How To Set Financial Goals: 6 Simple Steps

Look, I’ll be straight with you, most people mess up their financial goals before they even start. They either dream too big (hello, unrealistic expectations!) or they don’t plan at all. I’ve been there, done that, and bought the expensive t-shirt that taught me a lesson.

After years of helping people fix their financial mess and watching my own money journey unfold, I can tell you that setting proper financial goals isn’t rocket science.

But it does require some actual thinking and planning. Let me share what I’ve learned so you don’t have to make the same costly mistakes I did.

What Is A Financial Goal?

Think of financial goals as your money roadmap. They’re specific targets for spending, saving, or investing that you want to hit within a certain timeframe. Could be next month, next year, or even next decade – depends on what you’re after.

Here’s the thing though: your financial goals need to match where you actually are in life, not where you wish you were. I see too many college students planning to buy luxury cars while drowning in ramen debt.

Meanwhile, working professionals with steady income hesitate to set ambitious long-term goals because they underestimate their potential.

Short-term goals (less than a year) might include:

- Building an emergency fund

- Paying off that annoying credit card

- Saving for a vacation

Medium-term goals (1-5 years) could be:

- House down payment

- New car purchase

- Starting a business

Long-term goals (5+ years) often involve:

- Retirement planning

- Kids’ college funds

- Investment property

The key is being honest about your timeline and your current situation. No shame in starting small!

Why Is It Important To Have Financial Goals?

Ever tried building something without blueprints? Yeah, that’s what managing money without goals looks like – messy, expensive, and usually disappointing.

Financial goals give you direction and help you make smarter money decisions. When you know you’re saving for a house down payment, you’re less likely to blow $200 on those shoes you saw online at 2 AM (we’ve all been there :/).

Here’s what proper goal-setting actually does for you:

Creates accountability: You can track progress and celebrate wins Prevents impulse spending: Each purchase gets measured against your bigger picture Builds discipline: You develop better money habits naturally Reduces money stress: You know where your money goes instead of wondering where it went

I learned this lesson the hard way when I spent three years “saving” for a vacation but never actually saved anything specific. Guess what? No vacation happened. But once I set a clear goal with a deadline and amount, I had that trip booked within eight months.

How To Set A Financial Goal?

Setting financial goals isn’t about picking random numbers and hoping for the best. You need to start with reality – your actual financial situation, not the Instagram version of your life.

First, examine where you stand financially. What’s coming in, what’s going out, and what’s left over? This isn’t the fun part, but it’s absolutely necessary.

Next, make sure your goal actually matters to you. I can’t stress this enough – if you’re setting goals because you think you “should” rather than because you genuinely want them, you’re setting yourself up for failure.

Your financial goals should be:

- Specific: “Save money” isn’t a goal, “save $5,000 for emergency fund” is

- Measurable: You need numbers to track progress

- Achievable: Stretch yourself, but stay realistic

- Relevant: It should align with your values and life situation

- Time-bound: Deadlines create urgency and focus

How To Set Financial Goals – 6 Simple Steps

Ready to get serious about your money? These six steps will take you from financial confusion to clear direction. I’ve used this exact process with hundreds of clients, and it works when you actually do the work.

