just-getting-by crowd. Are you accumulating assets that will grow in value over time?

I’m talking about things like retirement accounts, investment portfolios, real estate, or even a business you’re building. These are assets that work for you, growing in value while you sleep (or at least while you’re doing other things).

The magic here is compound growth. When you start investing early, even small amounts can snowball into serious wealth over decades. A $500 monthly investment starting at age 25 can be worth over $1 million by retirement, assuming average market returns. That’s the power of time and consistency.

If you’re not investing yet, start researching your options. Many employers offer 401(k) plans with matching contributions (that’s literally free money, FYI). You can also open an IRA on your own through platforms like Vanguard or Fidelity. The key is to start, even if it’s with small amounts.

7. You’re Saving For Retirement

Speaking of investing, let’s talk retirement. One of the clearest signs you are financially healthy is having a concrete plan for your golden years that doesn’t involve working until you’re 90 or relying entirely on Social Security.

Social Security was never designed to be anyone’s sole retirement income. It’s a supplement, not a solution. If you’re counting on it to fund your retirement, you’re setting yourself up for a pretty tight budget in your later years.

The good news? You don’t need to be rich to retire comfortably. You just need to start early and be consistent. Thanks to compound interest, someone who starts saving $200 a month at age 25 will end up with way more than someone who starts saving $500 a month at age 45.

I know retirement feels impossibly far away when you’re young (trust me, I get it). But future you will be incredibly grateful that present you took action. Set up that 401(k) contribution. Open that Roth IRA. Your 65-year-old self is already thanking you.

8. Debt Doesn’t Control Your Life

Let’s be real: most people have some debt. Mortgages, car loans, maybe some student loans. That’s normal and not necessarily a problem. The question is whether that debt is manageable or whether it’s strangling your finances.

Financially healthy people keep their debt-to-income ratio low, ideally under 36%. This means your monthly debt payments (not including mortgage) don’t eat up more than 36% of your gross monthly income. When debt stays in this range, you can handle payments comfortably without sacrificing other financial goals.

Credit card debt is the big villain here. If you’re carrying balances month to month and only making minimum payments, you’re hemorrhaging money to interest charges. A $5,000 balance at 20% interest will cost you over $6,000 in interest alone if you only pay minimums. That’s insane.

Focus on eliminating high-interest debt first. Use the debt avalanche method (paying off highest interest rates first) or the debt snowball method (paying off smallest balances first for psychological wins). Either works, just pick one and stick with it.

9. You Can Actually Enjoy Your Life Without Guilt

Here’s something people don’t talk about enough: financial health should include enjoyment. If you’re so focused on saving that you can’t ever relax or have fun, that’s not healthy either.

Financially healthy people budget for leisure. They take vacations without drowning in credit card debt afterward. They go out to dinner occasionally. They pursue hobbies. The key is that these things are planned and budgeted, not impulsive splurges that derail everything else.

I learned this lesson the hard way. I went through a phase where I was so obsessed with saving that I said “no” to everything. No dinners with friends, no trips, no fun purchases. I hit my savings goals, sure, but I was miserable and my relationships suffered.

Balance is everything. Build fun into your budget. Life is happening right now, not just in some future retirement fantasy. Enjoy it responsibly.

10. Your Spending Stays Below Your Earnings

This sounds stupidly simple, but it’s where tons of people fail. Living below your means is fundamental to financial health, yet lifestyle inflation constantly tries to sabotage it.

Lifestyle inflation is sneaky. You get a raise, so you upgrade your apartment. Then you need furniture to match. Then your old car seems shabby compared to your new place, so you lease something nicer. Before you know it, that raise is gone and you’re no better off financially than before.

Financially healthy people resist this trap. When their income increases, they increase their savings and investments proportionally, not just their spending. They understand that the gap between earning and spending is where wealth gets built.

Track your spending for a month (honestly, every dollar). You’ll probably find money leaking out in ways you didn’t realize. Subscriptions you forgot about, daily coffee runs that add up, impulse purchases that seemed small individually but total hundreds monthly. Plug those leaks.

11. You Invest In Your Own Growth

One of the smartest financial moves you can make is investing in yourself. I’m talking about education, skills training, health, and personal development. These investments typically have the highest returns of anything you’ll ever do.

Taking a course that helps you earn a promotion? That’s a fantastic investment. Paying for therapy that helps you overcome destructive money patterns? Worth every penny. Maintaining your health so you avoid massive medical bills later? That’s just smart financial planning.

I’ve spent thousands on courses, conferences, and coaching over the years. Some people thought I was crazy, but those investments directly led to career advances and income increases that paid for themselves many times over. Plus, the knowledge is mine forever.

This doesn’t mean going into debt for an overpriced degree you don’t need. Be strategic. Look for investments in yourself that have clear pathways to increased earning potential or improved quality of life. Your future earning power is your biggest asset, so nurture it.

12. You Have Appropriate Insurance

Okay, insurance is boring. I know. But it’s also one of those things that separates financially healthy people from those who are one disaster away from ruin.

Think of insurance as a financial safety net. Health insurance keeps medical emergencies from bankrupting you. Life insurance protects your family if something happens to you. Disability insurance ensures you still have income if you can’t work. Home and auto insurance protect your major assets.

I’ve seen people lose everything because they skipped insurance to save a few bucks monthly. A single uninsured medical emergency can wipe out years of savings. A house fire without insurance can leave you with nothing. It’s not worth the risk.

Yes, insurance premiums feel like throwing money away, especially when you don’t use them. But that’s the point. You’re paying for peace of mind and protection against catastrophic loss. When you need it, you’ll be incredibly grateful you have it.

