13 Best Personal Finance Books For Women

Managing money can feel like trying to solve a Rubik’s cube blindfolded, especially when you’re juggling career goals, family responsibilities, and maybe a side hustle or two. And honestly? Women face some unique financial hurdles that nobody really talks about enough.

But here’s the good news: you don’t need a finance degree to get your money situation sorted. Sometimes, all it takes is the right book to flip that switch in your brain and suddenly everything clicks into place.

I’ve spent years reading personal finance books (yeah, I’m that person who reads money books for fun), and I’ve rounded up 13 absolute gems that speak directly to women. Whether you’re drowning in debt, trying to figure out investing, or just want to stop living paycheck to paycheck, there’s something here for you.

Ready to level up your financial game? Let’s get into it.

What Is A Personal Finance Book?

Before we jump into the juicy stuff, let’s talk about what we actually mean by a personal finance book. Think of it as your money mentor in paper form (or digital, if you’re team Kindle).

Personal finance is basically the art and science of managing your cash flow. We’re talking budgeting, saving, investing, dealing with debt, and planning for big goals like buying a house or retiring without eating ramen noodles every night.

A solid personal finance book doesn’t just throw numbers at you. It teaches you the why behind the what. Why do you impulse-buy those shoes you’ll wear once? Why does investing feel so scary? Why does talking about money make you want to hide under a blanket?

The best ones cover both the practical stuff (like how credit scores actually work) and the emotional baggage we all carry around money. Because let’s face it, money is personal. It’s tied to our self-worth, our relationships, and our dreams for the future.

Now that we’ve got that covered, let’s dive into the books that’ll actually change how you think about and handle your money.

13 Best Personal Finance Books For Women

Whether you’re building a business empire, climbing the corporate ladder, or just trying to get your financial life together, this list has got you covered. These books will inspire, educate, and maybe even make you laugh a little.

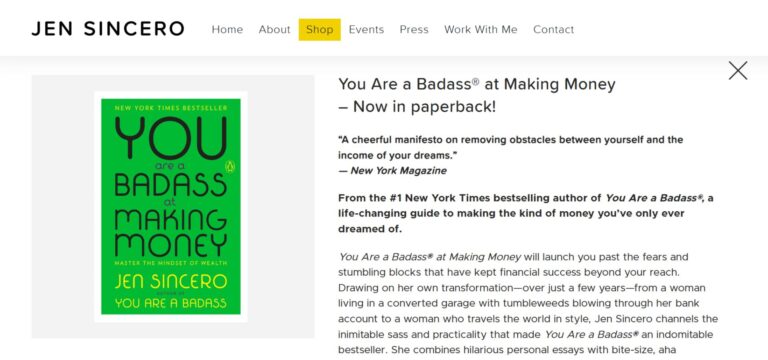

1. You Are A Bad#ss At Making Money by Jen Sincero

Kicking off our list is Jen Sincero’s powerhouse book “You Are a Bad#ss at Making Money.” that’s basically a pep talk and a finance lesson rolled into one hilarious package. If you’ve ever felt weird about wanting more money or thought that desiring wealth made you shallow, this book will slap those thoughts right out of your head (in the nicest way possible).

Sincero gets real about the mental blocks that keep us broke. She mixes personal stories with actionable advice, all while making you laugh out loud. This isn’t your typical dry finance book. It’s more like your funny friend who happens to be really good with money giving you a reality check over coffee.

What makes this book special is how it tackles the mindset piece that so many finance books ignore. You can have all the budgeting spreadsheets in the world, but if you secretly believe you don’t deserve wealth, you’ll sabotage yourself every time.

Key takeaways:

- How to identify and demolish limiting beliefs about money

- Practical exercises to shift from scarcity to abundance thinking

- Real talk about why playing small financially hurts everyone, not just you

- Actionable steps to set bold financial goals and actually achieve them

Use this book when you need a motivational kick in the pants. Read it, do the exercises, and watch your relationship with money transform. Trust me, it’s worth it.