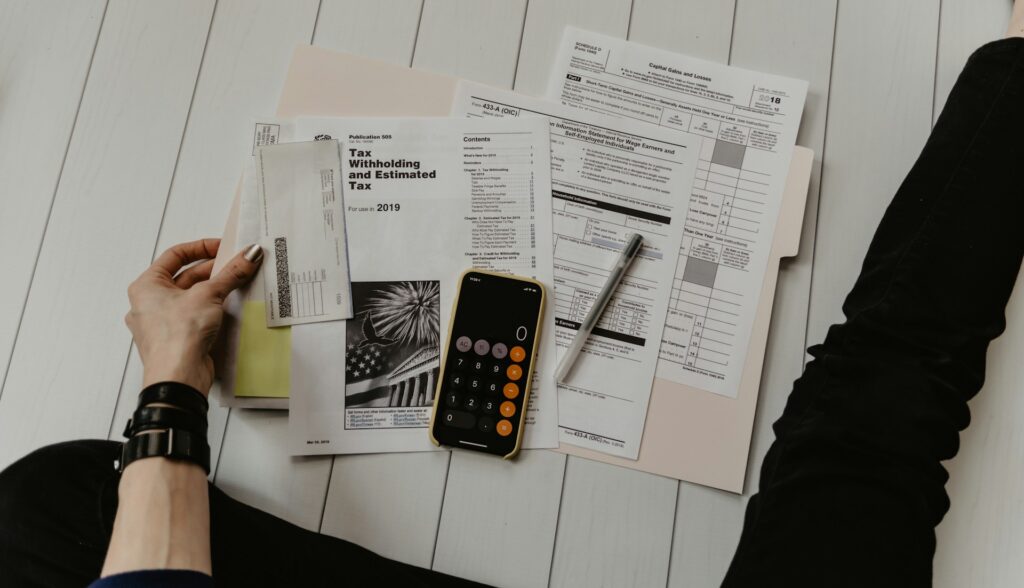

1. Gather Your Financial Paperwork

Time for some financial archaeology! You need to dig up all your money-related documents. Yes, even the scary ones you’ve been avoiding.

What you need:

- Bank statements (last 3 months minimum)

- Credit card statements

- Investment account summaries

- Loan statements (mortgage, car, student loans)

- Recent utility bills

- Insurance policies

- Pay stubs or tax returns

I know this feels overwhelming, but think of it as a financial health checkup. You can’t treat what you don’t diagnose, right?

Pro tip: Create a simple folder (physical or digital) to keep everything organized. Future you will thank present you for this organization.

This step reveals your true financial picture, not the one you imagine in your head. I once had a client who thought he was “pretty good with money” until we laid out all his statements. Turns out he was paying $300+ monthly in subscription services he’d forgotten about!

2. Calculate Your Income

Now let’s figure out what’s actually coming into your bank account each month. This sounds simple, but many people get this wrong.

For employees with steady paychecks: Look at your take-home pay after taxes, insurance, and other deductions. Don’t use your gross salary – that’s not what you can actually spend or save.

For freelancers and business owners: This gets trickier since your income varies. Use your lowest-earning month from the past year as your baseline. Yes, it’s conservative, but it keeps you from overcommitting when business is good and struggling when it’s not.

Multiple income streams? Add them all up, but be realistic about what’s reliable versus what’s sporadic. That side hustle bringing in $500 some months and $50 others? Use the lower number for planning purposes.

I made this mistake early in my freelance career – budgeting based on my best month instead of my average month. Let’s just say ramen became a food group for a while.

3. Create A List Of Monthly Expenses

Time for the reality check that makes most people want to hide under a blanket. You need to track where every dollar goes each month.

Fixed expenses (same amount every month):

- Rent or mortgage

- Insurance payments

- Phone bill

- Subscriptions services

- Loan payments

- Childcare

Variable expenses (amounts change):

- Groceries

- Utilities

- Gas

- Entertainment

- Dining out

- Personal care

- Medical costs

Don’t forget the sneaky expenses:

- Annual fees (divide by 12)

- Quarterly payments

- Holiday and birthday gifts

- Car maintenance

- Home repairs

Here’s a trick that saved my financial life: track everything for one full month using your bank and credit card statements. Don’t rely on memory – it’s terrible at remembering that $4 coffee you bought every Tuesday.

The goal isn’t to judge your spending (we all have our weaknesses), but to understand your patterns so you can make informed choices.

4. Total Your Income And Expenses

Math time! This is where the rubber meets the road. Add up everything coming in and everything going out.

If income > expenses: Congratulations! You have room to work with. This extra money is your foundation for achieving financial goals.

If expenses > income: Houston, we have a problem. You’re living beyond your means, which explains why you feel financially stressed all the time.

Don’t panic if you’re in the second category – about 40% of Americans spend more than they earn. The important thing is recognizing it so you can fix it.

When I first did this calculation years ago, I discovered I was spending $200 more per month than I earned. No wonder I felt broke despite having a decent job! But identifying the problem was the first step to solving it.

