15 Surprisingly Lazy Ways To Make Money

Look, I’m not going to sugarcoat it, we’ve all fantasised about making money while sitting in our pyjamas, right?

Maybe you’re scrolling through your phone during lunch breaks, thinking there has to be a better way than trading your time for pennies at a soul-crushing job.

Well, here’s the thing: lazy money is absolutely real. And no, I’m not talking about some pyramid scheme your cousin tried to recruit you into last Thanksgiving.

I’m talking about legitimate, tested methods that actually put cash in your pocket without requiring you to become the next hustler extraordinaire.

As someone with a finance background (yeah, I’ve got the fancy degrees to prove it), I’ve spent years analysing income streams and breaking down what actually works versus what’s just internet noise.

The methods I’m sharing aren’t those “get rich quick” fantasies; they’re realistic approaches that real people use to supplement their income.

Ready to discover how you can earn money without burning yourself out? Let’s get into it.

15 Surprisingly Lazy Ways To Make Money

Here’s what gets me excited about this list: every single method here is something you can start today.

No extensive training required, no massive upfront investment, and definitely no need to quit your day job.

Some of these will earn you pocket change for your coffee habit, while others could genuinely replace a part-time income. The beauty? You pick what fits your lifestyle.

1. Watch Videos For Money

Remember when your parents told you watching TV would rot your brain and never pay the bills? Well, they were half right 🙂

Companies desperately need eyeballs on their content. Advertisers want to know if their commercials actually hold attention, and content creators need feedback on their videos.

That’s where you come in, literally getting paid to do what you probably already do during your commute or lunch break.

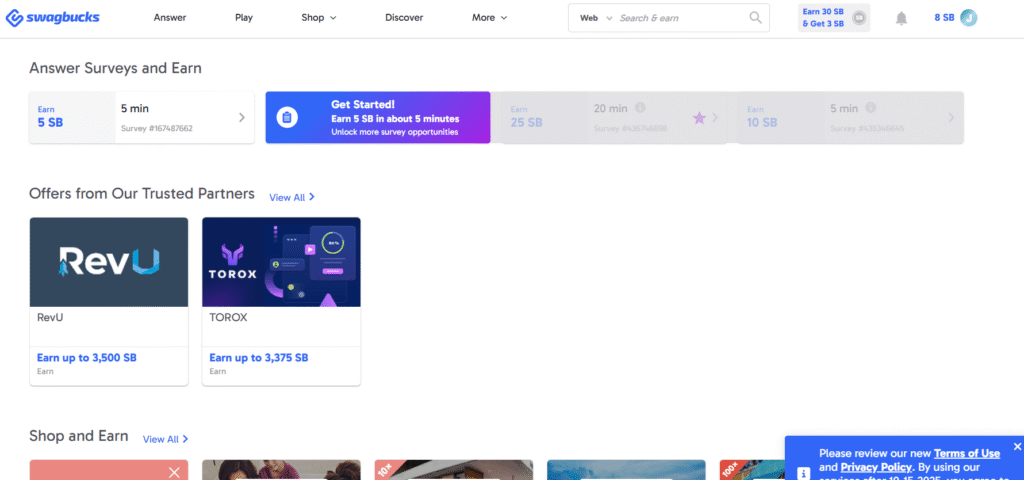

Here’s the financial reality: You won’t become a millionaire watching cat videos, but platforms like Swagbucks, InboxDollars, and MyPoints can realistically net you $50-$200 monthly depending on your dedication.

The process is ridiculously simple. Sign up on one of these platforms, verify your email, and start browsing their video categories.

You’ll find everything from movie trailers to news clips to straight-up advertisements.

Watch for the required time (usually 30 seconds to a few minutes), and boom, you’ve earned points convertible to cash or gift cards.

Pro tip from my experience: Don’t just stick to one platform. I juggle three different apps and let videos play while I’m doing other mundane tasks. Multitasking is your friend here.

The earnings add up faster when you’re strategic about it, and honestly, it beats staring blankly at the wall during your downtime.

2. Get Paid For Online Surveys

Every product you see on store shelves has gone through countless rounds of consumer research.

Companies literally spend billions trying to figure out what you want to buy and how much you’ll pay for it. Your opinion? It’s valuable data they’re willing to purchase.

Now, I’ll be straight with you, online surveys get a bad rap because some people expect to make thousands monthly.

That’s unrealistic. But as supplemental income for sharing thoughts you already have? Absolutely worth it.

Survey Junkie, Swagbucks, and Vindale Research are the heavy hitters in this space.