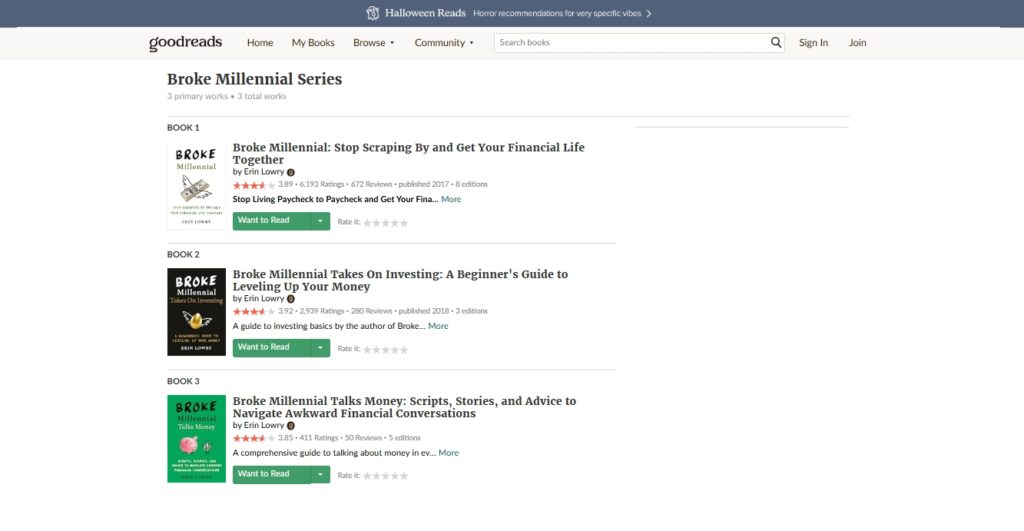

2. Broke Millennial by Erin Lowry

Ever felt like adulting is just pretending you know what you’re doing while secretly Googling everything? Yeah, Erin Lowry gets it. Her book “Broke Millennial” is like having a financially savvy older sister walk you through all the money stuff nobody taught you in school.

Lowry tackles the real issues young women face: student loans that feel like a life sentence, credit cards that seem both terrifying and necessary, and the general overwhelm of trying to build wealth when you’re just trying to afford avocado toast (kidding… sort of).

What I love about this book is how relatable it is. Lowry doesn’t talk down to you or make you feel dumb for not knowing this stuff already. She breaks down complex topics like retirement accounts and investment strategies into bite-sized pieces that actually make sense.

What you’ll learn:

- How to create a budget that doesn’t make you want to cry

- Strategies for tackling student loan debt without living in your parents’ basement forever

- Credit score basics and how to build yours from scratch

- Negotiation tactics for everything from bills to salary

Each chapter ends with practical exercises you can do immediately. No waiting around or “someday” planning. This is about taking action now, even if your bank account is currently laughing at you.

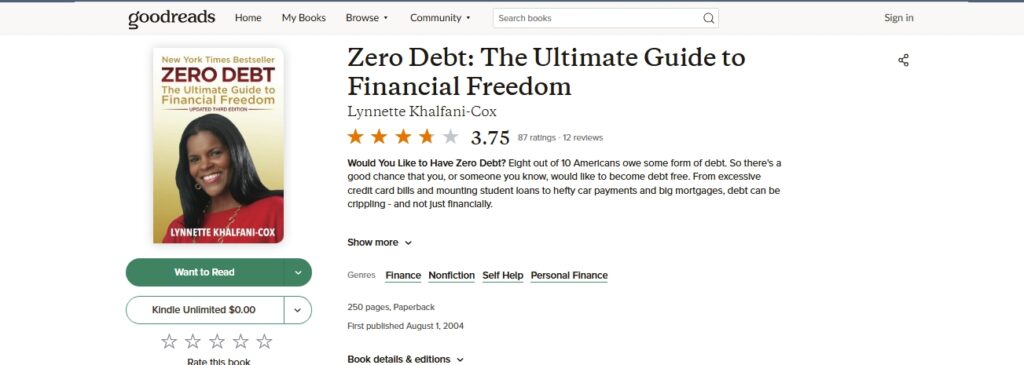

3. Zero Debt by Lynnette Khalfani-Cox

Debt is like that toxic relationship everyone tells you to leave but somehow you’re still in. If you’re feeling trapped by credit card balances, student loans, or any other financial burden, Lynnette Khalfani-Cox “Zero Debt” here to help you break free.

Khalfani-Cox knows what she’s talking about because she’s been there. She paid off over $100,000 in credit card debt (yes, you read that right), so when she gives advice, it comes from real experience, not just theory.

This book provides a step-by-step roadmap for getting out of debt. Not vague suggestions or feel-good platitudes, but actual strategies you can implement today. She covers everything from negotiating with creditors to prioritizing which debts to pay off first.

