How To Organize Your Finances In 10 Simple Steps (Like A Pro)

Let’s be real for a second. Your finances are probably a mess right now. Don’t worry, I’m not judging because mine were too until I decided to get serious about money.

You know that feeling when you can’t remember if you paid that one bill or when you’re scared to check your bank balance? Yeah, that’s exactly what we’re fixing today.

Getting your financial life together isn’t rocket science, but it does require some effort. The good news? Once you set up these systems, your money practically manages itself.

I’m going to walk you through everything step by step, just like I’m sitting across from you at a coffee shop.

No fancy jargon. No complicated formulas. Just straight talk about getting your money sorted out so you can actually sleep at night. Ready? Let’s get into it.

How Do I Make Sure My Finances Are In Order?

Before we jump into the nitty-gritty details, you need to understand one fundamental thing about your money. It all comes down to cash flow. Sounds boring, I know, but stick with me here.

Cash flow is simply tracking how much money comes in versus how much goes out each month. That’s it. If you can’t answer these two questions right now, you’ve got work to do: How much did you earn last month? How much did you spend?

Most people have zero clue about their actual numbers. They just swipe cards and hope everything works out. That’s like driving blindfolded and hoping you don’t crash. Not exactly a winning strategy, right?

When you know your cash flow inside and out, you can spot problems before they become disasters. You’ll see if you’re spending more than you earn (yikes), or if you actually have money left over to save and invest (winning!).

The Importance Of Organizing Your Finances

Maybe you’re thinking, “My finances aren’t that bad. Why should I bother organizing everything?” Fair question. Let me give you some solid reasons why this matters more than you think.

1. Organizing Your Finances Helps You Know Your Net Worth

Ever wonder what you’re actually worth financially? Not your value as a person, but your actual net worth in dollars and cents?

When wealthy people talk about their net worth, they’re not guessing. They know their numbers because they’ve taken time to calculate everything. Your net worth is simply what you own minus what you owe. Assets minus liabilities equals net worth.

You might be surprised to discover you’re worth more than you thought. Or maybe you’ll realize you need to make some changes. Either way, you can’t improve what you don’t measure. That’s just facts.

I remember the first time I calculated my net worth. It was eye-opening and honestly a bit depressing at first. But knowing that number motivated me to make real changes. Now I check it quarterly and watching it grow feels amazing.

2. Organizing Your Finances Saves You Time And Energy

Picture this: You need to find last year’s insurance documents or a specific receipt for your taxes. Where do you even start looking? The junk drawer? That random box in the closet? Your email from six months ago?

When your financial records are scattered everywhere, finding anything becomes a frustrating scavenger hunt. You waste hours digging through papers and old emails. It’s exhausting and completely unnecessary.

But when everything is organized in one system (whether that’s a filing cabinet, a digital folder, or a money management app), you can find what you need in seconds. Literally seconds. That’s time you can spend doing literally anything else more enjoyable.

I use a combination of digital tools and one physical folder for important documents. When tax season rolls around, I’m not stressed because everything is already where it needs to be. Game changer.

3. Organizing Your Finances Keeps You In Control

Being “in control” of your finances means you’re not just passively watching money come and go. You’re actively directing where every dollar goes and understanding what’s happening in all your accounts.

This isn’t about obsessing over every penny. It’s about awareness and intentionality. When your checking account balance drops unexpectedly, you notice immediately instead of weeks later when you’re hit with overdraft fees.

When your net worth starts declining, you can investigate why and fix the problem before it snowballs. Maybe you’ve been eating out too much, or maybe there’s a subscription you forgot to cancel. Without organization, these money leaks continue draining your finances.

Financial control means you make decisions about your money instead of your money making decisions for you. Big difference.

4. Organizing Your Finances Builds Confidence

There’s something incredibly empowering about knowing exactly where you stand financially. When you have systems in place, you stop feeling anxious about money and start feeling confident.

You can handle unexpected expenses without panicking. You know you have enough for rent and groceries. You’re making progress on your savings goals. That confidence spills over into other areas of your life too.

I used to get genuinely anxious every time I checked my bank account. Now? I check it regularly without any stress because I know what to expect. My budget is working, my bills are paid, and I’m making progress toward my goals. That peace of mind is priceless.

When you’re confident in your finances, you make better decisions overall. You’re not desperate, so you don’t accept bad deals. You can negotiate from a position of strength. You can plan for the future instead of just surviving day to day.