After creating your profile (be thorough here, as it determines which surveys you’re matched with), you’ll start receiving survey opportunities.

Most take 5-30 minutes and pay anywhere from $0.50 to $5 per survey.

Financial insight: The key to maximising survey income is consistency. Companies want demographic diversity, so your profile matters.

If you’re in a niche demographic (say, a millennial homeowner who shops organic), you’ll qualify for higher-paying surveys more frequently.

From a finance perspective, think of this as earning $10-15 hourly for low-effort work you can do while binge-watching Netflix.

Not bad for clicking buttons and sharing opinions, right?

3. Offer Voice-Over Work

Got a voice? Congratulations, you have a marketable asset.

Voice-over work has exploded with the rise of YouTube, podcasts, audiobooks, and online courses.

Content creators need voices for explainer videos, animations, commercial spots, and more.

Unlike five years ago, you don’t need a $5,000 studio setup.

A decent USB microphone ($50-100) and a quiet room will get you started.

Platforms like Fiverr, Upwork, and Voices.com connect voice talent with clients.

Start by recording sample clips showcasing different styles: professional corporate, casual conversational, energetic commercial, etc.

Real talk from personal observation: Beginners typically charge $5-25 for short scripts (under 150 words), but experienced voice artists easily command $100-300 per project.

The income potential scales beautifully with experience and portfolio quality.

The laziness factor? Once you’ve recorded and delivered a project, you’re done.

No ongoing maintenance, no customer service headaches. Record, submit, get paid. Simple.

4. Rent Out Your Driveway Or Car For Ads

Your car sits parked 95% of its life. Your driveway? Probably even more. What if those idle assets could generate passive income?

Here’s the deal: advertisers pay drivers to wrap their vehicles with branded vinyl.

You literally drive around as normal, going to work, running errands, picking up groceries, while earning $200-600 monthly, depending on your driving patterns and location.

Platforms like Wrapify, Carvertise, and StickerRide handle the matchmaking between drivers and advertisers.

They have specific requirements (clean driving record, minimum monthly mileage, certain vehicle years), but if you qualify, the installation is free and completely reversible.

For driveway rental, SpotHero, Neighbor, and JustPark let you rent unused parking spaces.

If you live near stadiums, airports, universities, or downtown areas, you could earn $100-500 monthly from space that literally just sits there.

Financial perspective: From a pure ROI standpoint, this is nearly perfect passive income. You’re monetising assets you already own without changing your lifestyle.

The profit margin is basically 100% since you’re not producing anything new, just leveraging existing resources.

5. Make Money Clicking Ads

Okay, I know what you’re thinking: this sounds like a scam your uncle fell for in 2008. But hear me out.

Legitimate paid-to-click platforms exist because advertisers need verified engagement metrics.

They’ll pay small amounts for real users to view their ads, which improves their campaign data and potentially drives conversions.

Sites like NeoBux, InboxDollars, and ClixSense pay users to click ads, view websites, or watch promotional content.

You’ll earn pennies per click (typically $0.01-0.10), but consistent daily engagement can generate $20-50 monthly.

Is this going to replace your salary? Absolutely not. But here’s the thing, clicking ads takes literally seconds.

You can knock out your daily quota during commercial breaks or while waiting for your coffee to brew.

The effort-to-reward ratio isn’t terrible for genuinely zero-skill work.

Word of caution: Stick with established platforms.

The paid-to-click world has plenty of shady operators who never pay out. Research platforms thoroughly before investing time.

6. Earn Passive Income From Dividend Stocks

Now we’re talking my language. As someone with a finance degree, dividend investing is probably my favourite “lazy” money method because it’s truly passive once established.

Here’s the beautiful simplicity: You buy shares of companies that distribute profits to shareholders quarterly. You hold those shares. Money appears in your account. That’s it.

Unlike day trading (which is decidedly NOT lazy and incredibly risky), dividend investing rewards patience.

Companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble have paid dividends for decades, with many increasing payouts annually.

Getting started is straightforward. Open a brokerage account with Robinhood, M1 Finance, or Vanguard.

Look for companies with consistent dividend histories and reasonable payout ratios (below 60% is generally healthy).

Start with dividend ETFs like SCHD or VYM if you want diversification without researching individual stocks.

Real numbers: A $10,000 investment in a 4% dividend-yielding stock generates $400 annually, that’s about $100 quarterly just for holding shares.

Reinvest those dividends, and compound growth works its magic over time.