Inside this book:

- Proven strategies for negotiating with creditors and collection agencies

- The psychology behind why we get into debt and how to change those patterns

- Detailed payment prioritization systems

- How to avoid common pitfalls that keep people in debt longer

Use this book as your personal debt-elimination blueprint. Track your progress, celebrate small wins, and remember that getting out of debt isn’t just about numbers. It’s about reclaiming your freedom and peace of mind.

4. Clever Girl Finance by Bola Sokunbi

If the world of personal finance feels like an exclusive club you weren’t invited to, Bola Sokunbi is here to crash that party and bring you along. “Clever Girl Finance” is designed specifically for women who want financial independence but don’t know where to start.

Sokunbi’s approach is refreshingly practical and encouraging. She doesn’t assume you know anything about finance, which honestly is such a relief. Too many finance books act like everyone should already understand compound interest and asset allocation. Spoiler alert: most of us don’t, and that’s okay!

This book covers everything from the ground up: budgeting basics, building an emergency fund, understanding different types of investments, and planning for long-term wealth. It’s comprehensive without being overwhelming.

What makes this book essential:

- Beginner-friendly explanations of complex financial concepts

- Practical budgeting templates and worksheets

- Goal-setting frameworks that actually work

- Introduction to investing for complete beginners

- Real-life examples from women at different financial stages

Think of this as your personal finance 101 textbook, but way more fun and actually useful. Keep it handy as a reference guide when you’re making financial decisions or need a confidence boost.

5. We Should All Be Millionaires by Rachel Rodgers

Rachel Rodgers came to shake the table, and honestly, I’m here for it. “We Should All Be Millionaires” isn’t just about building wealth. It’s a full-on manifesto challenging everything society taught us about women and money.

Rodgers addresses the elephant in the room: women, especially women of color, face systemic barriers when it comes to building wealth. The wage gap is real. Discrimination is real. But you know what else is real? Your power to rise above these challenges and claim your financial throne.

What I love most about this book is the concept of “million-dollar decisions.” Rodgers argues that wealth isn’t built through penny-pinching (though budgeting matters). It’s built through bold choices: asking for what you’re worth, investing in yourself, outsourcing tasks that drain your energy, and thinking bigger than you ever have before.

Game-changing insights:

- How to identify and make million-dollar decisions daily

- Why the wage gap exists and strategies to overcome it personally

- The importance of building wealth, not just earning income

- How to stop undervaluing your work and start charging what you’re worth

- Practical strategies for scaling your income significantly

This book will make you uncomfortable in the best way possible. It’ll challenge you to stop playing small and start taking up the space you deserve. If you’re ready to stop apologizing for wanting more, read this book immediately.

6. When She Makes More by Farnoosh Torabi

Let’s talk about the elephant in many relationships: what happens when she’s the breadwinner? Despite it becoming increasingly common, this situation still comes with weird social baggage and relationship challenges nobody really prepares you for.

Farnoosh Torabi tackles this topic head-on in “When She Makes More.” Whether you already out-earn your partner or you’re on that trajectory, this book provides invaluable insights into navigating the financial and emotional dynamics that come with the territory.

Torabi combines research, interviews, and practical advice to help women (and their partners) thrive in this situation. She addresses everything from managing joint finances to dealing with societal judgment to maintaining relationship harmony when traditional gender roles get flipped.

What you’ll discover:

- How to have productive money conversations with your partner

- Strategies for managing household finances when you’re the primary earner

- Ways to navigate power dynamics without resentment

- How to handle judgment from family and friends

- Tips for maintaining your partner’s confidence and your relationship health

This book is especially valuable because it acknowledges that earning more can be empowering and complicated at the same time. It’s okay to feel both proud of your success and worried about how it affects your relationship. Torabi helps you work through all of it.

7. Get Good With Money by Tiffany Aliche

If you’ve ever felt like you need a complete financial overhaul but don’t know where to start, Tiffany Aliche (aka The Budgetnista) has your back. “Get Good With Money” introduces the concept of “financial wholeness”, which is basically getting every aspect of your financial life in order.

Aliche breaks this down into a ten-step formula that covers everything: budgeting, saving, debt management, credit building, investing, insurance, net worth tracking, retirement planning, estate planning, and financial independence. Yeah, it’s comprehensive. But don’t worry, she makes it all manageable.

