10 Best Personal Finance Books Of All Time

Let’s be real here, most of us didn’t grow up with parents teaching us how to invest, build wealth, or even budget properly.

We learned how to balance chemical equations in school, but somehow missed the class on balancing our bank accounts. :/

Here’s the thing: your financial success isn’t about how much you earn; it’s about how you manage and multiply what you’ve got.

I’ve spent years in finance (yeah, I’ve got the degrees to prove it), and honestly?

Some of the best financial education I received came from books, not textbooks.

If you’re tired of living paycheck to paycheck or just want to level up your money game, you’re in the right place.

These aren’t just books; they’re financial blueprints written by people who’ve actually walked the walk.

No fluff, no BS, just solid advice that works.

What Is The Best Finance Book To Read?

Ever scrolled through Amazon looking at finance books and felt completely overwhelmed? I get it.

The best personal finance book isn’t necessarily the one with the fanciest cover or the most reviews.

It’s the one that teaches you how to manage AND multiply your money.

That’s the secret sauce right there. Rich people don’t just save money; they make it work for them while they sleep.

From my experience, any finance book worth your time should answer these questions:

How do I stop money from slipping through my fingers?

How do I make more of it? And how do I keep it growing long-term?

If a book comprehensively tackles these topics with actionable strategies (not just feel-good quotes), it’s probably worth reading.

The books I’m about to share? They nail all three.

Do Personal Finance Books Help?

Short answer? Absolutely, yes. Long answer? These books aren’t magic pills that’ll make you rich overnight (sorry to burst that bubble).

But here’s what they will do: they’ll completely shift how you think about money.

Think about it this way: the authors of these books are millionaires and billionaires.

They’re not theorising from ivory towers; they’re sharing the exact blueprints they used to build wealth.

It’s like having a mentor who’s already made every mistake in the book, so you don’t have to.

I’ve personally applied strategies from several of these books, and let me tell you, my investment portfolio looks very different now than it did five years ago.

The right book at the right time can be a total game-changer.

Benefits Of Reading Personal Finance Books

Before we jump into the list, let’s talk about why you should even bother reading these books.

These benefits are backed by both research and real-world results.

Improves Your Money Mindset

Your mindset is everything. Seriously.

If you think money is evil or that rich people are greedy, you’ll subconsciously sabotage your own financial success.

It sounds woo-woo, but it’s true. I’ve seen it happen countless times in my career.

Finance books rewire your brain to think like wealthy people think.

You’ll start spotting opportunities instead of obstacles.

You’ll see investments where you once saw expenses.

This mental shift is the foundation of everything else.

Financial Literacy

Financial literacy means understanding money inside and out, how to earn it, invest it, protect it, and grow it.

Most people are financially illiterate, and that’s not their fault.

Our education system just doesn’t prioritise teaching this stuff.

But here’s the kicker: financial literacy is what separates the wealthy from the broke.

When you read these books, you’ll learn about compound interest, asset allocation, debt management, tax strategies, and risk assessment.

These aren’t just fancy terms; they’re tools that can literally change your life.

Helps You Avoid Financial Crises

Remember 2008? Or more recently, the economic chaos of 2020?

Financially educated people don’t just survive recessions; they often thrive during them.

Why? Because they’ve prepared. They understand market cycles.

They’ve diversified their income streams. They’re not panicking; they’re capitalizing on opportunities.

These books teach you how to build financial fortresses that can weather any storm.

When everyone else is freaking out, you’ll be the calm one with a solid plan.

You Could Get Rich

Let’s not dance around this one. Yes, reading the right finance books can make you rich.

I’m not talking lottery-rich or inheritance-rich.

I’m talking about building sustainable wealth through smart decisions, strategic investments, and disciplined execution.

The strategies in these books have created countless millionaires; why shouldn’t you be next?

The money-making tactics are all there, documented and ready for you to implement.

The question is: will you actually do it?

Top 10 Best Personal Finance Books Of All Time

Alright, let’s get to the good stuff. These are the books that have stood the test of time and transformed millions of lives (including mine).