How To Organize Your Finances In 10 Simple Steps

Alright, enough theory. Let’s get practical. Here are ten concrete steps you can take right now to get your financial life organized. Don’t try to do everything at once. Pick one, master it, then move to the next.

1. Create A Budget

I know, I know. The word “budget” makes you want to close this tab and pretend you never read this article. But hear me out because budgeting is literally the foundation of everything else.

Think about it like this: Imagine walking into a library where all the books are dumped on the floor in random piles. Chaos, right? You can’t find anything, and the whole space feels overwhelming. That’s your finances without a budget.

A budget is simply a plan for your money. It tells each dollar where to go before the month starts. You’re not restricting yourself; you’re giving yourself permission to spend on what matters while cutting out the stuff that doesn’t.

Your budget should include all your income sources and all your expenses. Fixed expenses like rent, utilities, and car payments. Variable expenses like groceries, gas, and entertainment. And don’t forget irregular expenses like car maintenance and holiday gifts.

Start simple. List your income at the top. List all your expenses below. Make sure your income minus expenses equals zero. That’s zero-based budgeting, and it’s the most effective method I’ve found. Every dollar has a job, and nothing falls through the cracks.

2. Have Budget Meetings

Creating a budget is step one. Actually sticking to it? That’s where budget meetings come in. This might sound formal and boring, but it’s actually super helpful.

A budget meeting is just a regular check-in where you review your spending and make adjustments. If you have a partner, you do this together. If you’re single, you can do it solo or with an accountability buddy (maybe a financially savvy friend or family member).

During these meetings, ask yourself some key questions: Are we staying on track with our spending categories? Did any unexpected expenses pop up? Do we need to adjust anything for next month? What’s working well, and what’s not?

I do budget meetings with my spouse every Sunday evening. Takes maybe 20 minutes, and it keeps us both on the same page. We catch problems early, celebrate wins, and make adjustments before small issues become big problems.

These meetings also create accountability. When you know you’ll be reviewing your spending, you’re less likely to make impulsive purchases. It’s like having a workout buddy who keeps you from skipping the gym.

3. Monitor Your Transactions

You can’t manage what you don’t monitor. Sounds obvious, but most people set up a budget and then never actually track their spending against it. That’s like creating a workout plan and never going to the gym.

Monitoring your transactions means regularly checking your bank accounts and credit cards to see where your money is going. You need to know when money comes in and when it goes out.

This doesn’t mean obsessively checking your balance ten times a day (though no judgment if you do). It means reviewing your transactions at least weekly to make sure everything aligns with your budget.

When you notice you’re about to exceed your restaurant budget, you can adjust immediately. Maybe you cook at home more for the rest of the month. This real-time awareness prevents you from blowing your entire budget and then feeling guilty about it later.

I check my accounts every Monday and Thursday. Just a quick five-minute review to make sure there are no fraudulent charges and that my spending is on track. It’s become such a habit that I don’t even think about it anymore.

4. Plan For Miscellaneous Expenses

Here’s something that trips up even experienced budgeters: the random stuff that pops up. Your kid needs money for a school field trip. Your friend’s birthday is coming up. The dog needs an unexpected vet visit.

Life happens, and if you don’t plan for these miscellaneous expenses, they’ll destroy your budget every single month. Then you’ll feel like budgeting doesn’t work, when really you just needed a miscellaneous category.

I recommend setting aside at least 5-10% of your budget for miscellaneous expenses. This is your buffer for all the little things you inevitably forget or can’t predict. It’s not a free-for-all spending category; it’s insurance against budget-busting surprises.

Some months you won’t use it all, and that’s great. You can roll it into next month or move it to savings. Other months you’ll be grateful it’s there when your car needs new tires or your phone screen cracks.

This one category has saved my budget more times than I can count. It takes the stress out of unexpected expenses because you’ve already planned for them, even if you didn’t know exactly what they’d be.

5. Use Two Bank Accounts

This strategy is so simple it feels almost too easy, but it works incredibly well. Instead of keeping all your money in one checking account, split it into two accounts with specific purposes.

Account #1 is for bills and fixed expenses. Rent, utilities, car payment, insurance, subscriptions. All the stuff that has to get paid every month no matter what. This money is untouchable for anything else.

Account #2 is for discretionary spending and savings. Groceries, entertainment, dining out, personal spending money. This is the account you can actually spend from without worrying about accidentally using your rent money.