What sets this book apart is Aliche’s warm, encouraging tone. She’s like that friend who believes in you even when you don’t believe in yourself. She understands that financial mistakes happen and that starting from zero (or below zero) is nothing to be ashamed of.

The ten-step framework covers:

- Budget building that actually fits your lifestyle

- Emergency fund strategies for different income levels

- Debt payoff plans that won’t make you miserable

- Credit score improvement tactics

- Beginner-friendly investing guidance

- Insurance essentials everyone needs

- Long-term wealth building strategies

Use this book as your financial roadmap. Work through each step systematically, and you’ll be amazed at how much progress you can make. Aliche’s approach is all about sustainable change, not quick fixes that don’t last.

8. Know Yourself, Know Your Money by Rachel Cruze

Ever wonder why you make the financial decisions you do? Why your best friend can walk past a sale without blinking while you’re already calculating how much room is left on your credit card? Rachel Cruze explores exactly this in “Know Yourself, Know Your Money.”

This book digs into the psychology behind your spending habits. Cruze introduces the concept of “money classrooms,” which are basically the environments and experiences that shaped your financial beliefs growing up. Understanding these influences is key to changing behaviors that aren’t serving you.

What I appreciate about this book is that it doesn’t just tell you what to do with your money. It helps you understand why you do what you do, which is honestly the missing piece in most financial advice. You can have the perfect budget, but if you don’t understand your emotional triggers, you’ll keep sabotaging yourself.

Key concepts explored:

- How your childhood experiences shaped your money mindset

- Identifying your unique spending triggers and patterns

- The connection between emotions and financial decisions

- How to break unhealthy money habits for good

- Building a healthier, more intentional relationship with money

This book pairs perfectly with more tactical finance books. Use it to understand yourself better, then apply that self-awareness to the practical strategies you learn elsewhere. It’s powerful stuff.

9. On My Own Two Feet by Manisha Thakor and Sharon Kedar

“On My Own Two Feet” is the comprehensive guide every woman needs for achieving financial independence. Manisha Thakor and Sharon Kedar cover literally everything: budgeting, saving, investing, insurance, retirement planning, and more.

What makes this book stand out is how the authors break down complex concepts into manageable steps. They don’t assume you have any prior knowledge, which is refreshing. Whether you’re fresh out of college or mid-career and finally ready to get serious about money, this book meets you where you are.

The authors also address the unique financial challenges women face, from career interruptions for caregiving to longer life expectancies (which means needing more retirement savings). They don’t just acknowledge these challenges; they provide specific strategies to overcome them.

Comprehensive coverage includes:

- Creating a personalized budget that aligns with your values

- Building emergency and long-term savings simultaneously

- Investment basics for different risk tolerances

- Retirement planning strategies for women

- Insurance needs at different life stages

- How to align your money with your personal goals

Think of this as your financial encyclopedia. It’s the kind of book you’ll reference repeatedly as your life and financial situation evolve. Keep it on your shelf and revisit it whenever you hit a new life stage or financial milestone.

10. Real Money Answers For Every Woman by Patrice C. Washington

Patrice C. Washington doesn’t mess around. “Real Money Answers for Every Woman” is exactly what the title promises: straight talk and practical solutions for the financial questions women actually have.

Washington structures this book around real questions she’s received from women at all income levels and life stages. Should I pay off debt or save first? How do I start investing with limited funds? What’s the best way to handle money in relationships? She tackles all of it with honesty and practical wisdom.

What I love about Washington’s approach is that she doesn’t judge. Whether you’re making six figures or barely scraping by, whether you’ve made smart money moves or a series of mistakes, she meets you with compassion and actionable advice.

Real answers to real questions about:

- Debt payoff strategies for different situations

- Balancing multiple financial priorities

- Starting to invest with small amounts

- Managing money in relationships and marriage

- Building wealth at any income level

- Recovering from financial setbacks

Use this book as your go-to reference when you’re facing a specific financial decision or challenge. The Q&A format makes it easy to find exactly what you need without reading cover to cover (though you should definitely do that too).

11. Women With Money by Jean Chatzky

Jean Chatzky has been in the personal finance game for decades, and “Women With Money” distills all that wisdom into one powerful book. This isn’t just about managing money. It’s about understanding your unique relationship with wealth as a woman and leveraging your strengths.

Chatzky addresses something important that many finance books skip: women are actually really good with money. Studies show women are often better investors than men (we’re less likely to make impulsive trades), better savers, and more thoughtful about long-term planning. This book helps you own those strengths.