1. Rich Dad Poor Dad By Robert Kiyosaki

If you only read one book from this list, make it this one.

Rich Dad Poor Dad is the book that changed how an entire generation thinks about money.

Robert Kiyosaki tells the story of growing up with two father figures, his biological dad (poor dad) and his best friend’s dad (rich dad).

The contrast in their financial philosophies is eye-opening.

Here’s what blew my mind when I first read this: assets put money IN your pocket, while liabilities take money OUT.

Sounds simple, right? But most people think their house is an asset when it’s actually a liability (gasp!).

The book teaches you to:

- Focus on acquiring income-generating assets like real estate, stocks, and businesses

- Understand the difference between working for money and having money work for you

- Recognise and manage financial risks before they become disasters

- Think like an investor, not an employee

Has the book sparked controversy? Sure. Some critics argue with Kiyosaki’s definitions and approaches. But you know what?

Over 40 million copies sold and 20+ years as a bestseller speak for themselves.

This book fundamentally changed how I view purchases.

Now, before I buy anything, I ask myself: “Is this an asset or a liability?”

2. Money: Master The Game By Tony Robbins

Tony Robbins isn’t just a motivational speaker; he’s a guy who interviewed 50 of the world’s most successful investors to crack the wealth-building code.

Money: Master the Game was born from the 2008 financial crisis.

Tony saw millions of Americans losing everything and decided to create a comprehensive guide to financial freedom.

The book breaks down into seven simple steps that anyone can follow:

- Make the most important financial decision of your life (spoiler: it’s about saving more than you think you can)

- Become an insider and know the rules of the financial game

- Make the game winnable by setting achievable goals

- Make investment decisions like a billionaire (this chapter alone is worth the price)

- Create a lifetime income plan so you never outlive your money

- Invest like the .001% using strategies from the ultra-wealthy

- Find fulfilment because money without meaning is empty

IMO, the sections on compound interest and asset allocation are absolute gold. Tony explains complex financial concepts in ways that actually make sense.

No jargon, no condescension, just straight talk.

I particularly love how he exposes the hidden fees in retirement accounts that can cost you hundreds of thousands over your lifetime.

That information alone saved me a fortune.

3. The Barefoot Investor By Scott Pape

Australian finance guru Scott Pape created something special with The Barefoot Investor.

This book has sold over a million copies because it takes complex financial planning and makes it ridiculously simple.

Scott’s “bucket system” for managing money is brilliant.

You divide your income into different bank accounts (buckets) for specific purposes: daily expenses, splurge money, emergencies, and long-term wealth.

What you’ll learn:

- How to eliminate debt systematically without feeling deprived

- The exact percentages to allocate to each financial bucket

- Index fund investing made simple for retirement planning

- How to automate your finances so good money habits happen on autopilot

The beauty of this book is its practicality.

Scott doesn’t just tell you what to do, he tells you exactly how to do it, step by step. It’s like having a financial advisor in your pocket.

When I implemented the bucket system, my savings rate jumped by 40% within three months.

No joke.

4. The One-Page Financial Plan By Carl Richards

Carl Richards spent over two decades as a financial advisor, and he noticed something interesting: the best financial plans fit on a single page.

The One-Page Financial Plan strips away all the complexity and gets to the heart of what actually matters.

Carl uses simple sketches (literally stick figures) to illustrate financial concepts that intimidate most people.

The book covers:

- Creating a financial plan that actually works for your unique situation

- Budgeting without the misery (seriously, he makes it fun)

- Why paying off debt is an investment in your future self

- How to make financial decisions aligned with your values

Here’s what I love about Carl’s approach: he acknowledges that personal finance is personal.

There’s no one-size-fits-all solution. Your priorities, goals, and circumstances are unique, so your financial plan should be too.

The chapter on budgeting changed my perspective completely.

Instead of viewing budgets as restrictive, I now see them as permission slips to spend guilt-free within my limits.