This separation creates a mental barrier that prevents you from overspending. When you see a lower balance in your spending account, you instinctively slow down your spending. Meanwhile, your bills account sits there safely, ready to cover your obligations.

I take this a step further and have a third account specifically for savings goals. Out of sight, out of mind. I pretend that money doesn’t exist unless I’m working toward a specific goal like a vacation or emergency fund.

6. Set Up Direct Deposit For Savings

Want to know the easiest way to save money? Make it automatic. Seriously, this is probably the best money hack I can share with you.

When you set up direct deposit to your savings account, the money gets saved before you even see it. You can’t spend what you don’t have access to, right? This method removes willpower from the equation entirely.

Let’s say you want to save $200 per month. Instead of hoping you’ll have $200 left over at the end of the month (spoiler: you won’t), you set up an automatic transfer of $200 on payday. Done. You just saved $2,400 this year without thinking about it.

This works for any savings goal. Emergency fund, retirement contributions, vacation fund, down payment for a house. Automate it, and it happens consistently without requiring any mental energy or discipline.

One caveat: if you’re currently drowning in high-interest debt, focus on that first. Paying off a credit card with 20% interest gives you a guaranteed 20% return on your money. That’s better than any savings account. Once the debt is gone, then automate your savings aggressively.

7. Pay Your Bills Online

If you’re still writing checks and mailing bills, I need you to stop immediately. Not only is it time-consuming, but you’re also way more likely to miss a payment and get hit with late fees.

Setting up automatic online bill pay eliminates the risk of forgetting a payment. Your bills get paid on time, every time, without you having to remember anything. It’s beautiful.

Most banks and service providers make this super easy. You just log in, enter your payment information, set the amount and frequency, and you’re done. Your electricity, internet, phone, insurance, and streaming services all get paid automatically.

Here’s the important part though: you need to make sure you have enough money in your account when these payments hit. Mark payment dates on your calendar or set up alerts so you’re never caught off guard with an overdraft.

I have almost everything on autopay except for a few variable bills that I prefer to review each month. This system has saved me probably hundreds of dollars in late fees over the years, plus the peace of mind is worth it alone.

8. Use The Envelope Strategy

This is an old-school method that still works incredibly well, especially if you struggle with overspending. The concept is beautifully simple: you use physical cash and actual envelopes for your spending categories.

Here’s how it works. After you get paid, you cash your paycheck and divide the money into envelopes labeled with different categories. Groceries, gas, entertainment, dining out, personal spending, whatever categories you need.

When you need to buy groceries, you take money from the grocery envelope. When that envelope is empty, you’re done buying groceries for the month. You can literally see your budget, which makes it way harder to overspend.

There’s something psychological about handing over physical cash that makes you more aware of your spending.

Studies show people spend less when using cash versus cards. You feel the money leaving your hands, and it creates a natural brake on impulse purchases.

Now, I know carrying cash everywhere isn’t always practical or safe. You can do a modified version where you use envelopes for your most problematic spending categories (like dining out or entertainment) while keeping other expenses on your debit card.

9. Pay Off Debt

Let’s talk about the elephant in the room: debt. If you’re carrying credit card balances, student loans, car payments, or personal loans, getting your finances organized means making a plan to eliminate that debt.

Debt is like a weight tied to your financial future. Every dollar you owe is a dollar you can’t save, invest, or use to build wealth. Plus, you’re paying interest, which means you’re literally paying extra money for the privilege of owing money. It’s a terrible deal.

The two most popular debt payoff methods are the debt snowball and the debt avalanche. The snowball method has you pay off your smallest debt first for quick psychological wins. The avalanche method has you tackle the highest interest rate first to save the most money on interest.

Honestly? Pick whichever method motivates you more. The best debt payoff strategy is the one you’ll actually stick with. Both methods work if you commit to them.

I used the snowball method to pay off about $15,000 in debt, and those early wins kept me motivated when the journey felt long. Seeing accounts hit zero and crossing debts off my list felt amazing. Now that I’m debt-free except for my mortgage, I have so much more flexibility with my money.

10. Avoid Using Credit Cards

This one might be controversial, but I’m going to say it anyway: stop using credit cards. At least until you’ve proven you can use them responsibly without carrying a balance.

The average American with credit card debt owes over $6,000. That’s a massive anchor dragging down your financial progress. Credit cards make it way too easy to spend money you don’t have, and before you know it, you’re trapped in a cycle of minimum payments and mounting interest.

