14 Top Secret Websites To Make Money Effortlessly

Look, I get it. You’re tired of hearing about the same old “make money online” advice that promises the world but delivers pocket change.

Survey sites that pay you $0.50 after 30 minutes? Video watching platforms that require you to glue yourself to a screen for hours just to earn enough for a coffee. Yeah, no thanks.

Here’s the thing, though, there are websites out there that actually pay decent money without making you want to pull your hair out.

The catch? Most people don’t know about them because they’re not plastered all over YouTube ads or promoted by every influencer and their dog.

I’ve spent years in personal finance, analysing income streams and testing platforms that claim to help you earn.

After filtering through the nonsense, I’ve put together this list of 14 legitimate, lesser-known websites that can actually put real money in your pocket.

Whether you’re a college student juggling classes, a parent working from home, or just someone who wants extra cash without the extra stress, trust me, there’s something here for you.

14 Top Secret Websites To Make Money Effortlessly

The beauty of these platforms? They’re not asking you to invest thousands upfront or quit your day job.

They’re realistic opportunities that respect your time and actually compensate you fairly.

Some require skills you probably already have, while others just need your honest opinion or a few spare minutes.

Let’s get into it.

1. Rumble

Ever heard of Rumbe? Probably not, and that’s exactly why it’s on this list.

This platform is still flying under the radar, but it’s genuinely one of the better microtask websites I’ve come across.

Unlike those cluttered sites that bombard you with pop-ups and pay you in what feels like Monopoly money, Rumbe keeps things clean and straightforward.

You sign up, browse available tasks, things like testing apps, writing short reviews, or providing feedback on user experiences, and get paid through PayPal or direct bank transfer.

The tasks aren’t complicated, and most take less than 15 minutes.

What makes Rumbe different? The pay rates. While most microtask sites give you pennies, Rumbe compensates you fairly for your time.

It’s not going to replace your full-time income, but if you’re looking to make quick cash during your lunch break or while waiting for your Netflix show to load, this is solid.

From a financial perspective, microtask platforms like Rumbe work best when you treat them as supplementary income.

Stack them with other platforms on this list, and you’ve got yourself a nice little portfolio of income streams.

FYI, diversification isn’t just for investment portfolios, it applies to side hustles too 🙂

2. Product Tube

Now here’s one for those of you who don’t mind being in front of a camera. Product Tube is basically market research meets reality TV, minus the drama.

Companies want real feedback from real consumers, and they’re willing to pay for it.

You get assigned a project, maybe reviewing a product you bought or filming yourself shopping, and you create a short video (usually under five minutes).

Upload it, wait for approval, and boom, you’re paid anywhere from $10 to $50 per video.

Why Product Tube works: Brands are desperate for authentic content.

Traditional market research feels staged and scripted. Video feedback from everyday shoppers?

That’s gold to them, and they’ll pay accordingly.

You don’t need professional equipment. Your smartphone camera is more than enough.

Just be yourself, share your honest thoughts, and watch the payments roll in. If you’re comfortable on camera and already shop regularly, this is one of those rare win-win situations.

I’ve always believed that monetising existing habits is the smartest form of earning.

You’re shopping anyway, right? Might as well get paid for it.

3. Idle Empire

The name says it all: Idle Empire lets you earn while doing basically nothing.

This platform pays you for watching videos, completing surveys, playing games, and referring friends.

But here’s the kicker: you can run activities in the background while you do other stuff.

It’s passive income at its finest.

Points accumulate automatically, and you can cash them out for PayPal money, gift cards, or even cryptocurrency like Bitcoin.

The payout system is fast, with no waiting weeks to access your earnings.

Here’s my take: Idle Empire won’t make you rich. But it’s perfect for filling dead time. Commuting? Let it run.

Binge-watching your favourite show? Let it run. Pretending to work in a Zoom meeting? Well… you get the idea.

From a finance perspective, this is what I call “opportunity cost optimisation.” You’re turning wasted time into tangible value.

Even earning $20-$30 extra per month adds up to nearly $300-$360 annually. That’s a weekend trip, a few nice dinners, or a chunk toward paying off debt.

4. Teachable

Let’s switch gears. If you’ve got knowledge or a skill worth sharing, Teachable can turn that into long-term income.

This platform lets you create and sell online courses on literally anything. Marketing? Photography? Excel shortcuts?

How to bake sourdough without burning down your kitchen? If people want to learn it, you can teach it.

Why Teachable stands out: It’s built for regular people, not tech wizards. You don’t need coding skills or design experience.

The drag-and-drop builder makes course creation surprisingly simple, and you have full control over pricing, branding, and content.

Here’s where the finance nerd in me gets excited: Teachable offers multiple revenue models. You can do one-time payments, monthly subscriptions, or payment plans.