5. The Intelligent Investor By Benjamin Graham

Warren Buffett calls The Intelligent Investor “the best book on investing ever written.” When the Oracle of Omaha recommends something, you listen.

Benjamin Graham literally wrote the book on value investing, the strategy of finding quality companies trading below their intrinsic value and holding them long-term.

This book teaches you:

- How to identify undervalued stocks using fundamental analysis

- The difference between investing and speculating (most people are speculating without realising it)

- Managing investment risk through diversification and margin of safety

- The psychological aspects of investing and how to avoid emotional decisions

Full transparency? This isn’t a light beach read. Graham’s writing is dense and requires concentration.

But if you’re serious about building wealth through the stock market, this book is mandatory reading.

I’ve used Graham’s principles to build a value-focused portfolio that’s consistently outperformed the market.

The concept of “Mr Market”, Graham’s metaphor for market volatility, completely changed how I react to stock price fluctuations.

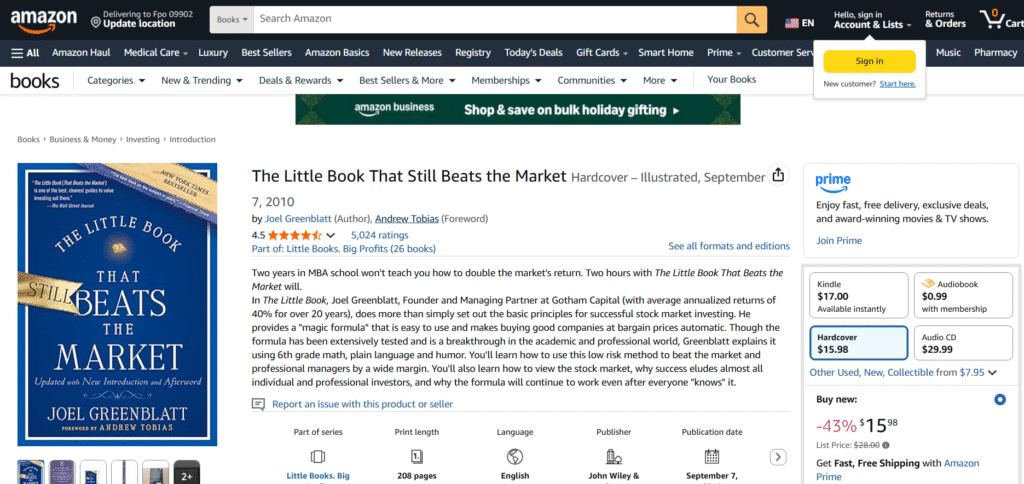

6. The Little Book That Beats The Market By Joel Greenblatt

Don’t let the title fool you, The Little Book That Beats The Market packs a serious punch.

Joel Greenblatt, a legendary hedge fund manager, reveals his “Magic Formula” for stock selection.

It’s a simple mathematical approach that identifies quality companies at bargain prices.

The formula considers two factors:

- Return on capital (how efficiently a company generates profits)

- Earnings yield (how cheap the stock is relative to earnings)

What makes this book special? Joel proves his formula works with decades of backtested data.

Companies meeting his criteria have historically crushed the broader market returns.

Key takeaways:

- Patience is essential in value investing

- Systematic approaches beat emotional decisions every single time

- Long-term thinking wins over short-term speculation

- You don’t need to be a genius to succeed in the stock market

I implemented a modified version of Joel’s strategy in 2019, and my returns have been exceptional.

The hardest part? Having the discipline to stick with it when other investments seem sexier.

7. The Millionaire Fastlane By MJ DeMarco

MJ DeMarco wrote The Millionaire Fastlane after retiring as a millionaire at 33.

Yeah, you read that right, thirty-three.

This book destroys the traditional wealth-building narrative of “go to school, get a job, save 10%, retire at 65.”

MJ calls this the Slowlane, and he argues it’s a terrible plan that leaves you broke and old by the time you’re financially free.

Instead, he presents the Fastlane, building or buying business systems that generate wealth rapidly.