I know the arguments for credit cards. The rewards points, the cashback, the fraud protection, building credit. All valid points. But here’s the thing: if you’re carrying a balance and paying interest, those rewards are meaningless. You’re losing way more in interest than you’re gaining in points.

If you struggle with credit card debt, cut them up. Seriously. Use a debit card or cash instead. Once you’ve organized your finances, built an emergency fund, and proven you can budget consistently, then maybe consider adding a credit card back into your life.

But only if you commit to paying the full balance every single month. No exceptions. If you can’t do that, credit cards will sabotage all your other financial progress. Not worth it.

Apps To Organize Your Finances

Okay, so maybe you’re feeling a bit overwhelmed by all these steps. I get it. The good news is that technology can make this whole process way easier. There are some fantastic apps that do most of the heavy lifting for you.

Let me walk you through some of the best money management apps I’ve used or researched. Each one has different strengths, so pick the one that fits your style and needs.

1. Mint

Mint is probably the most popular budgeting app out there, and for good reason. It’s completely free and super user-friendly.

You can sync all your financial accounts in one place, which gives you a complete picture of your money situation.

The app automatically categorizes your transactions, so you can see exactly where your money is going without manually entering every purchase. It shows you spending trends, alerts you to unusual activity, and helps you create budgets for different categories.

I used Mint for years when I was first getting my finances organized. The visual charts and graphs made it easy to spot problem areas. Seeing that I spent $400 on restaurants in one month was a wake-up call that led to real changes.

The main downside? It’s ad-supported and sometimes tries to sell you financial products. But if you can ignore that, it’s an incredibly powerful free tool. You can check it out at mint.intuit.com.

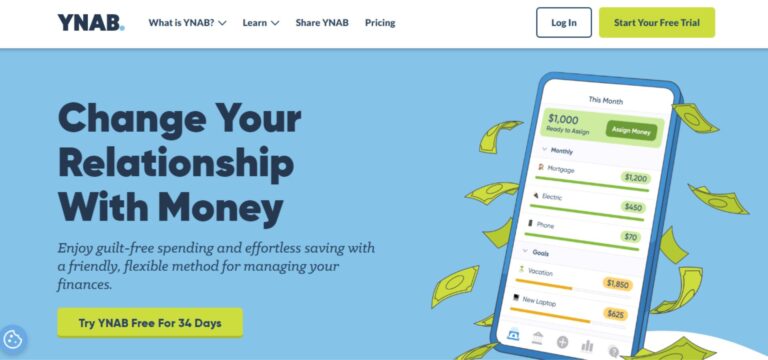

2. You Need A Budget (YNAB)

YNAB takes a different approach to budgeting. Instead of just tracking where your money went, it helps you plan where your money will go before you spend it. This is proactive budgeting rather than reactive tracking.

The app is built around the zero-based budgeting principle, which means you assign every single dollar a job. Whether it’s paying rent, buying groceries, saving for vacation, or building your emergency fund, every dollar has a purpose.

YNAB costs $99 per year (or $14.99 per month), which might seem like a lot for a budgeting app.

But users consistently report that the app helps them save way more than it costs. Many people save hundreds of dollars in the first month just by becoming more intentional with their spending.

The learning curve is steeper than Mint, but once you get the hang of it, YNAB can completely transform how you think about money. They offer a free 34-day trial, so you can test it out before committing. Check it out at youneedabudget.com.

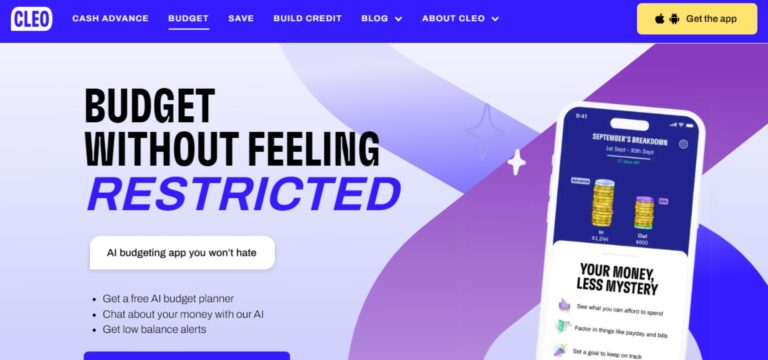

3. Cleo

Cleo is a bit different from traditional budgeting apps. It’s an AI-powered financial assistant that talks to you through chat, kind of like texting with a friend (a friend who’s really good with money and occasionally roasts you for bad spending decisions).