Quick reality check: If your expenses equal or exceed your income, you can’t achieve any meaningful financial goals until you fix this imbalance. Sorry, but math doesn’t lie.

5. Make Adjustments To Expenses

Time to play financial detective and find the money leaks in your budget. This step separates the people who actually want to change from those who just like talking about it.

Start with variable expenses: These are easier to adjust than fixed costs. Look for areas where you’re spending more than you realized or on things that don’t bring much value to your life.

Common money drains to examine:

- Eating out vs. cooking at home

- Premium subscriptions you rarely use

- Impulse online purchases

- Expensive hobbies or entertainment

- Brand name everything when generic works fine

Then tackle fixed expenses: These require more effort but can create bigger savings:

- Refinance loans for better rates

- Shop around for insurance

- Consider a cheaper phone plan

- Downsize housing if drastically needed

I’m not saying you need to live like a monk, but every dollar you spend on stuff that doesn’t matter is a dollar you can’t use for stuff that does matter.

The 24-hour rule: For any non-essential purchase over $100, wait 24 hours before buying. You’ll be amazed how often you realize you don’t actually need it.

6. Start Saving Towards Your Financial Goal

Finally, the fun part! Now that you’ve created space in your budget, it’s time to direct that money toward your goals.

Automate everything you can: Set up automatic transfers to your savings account right after payday. If you don’t see the money, you won’t spend it. Trust me on this – willpower is overrated.

Use the “pay yourself first” principle: Save for your goals before paying other bills (after necessities like rent and food, obviously). This flips the typical script of “I’ll save whatever’s left over.” Spoiler alert: there’s never anything left over.

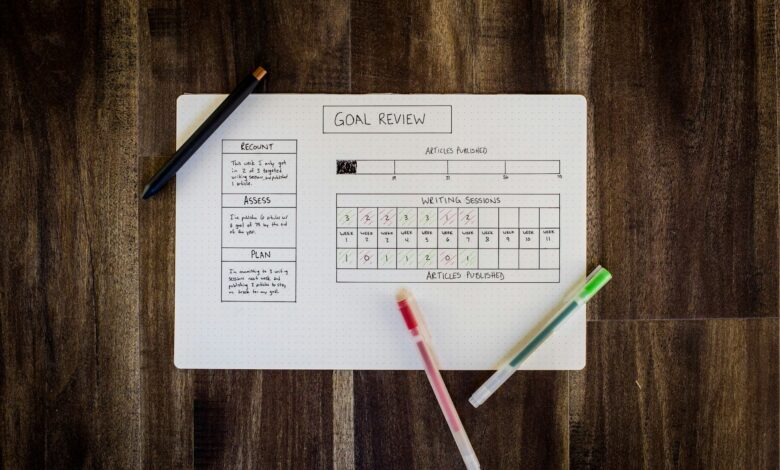

Track your progress: Whether it’s a spreadsheet, app, or old-school chart on your wall, monitoring progress keeps you motivated. Seeing that savings account grow is addictive in the best way.

Celebrate milestones: Hit 25% of your goal? Do something small to celebrate. Reached 50%? Time for a bigger (but budget-friendly) celebration. These moments keep you motivated during the long haul.

Stay flexible but committed: Life happens. Emergency expenses pop up, income changes, priorities shift. Adjust your timeline if needed, but don’t abandon the goal entirely.

I started my first serious savings goal with just $50 per month. Felt tiny at the time, but it built the habit and confidence to tackle bigger goals later.

Types Of Financial Goals You Should Consider

Not all financial goals are created equal. Some protect you from disasters, others build wealth, and some just make life more enjoyable. You need a mix of all three.

Emergency Fund Goals

This is your financial safety net. Aim for 3-6 months of expenses saved up for when life decides to throw curveballs.

Why it matters: Job loss, medical bills, car repairs, stuff happens, and cash cushions stress better than credit cards.

Debt Payoff Goals

High-interest debt is like having a money-eating monster in your budget. Feed it as little as possible by paying it off quickly.

