How to Create a Family Budget That Actually Works (Complete Guide for Parents)

Remember when budgeting was just about you? Those were simpler times. Now you’re juggling mortgage payments, daycare costs, soccer fees, grocery bills that seem to multiply overnight, and that dreaded question: “Can we get this?” from tiny voices in the cereal aisle.

Creating a family budget feels like trying to herd cats while blindfolded. Just when you think you’ve got everything figured out, someone needs new shoes, the car breaks down, or you discover your teenager has been ordering DoorDash like they’re running a small restaurant.

But here’s the thing I’ve learned after helping hundreds of families master their money: family budgeting isn’t harder than individual budgeting, it’s just different. And once you understand the unique challenges families face, you can build systems that actually work for real life with real kids and real chaos.

Today, I’m going to show you how to create a family budget that survives birthday parties, growth spurts, and teenage appetites while actually helping you build wealth and reduce financial stress.

Understanding the Family Budget Challenge

Family budgeting isn’t just individual budgeting times two (or three, or four). It’s an entirely different beast with unique challenges that most budgeting advice completely ignores.

Why Traditional Budgeting Fails Families

Individual budgets assume control: You decide what to buy, when to buy it, and how much to spend. Family budgets involve multiple decision-makers with different priorities, impulses, and understanding of money.

Static categories don’t work: Kids grow out of clothes, activities change seasonally, and family needs evolve constantly. A budget that worked six months ago might be completely irrelevant today.

Emotional complexity: Money decisions affect the whole family. Saying “no” to your kid’s field trip request hits differently than skipping your own coffee shop visit.

Communication complications: You and your partner might have completely different money philosophies, spending habits, and financial goals. Add kids to the mix, and alignment becomes even more challenging.

The Psychology of Family Money Management

Research from the Center for Financial Security shows that families with successful budgets share common psychological approaches:

Shared ownership: Everyone in the family understands and contributes to financial goals, even young children at age-appropriate levels.

Transparent communication: Regular family discussions about money normalize financial planning and reduce anxiety around money topics.

Flexible structure: Successful family budgets have clear boundaries but adapt to changing family needs without complete overhauls.

Values alignment: The budget reflects the family’s actual priorities, not what they think they should prioritize.

The Complete Guide to Family Budget Benefits

Financial Stability for the Whole Household

A well-crafted family budget creates predictable financial flow that reduces stress for everyone. When parents aren’t constantly worried about money, children feel more secure, and the entire family dynamic improves.

Practical stability benefits:

- Bills get paid on time without last-minute scrambling

- Emergency expenses don’t derail your entire month

- Seasonal expenses (back-to-school, holidays) are planned for in advance

- Family activities and experiences become possible rather than financial stressors

Teaching Financial Literacy Through Living Example

Your family budget becomes your children’s first and most important financial education. Kids learn by observing how their parents handle money decisions, prioritize spending, and work toward goals.

Age-appropriate financial lessons:

- Ages 3-7: Money comes from work, everything costs money, we make choices about spending

- Ages 8-12: Understanding needs vs. wants, saving for goals, comparing prices

- Ages 13-18: Income vs. expenses, debt concepts, investment basics, college financial planning

Resources like Jump$tart Coalition provide excellent age-appropriate financial education materials for families.

Improved Communication and Reduced Conflict

Money is one of the leading causes of relationship stress and family conflict. According to American Psychological Association research, families who regularly discuss finances experience significantly less money-related stress and conflict.

Communication improvements:

- Partners align on financial priorities and goals

- Children understand family financial boundaries

- Money conversations become normal, not taboo

- Decision-making becomes collaborative rather than reactive

Building Long-Term Wealth and Security

Family budgets enable wealth-building strategies that benefit everyone:

Wealth-building opportunities:

- Consistent retirement savings create multi-generational security

- Education funding reduces future family debt burdens

- Emergency funds prevent financial setbacks from becoming crises

- Investment accounts provide lessons in long-term thinking

The 3-Step Family Budget Foundation

Step 1: Calculate True Family Income

Family income calculation goes beyond just adding up paychecks. You need a complete picture of all money flowing into your household.

Primary Income Sources

Both partners’ employment income:

- Net take-home pay after all deductions

- Bonus and overtime income (use conservative estimates)

- Commission-based income (use 12-month averages)

- Benefits with cash value (employer HSA contributions, etc.)