13. You Have Multiple Streams Of Income

Here’s a reality check: relying on a single income source is risky, no matter how stable it seems. Companies downsize, industries change, and jobs disappear. Financially healthy people diversify their income streams.

This doesn’t mean you need five jobs (that sounds exhausting). But having 2-3 income sources provides security and accelerates wealth building. Maybe it’s a full-time job plus freelance work on the side. Or a salary plus rental income. Or a business plus investment dividends.

Multiple income streams also give you options and flexibility. Don’t like your job? Having side income makes it easier to leave. Want to retire early? Passive income streams can supplement your savings. Need extra cash for a goal? Ramp up the side hustle temporarily.

Start small. What skills do you have that people would pay for? Can you rent out a room or parking space? Could you start a small online business? Even an extra $500 monthly makes a huge difference over time, both for security and wealth building.

14. You’re Able To Help Others When It Matters

True financial health includes generosity. I’m not saying you need to be donating thousands to charity (though that’s great if you can). But being in a position to help family in a crisis, support causes you care about, or just pick up the tab for a friend going through hard times, that’s a sign you’ve got margin in your finances.

Generosity also improves your relationship with money. When you can give without resentment or financial strain, it shows you’ve moved beyond scarcity thinking into abundance. You’re not hoarding every dollar out of fear, you’re using money as a tool for good.

This doesn’t mean being financially irresponsible or letting people take advantage of you. Healthy generosity comes from overflow, not from sacrificing your own financial security. Put your oxygen mask on first, then help others.

The psychological benefits are real too. Studies consistently show that spending money on others increases happiness more than spending on yourself. When your finances allow for generosity, you’re not just helping others, you’re improving your own wellbeing too.

15. You’re Living On A Budget

Last but definitely not least, financially healthy people budget. Not because they’re restrictive or controlling, but because budgets create freedom through intentionality.

A budget is just a plan for your money. It tells your dollars where to go instead of wondering where they went. It ensures you’re covering necessities, saving for goals, and still having fun, all without the stress of flying blind financially.

The best budget is one you’ll actually stick to. Some people love detailed spreadsheets tracking every penny. Others prefer simpler approaches like the 50/30/20 rule (50% needs, 30% wants, 20% savings). Find what works for your personality and lifestyle.

I use a modified zero-based budget where every dollar has a job. At the start of each month, I assign all my expected income to categories: bills, savings, investments, fun money, etc. Then I track throughout the month to make sure I’m sticking to the plan. It takes maybe 30 minutes monthly, and it’s saved me from countless money mistakes.

If budgeting feels overwhelming, start simple. Track your spending for a month without changing anything, just to see where money goes. Then make small adjustments. You don’t need perfection, just awareness and intentionality.

What If You’re Not Checking All These Boxes?

Real talk: if you read through this list and realized you’re not hitting many of these markers, don’t freak out. Financial health is a journey, not a destination. Everyone starts somewhere, and recognizing where you need improvement is actually the first step toward getting there.

I certainly wasn’t checking all these boxes when I started my financial journey. I had debt, no emergency fund, and a spending problem that would make a shopaholic blush. But I made changes, one small step at a time, and gradually built the financial health I have today.

The key is to pick one or two areas to focus on first. Trying to overhaul everything at once is overwhelming and usually leads to giving up. Maybe start by building a small emergency fund. Or creating a basic budget. Or setting up automatic retirement contributions. Small wins build momentum.

Also, give yourself some grace. If you’re young, you’re supposed to be building financial health, not already having it perfected. If you’ve faced setbacks like job loss or medical issues, recovery takes time. Progress isn’t always linear, and that’s okay.

Your Next Steps Toward Financial Health

So where do you go from here? Start by honestly assessing which of these 15 signs you’re already hitting and which ones need work. Be brutally honest with yourself, no one’s judging, this is just information.

Then pick one or two areas to focus on immediately. Not ten, not all of them, just one or two. Maybe it’s finally creating that emergency fund you’ve been putting off. Or getting serious about paying down credit card debt. Or setting up automatic retirement contributions.

Make a specific, actionable plan. “Save more money” is too vague. “Save $100 from each paycheck into a high-yield savings account” is specific and actionable. “Get out of debt” is overwhelming. “Pay an extra $50 toward my highest-interest credit card each month” is doable.

Track your progress. Nothing motivates like seeing improvement, even small improvements. Watching your emergency fund grow from $0 to $500 to $1,000 feels amazing. Seeing your credit score climb 20 points gives you momentum to keep going.

And remember, financial health isn’t about deprivation or misery. It’s about creating a life where money supports your goals and values instead of constantly causing stress. It’s about having options, security, and peace of mind. That’s worth working toward, don’t you think?

You’ve got this. Start small, stay consistent, and watch as these signs you are financially healthy gradually become your reality. Future you is going to be so grateful you started today. 🙂

Final Thoughts

Here’s what I want you to take away from all this: financial health is absolutely achievable, regardless of where you’re starting from. It’s not about being rich or perfect. It’s about making consistent, smart choices that compound over time.

The signs you are financially healthy that we’ve discussed, sleeping well at night, having manageable debt, building assets, living below your means, these are all results of daily habits and decisions. You don’t wake up one day magically financially healthy. You build it, brick by brick, choice by choice.

Some of these signs might take years to achieve, and that’s normal. Building a solid emergency fund takes time. Growing investments requires patience. Developing multiple income streams doesn’t happen overnight. But every step forward counts, and every good financial decision today makes tomorrow easier.

The beautiful thing about financial health is that it’s never too late to start improving. I’ve seen people turn their finances around in their 50s and still build comfortable retirements. I’ve watched young people in their 20s make smart choices that set them up for incredible futures. Age and starting point matter less than consistency and commitment.