That flexibility means you can tailor your offerings to different audience segments and maximise revenue.

The best part? Build it once, earn indefinitely. That’s the dream of passive income.

Sure, you’ll need to put in upfront work creating content, but once your course is live, it can generate income for months or even years with minimal maintenance.

IMO, building an online course is one of the smartest financial moves you can make.

You’re essentially creating a digital asset that appreciates over time as you add students and testimonials.

5. Respondent

Okay, this one’s a game-changer for people who thought online surveys were useless.

Respondent isn’t your typical survey site. It connects you with companies and researchers conducting high-value studies, and they pay serious money, sometimes $50, $100, even $200+ per hour.

The catch? You need to fit specific profiles. Companies are looking for particular demographics, professions, or experiences.

Not everyone gets selected for every study, but when you do land one, it’s incredibly lucrative.

From a financial standpoint, Respondent represents high-value, low-frequency income.

You might only complete a few studies per month, but those few can bring in several hundred dollars.

That’s a significantly better ROI than grinding away at low-paying tasks.

Payments come through PayPal within days, not weeks. The application process can be competitive, so make sure your profile is detailed and honest.

The more information you provide, the better your chances of matching with studies.

Ever wondered why companies are willing to pay so much? Because quality market research directly impacts product development, marketing strategies, and ultimately, revenue.

They’re not being generous, they’re being strategic. And you get to benefit from that.

6. Second To None

Who knew you could get paid to shop and eat out? Second To None brings mystery shopping into the modern era.

After a quick onboarding process, you’ll start receiving assignments to visit stores, interact with staff, and report back on your experience.

Each task comes with clear instructions and fair compensation.

Why Second To None beats other mystery shopping platforms: Transparency.

No confusing points systems. No vague instructions. Just straightforward assignments with direct payment via monthly deposit.

I’ve always appreciated mystery shopping from a consumer behaviour perspective.

You’re essentially getting paid to observe service quality and customer experience, skills that translate to any business environment.

Plus, you often get reimbursed for purchases, meaning you can enjoy products or meals while earning money.

The assignments vary, including retail stores, restaurants, car dealerships, and banks. You evaluate everything from staff friendliness to store cleanliness to wait times.

If you’re naturally observant and enjoy providing feedback, this can be both fun and profitable.

Available to U.S. and Canadian residents, this platform is reliable and has been around long enough to prove its legitimacy.

In personal finance, longevity matters. Platforms that survive years in a competitive market usually do so because they treat users fairly.

7. Prolific

Prolific is what survey platforms should aspire to be.

Unlike those sketchy survey sites that screen you out after 10 minutes (after you’ve already given them free data), Prolific connects you with academic research studies from universities worldwide.

The studies are well-designed, ethically conducted, and fairly compensated.

Payment rates: Most studies pay between $6 $12 per hour, with some offering significantly more depending on complexity. Payments hit your PayPal account within a day or two.

Here’s what makes Prolific special: it respects your time. Studies are genuinely interesting, often exploring topics in psychology, economics, health, and social behaviour.

You’re not just clicking through mindless questions; you’re contributing to actual research.

From my experience in finance and behavioural economics, participating in research studies has an educational side benefit.

You start understanding consumer behavior, decision-making patterns, and psychological triggers that influence financial choices. That knowledge is valuable beyond the direct payment.

The platform maintains strict ethical standards, ensuring you’re never deceived or mistreated.

In an online space full of sketchy opportunities, that level of integrity is refreshing.

8. Enrol

Enrol is perfect if you’re camera-shy or just want super quick tasks.

This user testing platform helps companies improve their websites and apps by gathering feedback from real users.

Unlike other testing platforms that require video recordings or voice narration, Enroll keeps it simple: just click through screens, answer questions, and compare designs.

Time commitment: Most tasks take just a few minutes. While individual payouts are small, they stack up over time, especially if you check the platform regularly.

What I appreciate about Enrol is its accessibility. You can complete tasks from your phone, tablet, or desktop, making it ideal for filling those awkward in-between moments, waiting rooms, commute breaks, or commercial breaks during your favourite show.

From a financial efficiency standpoint, Enrol represents low-effort, consistent micro-earnings.

It’s not going to fund your retirement, but it’s perfect for offsetting small monthly expenses like subscription services or coffee runs.

The tasks are straightforward enough that you can do them while half-asleep (not that I’m encouraging that), making it one of the most frictionless ways to earn on this list.

9. Clickworker

Clickworker is the OG of microtasking, and it’s still going strong.

You complete small jobs, text creation, data categorisation, product tagging, web research, and more.

Pay varies depending on task complexity, but the platform’s beauty lies in its flexibility. You work when you want, choose tasks you prefer, and get paid for each completion.