Secondary Income Streams

Side hustles and gig work:

- Freelance or consulting income

- Ride-sharing or delivery earnings

- Online business revenue

- Part-time job income

Passive income sources:

- Rental property income (after expenses)

- Investment dividends and interest

- Child support or alimony received

- Government benefits (if applicable)

Income Calculation Tools

Use ADP’s paycheck calculator to verify your take-home calculations, especially if you have multiple jobs or complex deduction scenarios.

For families with variable income, track 12 months of earnings and use the lowest three-month average as your baseline budget number.

Step 2: Comprehensive Family Expense Assessment

Family expenses fall into categories that don’t exist in individual budgets. You need to capture everything from diaper costs to college savings.

Fixed Family Expenses

Housing costs:

- Mortgage/rent payments

- Property taxes and HOA fees

- Home insurance

- Basic utilities (water, electricity, gas)

Family insurance and benefits:

- Health insurance premiums

- Dental and vision insurance

- Life insurance premiums

- Disability insurance

Transportation:

- Car payments for family vehicles

- Auto insurance (family plan rates)

- Vehicle registration and inspection fees

Variable Family Necessities

Food and household supplies:

- Groceries (include growing appetites!)

- Household cleaning and paper products

- Personal care items for all family members

Childcare and education:

- Daycare or after-school care costs

- School supplies and fees

- Tutoring or educational support

- School lunch costs

Healthcare expenses:

- Medical copays and deductibles

- Prescription medications

- Dental and vision care costs

- Therapy or specialist visits

Family-Specific Categories

Child-related expenses:

- Clothing (account for growth spurts)

- Extracurricular activities and sports

- Birthday parties and gifts

- Babysitting and childcare

- Summer camps or vacation care

Family entertainment and activities:

- Streaming services and entertainment subscriptions

- Family outings and activities

- Vacation and travel funds

- Hobbies for all family members

Seasonal and Irregular Expenses

Back-to-school costs: Average $500-800 per child annually Holiday and birthday expenses: Plan for gifts throughout the year Summer activity costs: Camps, programs, increased entertainment Medical and dental check-ups: Annual and semi-annual appointments

Use tools like Mint or Personal Capital to analyze 6-12 months of family spending patterns and identify seasonal trends.

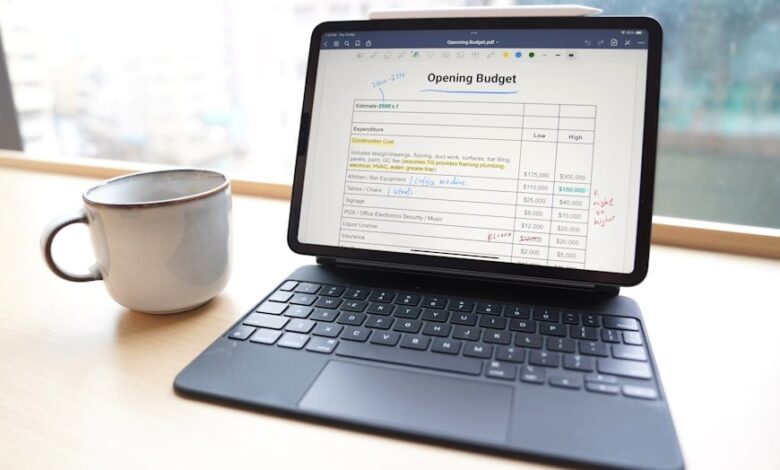

Step 3: Implement Zero-Based Family Budgeting

Zero-based budgeting is particularly powerful for families because it forces intentional decisions about every dollar while accommodating multiple family priorities.

Zero-Based Budgeting for Families

Every dollar gets a family purpose: Whether it’s mortgage payments, dance lessons, or college savings, every dollar serves a family goal before you spend it.

Monthly family budget meetings: Gather the whole family (age-appropriately) to discuss the upcoming month’s priorities and expenses.

Flexible category adjustments: As family needs change throughout the year, reallocate money between categories rather than abandoning the budget.

Family Budget Percentages

50-60% Basic Family Needs:

- Housing costs

- Transportation

- Food and household supplies

- Childcare and education

- Insurance and healthcare

15-25% Family Goals and Savings:

- Emergency fund building

- Retirement contributions

- College savings plans

- Vacation and experience funds

15-20% Family Lifestyle:

- Entertainment and activities

- Dining out and treats

- Hobbies and personal interests

- Family fun and experiences

5-10% Financial Flexibility:

- Buffer for unexpected expenses

- Seasonal adjustments

- Opportunity fund for family experiences

Adjust these percentages based on your family’s life stage, income level, and geographic location.