IMO, dividend investing is the ultimate lazy wealth-building strategy. It requires upfront research but minimal ongoing effort.

You’re literally making money while you sleep, and that’s not marketing hype, that’s basic financial mechanics.

7. Get Paid To Review Hotels Or Try Food

Imagine staying in hotels or eating at restaurants for free, and getting paid on top of that. Sounds too good to be true, right?

Yet companies desperately need authentic reviews to attract customers, and they’ll compensate you for detailed feedback.

Mystery shopping platforms like BestMark, Market Force, and Secret Shopper assign “shoppers” to evaluate hotels, restaurants, retail stores, and services.

You’re essentially a quality control consultant earning $15-100 per assignment, depending on complexity.

The process varies by assignment. Sometimes you’ll receive reimbursement for your meal or hotel stay plus a fee.

Other times, you’ll receive a flat payment. Either way, you’re experiencing things you might already enjoy, trying new restaurants, staying at hotels, while getting compensated.

Practical consideration: These gigs aren’t unlimited. You’ll typically complete 2-5 assignments monthly based on availability in your area.

But stack this with other methods on this list, and you’re diversifying your lazy income streams nicely.

Documentation is crucial. Take photos, keep receipts, and provide thorough reports.

The more professional your feedback, the more assignments you’ll receive.

8. Rent Out Your Gadgets

Your camera collects dust 350 days a year. Your gaming console? Maybe used a few hours weekly.

These idle electronics could be earning money instead of depreciating.

The sharing economy extends beyond Airbnb and Uber.

Platforms like Fat Llama, Grover, and Rent-A-Centre let you rent everything from cameras and laptops to drones and sound equipment.

Financial analysis: Let’s say you own a DSLR camera that costs $1,200. Renting it out for $50 daily, just 5-6 days monthly covers insurance and generates $250-300 monthly.

That’s $3,000 annually from equipment that was previously earning nothing.

The platforms handle insurance, payment processing, and dispute resolution.

You simply list your items with clear descriptions, set rental prices, and coordinate pickups/returns.

Most platforms take 15-25% commission, but you’re still profiting from assets that otherwise generate zero income.

Risk management tip: Always use platform insurance and document item condition before rentals.

Take photos, note serial numbers, and communicate clearly about usage expectations.

Protect your investment while generating passive income from it.

9. Rent Out Your Digital Storage Space

This one’s futuristic and frankly pretty cool. Decentralised cloud storage networks pay people to share unused hard drive space with users needing secure file storage.

Platforms like Filecoin, Sia, and Storj work by distributing encrypted file fragments across thousands of individual storage providers (that’s you).

Users pay to store files, and you earn cryptocurrency for providing space.

The technical setup requires installing software and allocating storage space, but once configured, the system runs automatically.

Files are encrypted, so you’re not accessing anyone’s data, just providing space.

Earning potential: This varies wildly based on storage capacity and network demand.

Providers with 1TB available might earn $5-20 monthly, while those offering 10TB+ could see $50-200.

It’s not huge money, but it’s genuinely passive once established.

From an investment perspective, you’re monetising excess capacity that costs you nothing additional.

Modern hard drives are cheap, and if you already have unused space, why not profit from it?

10. Create And Sell Digital Products

This is where lazy meets smart. Create something once, sell it infinitely. No inventory, no shipping, no manufacturing costs, pure digital profit.

Digital products span countless niches: Canva templates, Excel spreadsheets, printable planners, stock photos, Lightroom presets, resume templates, budget trackers, meal planning guides… the list is endless.

Platforms like Etsy, Gumroad, and Creative Market provide built-in marketplaces with millions of potential customers.

Create your product using free tools like Canva or Google Docs, upload it, set your price, and let passive sales roll in.

A simple budget template you create in 2-3 hours could sell for $5-15. Sell just 50 copies monthly, and that’s $250-750 in passive income from a single afternoon’s work.

Create 10 different products, and you’ve built a legitimate income stream.

The margins are incredible, often 70-90% after platform fees. There’s no cost of goods sold, no inventory risk, and unlimited scalability.

From a financial efficiency standpoint, digital products are tough to beat.

11. Rent Out Storage Space

Got an empty garage? Unused basement? Even a spare closet? People are desperate for affordable storage, and you can monetise that space without lifting a finger.

Traditional storage units are expensive, often $100-300 monthly, depending on size and location.

Peer-to-peer platforms like Neighbour, [Stow It] (https://www.stowitself storage.com), and Store at My House connect people needing storage with homeowners offering space at lower rates.