You connect your bank accounts, and Cleo analyzes your spending patterns. The app will literally call you out when you’re spending too much: “Hey, you’ve already spent $200 on takeout this month. Maybe cook at home tonight?” It’s surprisingly effective.

Cleo also has features to help you save money automatically. You can set savings goals, and the app will set aside small amounts regularly to help you reach them. Plus, there’s a feature that analyzes your subscriptions and helps you cancel ones you’re not using.

The basic version is free, and there’s a premium version called Cleo Plus for $5.99 per month with additional features.

The AI personality might not be for everyone, but if you respond well to a bit of tough love about your spending, Cleo might be perfect. Learn more at meetcleo.com.

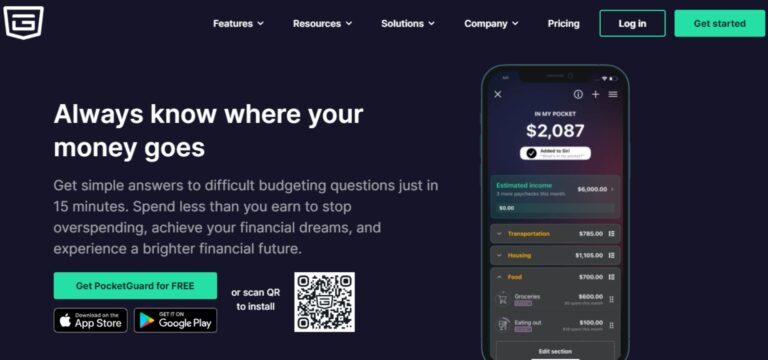

4. PocketGuard

PocketGuard answers one simple question: How much money can I safely spend right now? That’s it. That’s the whole focus, and it’s brilliant in its simplicity.

The app connects to all your accounts and calculates your “In My Pocket” amount. This is what you have left after accounting for bills, savings goals, and necessities. It’s the money you can actually spend without messing up your financial plans.

PocketGuard also identifies areas where you might be overspending and suggests ways to cut back. It can negotiate lower bills for you (in the paid version) and helps you find subscriptions you’ve forgotten about.

The free version is solid, but PocketGuard Plus ($7.99/month or $74.99/year) unlocks features like unlimited custom categories, debt payoff plans, and the bill negotiation service.

If you struggle with overspending, this app’s straightforward approach might be exactly what you need. Visit pocketguard.com for more info.

5. GoodBudget

Remember that envelope strategy I mentioned earlier? GoodBudget is the digital version of that system. Instead of physical envelopes with cash, you create virtual envelopes for different spending categories.

You allocate money to each envelope at the beginning of the month. As you spend, you record transactions and the money comes out of the appropriate envelope. When an envelope is empty, you’re done spending in that category until next month.

This system works great for people who like the envelope method but don’t want to deal with carrying cash everywhere.

It’s also fantastic for couples because you can sync your envelopes across devices, so both partners can see the budget in real-time.

The free version allows up to 10 envelopes, which is enough for most people starting out.

GoodBudget Plus costs $8/month or $70/year and gives you unlimited envelopes, longer transaction history, and other premium features. Check it out at goodbudget.com.

Final Thoughts

Look, I’m not going to lie to you. Getting your finances organized takes effort. It’s not something that happens overnight, and it’s definitely not as exciting as scrolling through social media or binge-watching your favorite show.

But here’s what I know from personal experience: the peace of mind you get from organized finances is absolutely worth every minute you invest in setting up these systems.

No more anxiety when checking your bank account. No more fighting with your partner about money. No more feeling helpless about your financial future.

You don’t have to implement all ten steps at once. That’s overwhelming and sets you up for failure. Pick one step, master it, then add another.

Maybe you start with creating a budget this month. Next month, you add automatic bill pay. The month after that, you set up direct deposit to savings.

Remember why you’re doing this. Maybe you want to stop living paycheck to paycheck. Maybe you want to buy a house. Maybe you’re tired of debt controlling your life.

Maybe you want to retire early and travel the world. Whatever your reason, keep it front and center when the process feels tedious.

You’ve got this. Seriously. If I can go from a financial mess to someone who actually enjoys managing money, anyone can. It’s just a matter of deciding that your financial future matters enough to put in the work. And I’m betting you’re ready to make that decision right now. 🙂