The book teaches:

- Why time is more valuable than money (and how to leverage it)

- The wealth equation: Wealth = Net Profit + Asset Value (and how to maximise both)

- Thinking like a producer instead of a consumer (game-changer!)

- Why entrepreneurship is the real path to extraordinary wealth

Let me be clear: this is NOT a get-rich-quick scheme.

MJ advocates for smart work, persistence, and building real value.

But he rejects the notion that you must sacrifice your youth for financial security in old age.

After reading this, I started my first side business.

Within two years, it was generating more income than my day job. That’s the Fastlane in action.

8. The Richest Man In Babylon By George S. Clason

Written in 1926, The Richest Man in Babylon proves that solid financial principles are timeless.

George Clason uses parables set in ancient Babylon to teach wealth-building fundamentals.

The storytelling format makes complex financial concepts incredibly accessible.

It reads like a novel, but every story contains wisdom that’s applicable today.

The book’s core principles:

- Pay yourself first (save at least 10% of everything you earn)

- Control your expenditures (don’t confuse necessities with desires)

- Make your gold multiply (invest wisely for compound growth)

- Guard your wealth from loss (avoid investments you don’t understand)

- Own your home (eliminate rent as an expense)

- Ensure a future income (plan for retirement and emergencies)

- Increase your earning ability (continuously improve your skills)

Despite being almost 100 years old, these principles remain the foundation of sound personal finance.

I’ve recommended this book to dozens of people because it cuts through modern financial noise and focuses on what actually works.

The story of Arkad, the richest man in Babylon, illustrates how anyone, regardless of starting point, can build wealth through discipline and smart choices.

9. Secrets Of The Millionaire Mind By T. Harv Eker

T. Harv Eker’s Secrets Of The Millionaire Mind focuses on something most finance books ignore: your money blueprint.

Harv argues that we all have subconscious beliefs about money programmed during childhood.

If your money blueprint is set for $50,000 a year, you’ll sabotage yourself whenever you exceed that amount.

It’s like a financial thermostat. The book identifies 17 ways rich people think differently from poor and middle-class people.

For example:

- Rich people believe “I create my life,” while poor people believe “Life happens to me”

- Rich people focus on opportunities; poor people focus on obstacles

- Rich people admire other wealthy people; poor people resent them

- Rich people are willing to promote themselves; poor people think negatively about selling themselves

What I appreciate about this book is its psychological approach.

You can know all the investment strategies in the world, but if your mind isn’t wired for wealth, you won’t succeed.

The exercises Harv provides for reprogramming your money blueprint are uncomfortable but effective.

After working through them, I noticed I stopped self-sabotaging whenever my income increased.

10. The Millionaire Next Door By Thomas J. Stanley

The Millionaire Next Door shattered my assumptions about wealthy people.

Thomas Stanley and William Danko spent years researching millionaires and discovered something shocking: most millionaires don’t look like millionaires.

They drive used cars, live in modest homes, and wear inexpensive clothes.

The research revealed that millionaires share these characteristics:

- They live well below their means (the average millionaire spends about 7% of their wealth annually)

- They allocate time and money efficiently toward building wealth

- Financial independence matters more than displaying a high social status

- They didn’t receive a significant inheritance (80% are first-generation wealthy)

- They choose the right occupation (often business owners or self-employed)

- Their adult children are economically self-sufficient

This book completely changed how I view spending. The fancy car, designer clothes, and luxury lifestyle? Those are wealth destroyers, not indicators of wealth.

Real millionaires are playing a different game. They’re accumulating assets while everyone else is accumulating stuff.

After reading this, I downsized my car, moved to a smaller home, and redirected that money into investments.

My net worth has skyrocketed.

Final Time

Out of countless finance books, these ten stand out for genuinely changing lives through proven, practical strategies.

Choose one, read it this month, take notes, and apply what you learn. Financial education compounds like interest it builds over time.

Your future financial freedom starts with a single step. Begin with book one and let small, consistent actions create lasting change.