The math is compelling: Rent a 10×10 garage space for $150 monthly. That’s $1,800 annually from space that was generating zero income.

Your only “work” is the initial listing and occasionally allowing renters access.

Most platforms handle payments, insurance, and contracts. You set availability, pricing, and access terms. Renters typically store seasonal items, furniture, business inventory, or vehicles.

Risk consideration: Vet renters carefully and understand platform insurance policies.

Use platforms with robust protection, clear contracts, and reliable payment systems.

This protects both parties and ensures your passive income remains genuinely passive.

12. Sell Greeting Card Messages

If you’ve got a way with words, greeting card companies will pay you for clever, heartfelt, or funny messages. No artistic skills required, just creativity with language.

Companies like Blue Mountain Arts, Hallmark, and Oatmeal Studios accept submissions from freelance writers.

They’re constantly seeking fresh content for birthdays, holidays, anniversaries, and special occasions.

Payment ranges: Accepted messages typically pay $50-300 each. Write and submit 10 messages monthly, and getting even 1-2 accepted generates $100-600 for work you can complete during lunch breaks.

The lazy factor is high you can write submissions anywhere on your phone or laptop.

There’s no ongoing commitment, no deadlines (beyond submission windows), and no client management. Submit, wait for acceptance, collect payment.

Writing tip: Study successful greeting cards before submitting. Understand each company’s tone; some prefer humour, others sentimentality, and some favour modern and edgy.

Tailor submissions accordingly to improve acceptance rates.

13. Text And Flirt Online For Money

Okay, this one raises eyebrows, but it’s legitimate and more common than you’d think.

Many people pay for virtual companionship, someone to chat with, flirt with, or just have a friendly conversation.

Platforms like ChatOperatorJobs, FlirtBucks, and Phrendly pay users to engage in text, chat, or video conversations.

This isn’t adult work (though those platforms exist separately), it’s more about providing companionship and attention.

Earning potential: Rates vary significantly, from $0.10-0.15 per message to hourly rates of $15-30 for video chats.

Active chatters can realistically earn $200-1,000 monthly, depending on time investment and platform.

Important boundaries: These platforms have strict rules about content and behaviour. Stay within guidelines, set personal boundaries, and never share personal information.

Treat it as customer service work focused on conversation.

Is this for everyone? Definitely not. But if you’re comfortable with virtual interaction and enjoy chatting, it’s a legitimate income source requiring minimal skills beyond being personable and responsive.

14. Get Paid To Browse The Internet

You already spend hours daily online, checking email, reading news, watching YouTube, and scrolling social media. What if that time earned you money?

Several platforms compensate users for browsing habits.

Brave Browser pays users in cryptocurrency for viewing privacy-respecting ads.

Microsoft Rewards gives points for using Bing search.

Nielsen Computer & Mobile Panel pays for passively sharing browsing data.

Realistic earnings: This won’t make you rich, but $20-50 monthly is achievable for normal browsing behaviour. You’re literally earning money for activities you’d do anyway.

The privacy consideration is real you’re sharing browsing data. However, established platforms anonymise data and comply with privacy regulations.

Read privacy policies and decide your comfort level.

FYI, I personally use Brave Browser for the crypto rewards while blocking traditional ads. It’s a win-win, better browsing experience plus passive earnings.

The crypto rewards accumulate automatically and can be exchanged for cash.

15. Sell Feet Pictures

Yeah, I’m ending with this one because it’s surprisingly lucrative and totally legitimate, even if it sounds weird initially.

There’s genuine demand for feet pictures from artists, photographers, stock photo sites, and yes, people with foot interests.

Platforms like FeetFinder, Instafeet, and OnlyFans allow sellers to safely monetise foot photos.

Earning reality: Quality matters. Well-photographed feet pictures can sell for $5-100 each, depending on buyer, exclusivity, and custom requirements.

Active sellers report $200-1,000+ monthly.

The process is straightforward: create an account, upload high-quality photos with good lighting and angles, set prices, and promote through social media. Platforms handle payments and protect seller privacy.

Comfort check: This isn’t for everyone, and that’s completely okay. But if you’re comfortable with it, it’s easy money requiring literally just your feet and a camera phone. No face required, complete anonymity possible, and legitimate platforms ensure safe transactions.

Final Thoughts

You can earn extra income without sacrificing peace or free time. By combining a few simple ideas and diversifying between passive and light active streams, you can steadily add $500–$2,000 a month.

Start small, test what works, and remember financial freedom comes from smart, consistent effort, not constant hustle.