Getting started: Register, complete an assessment to qualify for certain task types, and start working immediately. Payments are processed weekly via PayPal.

Here’s my honest take: Clickworker isn’t glamorous. You’re not going to brag to your friends about tagging product images at 11 PM.

But it’s reliable, consistent, and available in multiple countries. For people who need a predictable supplementary income, reliability beats flashiness every time.

From a portfolio perspective, Clickworker is a solid foundation.

Pair it with higher-paying but less consistent platforms like Respondent, and you’ve got both stability and upside potential.

The tasks can be repetitive, but if you’re someone who finds routine comforting (or just enjoys zoning out to podcasts while working), this could be your jam.

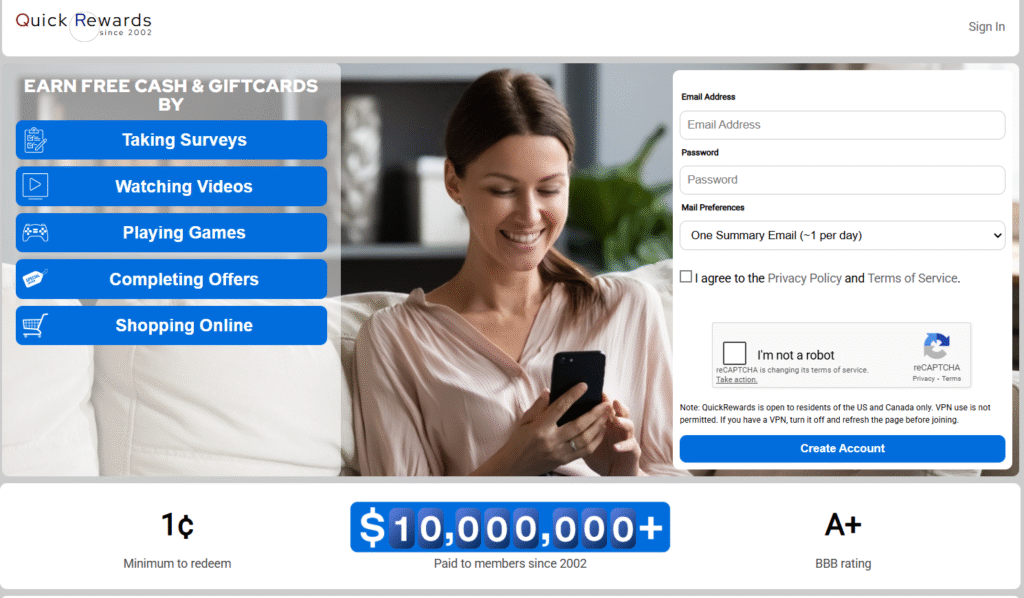

10. QuickRewards

QuickRewards might not win any design awards, but it wins where it counts, payouts.

This U.S.-based platform pays you for completing surveys, watching videos, shopping online, and clicking paid emails.

The standout feature? No minimum payout for PayPal cashouts. That’s right, you can cash out literally any amount, anytime.

Most platforms make you wait until you hit $10, $25, or even $50. QuickRewards says, “nah, take your money whenever you want.” That level of flexibility is rare and incredibly user-friendly.

Income opportunities: From cashback offers to paid email clicks to surveys, QuickRewards gives you multiple ways to stack earnings.

Yes, the interface looks dated, but functionality beats aesthetics when money’s involved.

I’ve always believed that cash flow matters more than total earnings in certain contexts.

Having immediate access to small amounts can be more valuable than waiting weeks for a larger sum, especially if you’re managing tight budgets or unexpected expenses.

In personal finance terms, QuickRewards offers high liquidity, the ability to convert your efforts into accessible cash quickly.

That’s a valuable feature often overlooked in side hustle discussions.

11. TaskRabbit

Time to move beyond the computer screen. TaskRabbit connects you with people who need help with real-world tasks, furniture assembly, moving, cleaning, delivery, handyman work, and more.

How it works: Create a profile, list your services and hourly rates, and wait for local clients to book you.

You control your schedule, choose which tasks to accept, and keep most of your earnings (minus a service fee).

What makes TaskRabbit special is the control it gives you. Unlike most gig apps that dictate pricing and availability, you’re the boss here.

Set your rates based on your skill level and market demand. Accept only the jobs you want.

From a financial perspective, TaskRabbit represents skilled labour monetisation.

If you’re handy, organised, or physically capable, those skills have tangible market value.

Hourly rates vary widely, but experienced Taskers in major cities regularly earn $30-$60+ per hour.

Real talk: TaskRabbit requires more effort than clicking surveys. You’re doing physical work, travelling to locations, and interacting face-to-face with clients.