Strategy tip: List debts by interest rate and attack the highest rate first while making minimum payments on others. The Debt Avalanche Calculator can help you map out your payoff strategy.

Retirement Goals

Future you deserves a comfortable retirement, but current you needs to make it happen. Even small amounts invested early can grow dramatically thanks to compound interest.

Home Ownership Goals

Whether it’s your first home or upgrading to something bigger, homeownership requires serious saving for down payments, closing costs, and maintenance funds.

Education Goals

Whether it’s your own skills development or kids’ college funds, education investments typically pay long-term dividends.

Experience Goals

Life’s not all about spreadsheets and saving. Budget for vacations, hobbies, and experiences that make you happy.

Common Financial Goal Mistakes To Avoid

I’ve seen people make the same financial goal mistakes repeatedly. Here are the big ones to dodge:

Setting vague goals: “Save more money” isn’t a goal, it’s a wish. “Save $10,000 for emergency fund by December 2026” is a goal.

Being unrealistic: Wanting to save $20,000 in six months on a $40,000 salary is setting yourself up for failure and frustration.

Not prioritizing: Trying to tackle five major financial goals simultaneously usually means achieving none of them.

Ignoring inflation: That retirement goal you set in 2020? It needs to be bigger now because everything costs more.

Forgetting to adjust: Your goals should evolve as your income, family situation, and priorities change.

No accountability: Flying solo makes it easier to give up when things get tough.

Tools And Resources For Financial Goal Success

You don’t need expensive software or complex systems. Simple tools work best because you’ll actually use them.

Budgeting apps: Mint, YNAB (You Need A Budget), or even a basic spreadsheet can track your progress effectively.

High-yield savings accounts: Make your money work harder while you save. Online banks like Marcus by Goldman Sachs and Ally Bank typically offer better rates than traditional banks.

Investment platforms: For long-term goals, consider low-cost index funds through platforms like Vanguard, Fidelity, or Charles Schwab.

Debt payoff calculators: See exactly how much time and money you’ll save by paying more than the minimum. Try Credit Karma’s debt calculator or Bankrate’s payoff calculator.

Financial advisors: For complex situations or large goals, professional guidance can be worth the investment.

Staying Motivated Throughout Your Financial Journey

Let’s be real – saving money isn’t always exciting. Some months you’ll want to give up and blow your progress on something fun but unnecessary. Here’s how to stay on track:

Remember your “why”: Connect each goal to something meaningful. You’re not just saving $15,000 – you’re saving for the freedom and security of homeownership.

Visual progress tracking: Whether it’s a chart on your wall or an app on your phone like Personal Capital or Tiller, seeing progress motivates continued effort.

Find an accountability partner: Share your goals with someone who’ll check in on your progress and call you out if you’re slacking.

Automate good behavior: The less you have to rely on daily willpower, the better your chances of success.

Build in small rewards: Reaching milestones deserves recognition, even if it’s just your favorite coffee or a movie night.

IMO, the hardest part isn’t starting – it’s continuing when motivation wanes and life gets in the way.

Final Thoughts

Setting and achieving financial goals isn’t about being perfect with money. It’s about being intentional with your choices and patient with your progress.

You’re going to mess up sometimes. You’ll have expensive emergencies that derail your timeline. You might realize a goal isn’t as important as you thought and need to pivot. That’s all normal and okay.

The key is getting started with whatever you can manage right now, then building momentum as you see results.

That $25 monthly savings might feel insignificant today, but it’s teaching you habits that’ll serve you when you’re saving $250 or $2,500 monthly.

Your financial goals should reflect your values and dreams, not what personal finance gurus think you should want.

Some people prioritize travel over homeownership. Others value security over experiences. Both approaches can be right.

Start today. Pick one goal, make it specific, and take the first step. Your future self is counting on present you to make smart choices.

FYI, I’m rooting for your success. Money management isn’t the most exciting topic, but financial freedom? That’s pretty amazing.

Remember: every financial success story started with someone who decided they were tired of wondering where their money went and ready to tell it where to go instead.

Now stop reading about financial goals and start setting them. Your money is waiting for some direction! 🙂