The book covers all the practical bases while also diving into the emotional and psychological aspects of money management. Chatzky understands that financial decisions aren’t just about math; they’re about values, goals, and the life you want to create.

What you’ll gain:

- Confidence in your financial decision-making abilities

- Strategies for maximizing your earning potential

- Investment approaches that align with your goals and values

- How to create a sustainable wealth-building plan

- Ways to use money as a tool for creating the life you want

This book is particularly valuable for women who already have some financial knowledge but want to take it to the next level. It’s about moving from financial stability to true financial power.

12. Your Money Or Your Life by Vicki Robin and Joe Dominguez

“Your Money or Your Life” is a classic that’s been changing lives since it was first published, and the updated version is just as relevant today. This book asks a profound question: what is your life energy worth?

Robin and Dominguez introduce a nine-step program that completely transforms how you think about money. Instead of seeing money as just dollars and cents, you start seeing it as traded life energy. Every purchase represents hours of your life you spent earning that money. Suddenly, that impulse buy hits different, doesn’t it?

This book is perfect for women who feel like they’re on a hamster wheel: working to earn money to buy stuff they don’t really need to impress people they don’t really like. If you’ve ever felt that disconnect between how hard you work and how fulfilled you feel, this book will resonate deeply.

The nine-step program teaches you to:

- Calculate your real hourly wage (it’s probably less than you think)

- Track every penny to understand your true spending patterns

- Evaluate purchases based on life energy, not just money

- Reduce expenses in ways that actually increase life satisfaction

- Align your spending with your deepest values

- Build toward financial independence and early retirement if desired

Fair warning: this book might make you rethink everything about your relationship with work and money. But that’s exactly why it’s so powerful. Use it to create a more intentional, fulfilling financial life.

13. Financial Feminist by Tori Dunlap

Saving the best for last? Maybe. Tori Dunlap’s “Financial Feminist” is part personal finance guide, part feminist manifesto, and 100% necessary reading for every woman who’s tired of the financial system being rigged against us.

Dunlap doesn’t shy away from the hard truths: the wage gap is real, women pay more for basically everything (hello, pink tax), and systemic barriers make wealth-building harder for women, especially women of color. But here’s the thing, she doesn’t just complain about it. She provides actionable strategies to fight back and win anyway.

What makes this book special is how it combines practical money advice with social commentary. You’ll learn how to budget, save, and invest, but you’ll also understand the bigger picture of why financial feminism matters and how your personal financial success contributes to broader change.

This book delivers:

- Honest discussion of systemic financial barriers women face

- Practical budgeting and saving strategies

- Investment guidance specifically for women

- How to negotiate salary and close your personal wage gap

- Ways to use your money to support causes and businesses you believe in

- The connection between personal finance and social justice

Use this book not just to improve your personal finances but to become part of a larger movement. Dunlap argues convincingly that women achieving financial independence isn’t just good for us individually; it’s essential for creating a more equitable society. And honestly? She’s right.

Final Take On Top Personal Finance Books For Women

So there you have it: 13 books that can genuinely transform your financial life. And here’s the thing—you don’t need to read all of them at once (though I won’t judge if you do). Pick the one that resonates most with where you are right now and start there.

Maybe you need the mindset shift that Jen Sincero offers. Maybe you’re drowning in debt and Lynnette Khalfani-Cox’s roadmap is exactly what you need. Or perhaps you’re ready to go big and Rachel Rodgers’ million-dollar mindset is calling your name.

The best personal finance books for women share something in common: they don’t just give you information. They give you tools, confidence, and permission to take control of your financial life. They acknowledge the unique challenges women face while empowering you to overcome them.

Here’s my advice: don’t just read these books. Actually do the exercises. Fill out the worksheets. Have the uncomfortable conversations. Track your spending. Set the goals. Take the action. A book sitting on your shelf (or in your Kindle library) won’t change your life. But a book you actually engage with and implement? That’s transformative.

Remember, every financially successful woman you admire started somewhere. Most of them started exactly where you are now: overwhelmed, uncertain, maybe a little scared. The difference is they took that first step. They read the book, learned the lesson, made the change.

Your financial freedom is waiting for you. It’s not about being perfect or never making mistakes. It’s about being intentional, staying curious, and consistently taking small steps forward. These books will light the path. You just have to start walking.

Now stop reading about reading books and actually go read one. Your future financially empowered self will thank you. 🙂