But the earning potential is significantly higher, and many people find the work more satisfying than screen-based tasks.

Plus, you’re building a reputation and potentially a small business.

Repeat clients, positive reviews, and word-of-mouth referrals can turn TaskRabbit from a side hustle into a legitimate income source.

12. Shutterstock

Calling all photographers and designers! Shutterstock lets you turn your creative work into passive income.

Every time someone downloads one of your images or designs, you earn a royalty. The more content you upload and the better your portfolio performs, the more you earn over time.

It’s the definition of “build once, profit repeatedly.”

The business model: Contributors earn based on total downloads, with tiered royalty rates that increase as you sell more.

Early on, payments might be modest, but as your library grows and gains visibility, so does your income potential.

From a financial asset perspective, a Shutterstock portfolio is like building an income-generating property. You put in upfront work (creating and uploading content), but once it’s live, it generates returns indefinitely with minimal ongoing effort.

Practical advice: Focus on evergreen content, images and designs that remain relevant across seasons and years.

Think business concepts, lifestyle shots, nature scenes, and versatile graphics. Trendy content might spike initially, but it loses value quickly.

Also, consistency matters. Uploading regularly signals to the algorithm that you’re an active contributor, potentially boosting your content’s visibility.

Even adding 5-10 quality images weekly can compound into significant monthly earnings over time.

The barrier to entry is low; you don’t need professional equipment, just a decent camera (or even a good smartphone) and an eye for composition.

For creative individuals looking to monetize their hobby, Shutterstock is honestly a no-brainer.

13. Studypool

If you’re academically inclined or just good at explaining stuff, Studypool can be surprisingly lucrative.

This homework-help platform connects you with students seeking answers to academic questions. Unlike traditional tutoring that requires scheduled sessions and long-term commitments, Studypool is task-based. You browse open questions, place bids on ones you can answer, and get paid per response.

Subject range: Math, science, writing, business, programming, social sciences, basically any academic topic. If you’ve got expertise or even just strong research skills, there’s likely demand for your knowledge.

Payment varies based on question complexity and your experience level, but seasoned tutors earn hundreds to thousands monthly. There’s also potential for passive income by selling study guides or notes you’ve already created.

Financial insight: Studypool represents knowledge monetisation at scale. Instead of trading time for money in a traditional 1-on-1 tutoring arrangement, you’re creating responses that can be used by multiple students (depending on the platform’s rules), effectively increasing your income per hour worked.

The flexibility is unbeatable, answer questions during commercial breaks, between classes, or late at night when you can’t sleep. No fixed schedule, no minimum commitment, just pure performance-based earning.

For students, particularly, this is brilliant. You’re getting paid to study, essentially. Answering questions reinforces your own understanding while building your bank account. Win-win? Yeah, I’d say so.

14. Decluttr

Last but not least, let’s talk about turning clutter into cash. Decluttr buys your unwanted tech, media, and gadgets directly, no listing, no waiting, no haggling with lowball offers.

How it works: Enter item details (or scan barcodes), get an instant price quote, ship items for free, and receive payment once they’re inspected. It’s stupidly simple.

From a financial perspective, Decluttr addresses the sunk cost fallacy. We hold onto stuff because we paid money for it, even though it’s currently providing zero value.

Decluttr converts those dormant assets back into liquid cash you can actually use.

What they buy: Old phones, tablets, game consoles, CDs, DVDs, books, gaming accessories, basically anything tech or media-related gathering dust in your closet.

The prices are fair market value, not top dollar, but the convenience and speed make up for it.

You’re not going to get eBay prices, but you’re also not dealing with flaky buyers, shipping hassles, or platform fees.

Real-world example: I cleaned out a closet last year and found old textbooks, a couple of outdated phones, and random tech accessories. Items I completely forgot I owned.

Sent them to Decluttr and got $180 back. Not life-changing, but definitely worth the 20 minutes it took to pack everything up.

The platform also has environmental benefits; your old stuff gets refurbished and reused instead of ending up in a landfill.

So you’re making money and being responsible. Look at you, being all eco-conscious and financially savvy 🙂

Final Thoughts

From my years working in finance, I’ve learned that sustainable wealth building comes from consistent, small actions compounded over time.

These platforms won’t make you a millionaire overnight, and honestly, anyone promising that is lying. But earning an extra $200-$500 monthly from combining several platforms?

Absolutely realistic and achievable.

That extra income can accelerate debt payoff, boost your emergency fund, fund vacations, or get invested for long-term growth. The point is, it’s real money with real impact on your financial health.

Start with one or two platforms that genuinely interest you. Get comfortable with how they work, build some momentum, then gradually add others.

Don’t overwhelm yourself trying to do everything at once. Remember, this is supposed to make your life easier, not more stressful.