Zero-Based Budgeting Tools for Families

YNAB (You Need A Budget): Excellent for families, with features for multiple users and goal-based savings categories.

EveryDollar: Free zero-based budgeting tool with premium features for automatic transaction import.

Family spreadsheet templates: Create custom templates using Google Sheets that family members can access and update together.

Advanced Family Budget Strategies

The Family Emergency Fund Strategy

Families need larger emergency funds than individuals due to higher expenses and more potential emergency scenarios.

Multi-Tier Family Emergency System

Tier 1: Monthly buffer ($1,000-2,500) Handles minor emergencies without disrupting the monthly budget:

- Unexpected medical copays

- Car repairs under $1,000

- Appliance replacements

- School emergency fees

2: Major emergency fund (3-6 months family expenses) Covers significant life disruptions:

- Job loss for primary earner

- Major medical expenses

- Home repairs and maintenance

- Extended childcare needs

Tier 3: Catastrophic fund (6-12 months expenses) Provides security for major life changes:

- Extended unemployment

- Serious illness or disability

- Economic downturns affecting both parents

- Major home or family crises

Emergency Fund Building Strategies

Automatic transfers: Set up transfers to high-yield savings accounts like Ally Bank or Marcus by Goldman Sachs immediately after each paycheck.

Tax refund allocation: Direct tax refunds to emergency funds rather than lifestyle spending.

Windfall management: Bonuses, gifts, and unexpected income go to emergency funds until fully funded.

College Savings Integration

Education funding should be integrated into your family budget from early childhood.

529 College Savings Plans

State-specific benefits: Most states offer tax deductions for contributions to their 529 plans. Check your state’s specific benefits through Saving for College.

Investment options: Choose age-appropriate investment allocations that become more conservative as children approach college age.

Contribution strategies:

- Start with $25-50 monthly per child

- Increase contributions with salary raises

- Direct birthday and holiday money gifts to 529 accounts

Alternative Education Funding

Coverdell ESAs: Allow broader educational expense coverage but have lower contribution limits.

UTMA/UGMA accounts: Provide flexibility but may impact financial aid eligibility.

Roth IRA strategies: Parents can withdraw contributions penalty-free for education expenses while maintaining retirement flexibility.

Family Debt Management

Family debt strategy requires balancing current family needs with debt elimination goals.

The Family Debt Avalanche Method

Priority order:

- Credit cards and high-interest consumer debt

- Student loans (consider income-driven repayment options)

- Auto loans

- Mortgage (balance prepayment with other family goals)

Involving Children in Debt Discussions

Age-appropriate explanations:

- Young children: “We’re working extra hard to pay off money we borrowed”

- Tweens: Basic concepts of interest and why debt costs extra money

- Teenagers: Real numbers and family debt payoff timeline

Family debt motivation:

- Visual debt thermometers showing progress

- Family celebrations for debt milestones

- Clear connection between debt payoff and family goal achievement

Family Budgeting Tools and Technology

Banking Solutions for Families

Multi-Account Family Systems

Primary family accounts:

- Joint checking for shared expenses

- Joint savings for emergency funds and family goals

- Individual “fun money” accounts for personal spending

Child-focused accounts:

- Savings accounts for each child’s goals

- 529 education savings plans

- UTMA accounts for longer-term child investments

Recommended family-friendly banks:

- Ally Bank: Free multiple accounts with competitive interest rates

- Capital One 360: No minimum balance requirements, good mobile app

- USAA: Excellent for military families with comprehensive family banking services

Family Budgeting Apps and Software

Best Apps for Family Budget Management

Honeydue: Specifically designed for couples and families

- Shared expense tracking

- Bill due date reminders

- Communication features for discussing expenses

PocketGuard: Great for families with spending control issues

- Shows exactly how much you can safely spend

- Prevents overspending in real-time

- Family account linking capabilities

Goodbudget: Digital envelope method perfect for families

- Shared envelope access for family members

- Visual spending limits

- Excellent for teaching children about budgeting

Tiller: Spreadsheet-based budgeting with automatic data feeds

- Customizable for unique family needs

- Detailed transaction categorization

- Family collaboration features

Teaching Tools for Children

Age-Appropriate Money Management Apps

Ages 6-12:

- Greenlight: Debit cards for kids with parental controls

- iAllowance: Chore and allowance tracking

- PiggyBot: Photo-based savings goal tracking

Ages 13-18:

- Copper Banking: Teen banking with financial education

- Stockpile: Teen investment accounts

- Acorns Early: Investment education for teens

Family Budget Meetings and Communication

Monthly Family Budget Meetings

Meeting Structure for Different Ages

Family meeting agenda:

- Review previous month’s successes and challenges

- Discuss upcoming month’s special expenses

- Address any budget category adjustments needed

- Celebrate progress toward family financial goals

- Plan for seasonal or irregular expenses

Age-Appropriate Participation

Ages 3-7:

- Simple concepts about family money priorities

- Understanding that money is limited and requires choices

- Participation in family goal celebrations

Age 8-12:

- Input on family activity choices and their costs

- Basic understanding of monthly expenses vs. income

- Responsibility for tracking their own spending money

Ages 13-18:

- Full participation in family financial discussions

- Understanding of college costs and family education funding plans

- Input on major family financial decisions that affect them

Teaching Financial Concepts Through Budgeting

Real-World Financial Education

Grocery shopping lessons:

- Compare unit prices and discuss value

- Involve children in coupon and sale planning

- Teach the difference between brand names and generics

Utility usage awareness:

- Explain how electricity, water, and gas usage affects family budget

- Create conservation challenges with small rewards

- Show how small changes impact monthly expenses

Family Financial Goal Setting

Short-term family goals (3-12 months):

- Family vacation planning and saving

- Home improvement projects

- Emergency fund building milestones

Long-term family goals (1-5 years):

- College savings targets

- Home purchase or upgrade

- Retirement planning discussions (age-appropriate level)

Use visual tracking methods like family goal thermometers or savings charts that children can help update.

Overcoming Common Family Budget Challenges

Challenge: Spouse Resistance to Budgeting

Building Buy-In Strategies

Start with shared goals: Focus on things both partners want (vacation, debt freedom, college savings) rather than budgeting as restriction.

Use pilot periods: Try budgeting for just one month as an experiment rather than a permanent lifestyle change.

Divide responsibilities: Let each partner lead categories they’re most interested in or skilled at managing.

Celebrate early wins: Acknowledge any progress, no matter how small, to build momentum and positive associations.

Challenge: Children Constantly Asking for Money

Setting Clear Financial Boundaries

Create “fun money” allocations: Each child gets a small weekly or monthly amount for discretionary spending, reducing constant requests.

Teach earning opportunities: Connect extra money to extra chores or helpful behaviors rather than just giving handouts.

Practice saying “that’s not in our budget”: Use consistent language that normalizes budget boundaries rather than making it personal.

Special Occasion Planning

Birthday and holiday budgeting:

- Set specific amounts for each child’s gifts well in advance

- Include children in planning how to maximize their gift budgets

- Create traditions around non-monetary gifts (experiences, homemade items)

Challenge: Unexpected Family Expenses

Building Flexibility Into Family Budgets

The family flex fund: Allocate 5-10% of monthly income to a flexible category for unexpected family needs.

Seasonal adjustment planning: Review and adjust budgets quarterly to account for changing family needs and seasons.

Emergency decision protocols: Establish clear guidelines for when it’s okay to break the budget and how to get back on track.

Challenge: Different Financial Values Between Partners

Finding Middle Ground

Values clarification exercises: Discuss what money means to each partner and what financial security looks like for your family.

Compromise strategies: Allocate portions of the budget to each partner’s priorities rather than requiring complete agreement.

Professional mediation: Consider working with a family financial counselor through National Foundation for Credit Counseling if differences are significant.

Advanced Family Financial Strategies

Tax Strategy for Families

Family Tax Planning Integration

Child-related tax benefits:

- Child Tax Credits and Additional Child Tax Credits

- Dependent Care FSA for childcare expenses

- Education credits for older children’s expenses

Strategic timing:

- Bunch deductible expenses in alternating years

- Time large purchases for maximum tax benefit

- Coordinate 529 contributions with state tax benefits

Tax preparation resources:

- TurboTax for comprehensive family tax situations

- H&R Block for complex family scenarios

- FreeTaxUSA for budget-conscious families

Insurance Planning for Families

Comprehensive Family Insurance Strategy

Life insurance needs:

- Term life insurance: 10-12x annual income for primary earner

- Consider coverage for stay-at-home parents (childcare replacement cost)

- Review and adjust coverage as family size and income change

Disability insurance:

- Both parents should have disability coverage

- Coordinate employer benefits with individual policies

- Consider increasing coverage as family expenses grow

Health insurance optimization:

- Compare family plan options annually during open enrollment

- Maximize HSA contributions for triple tax benefits

- Plan for predictable medical expenses (annual checkups, vision, dental)

Investment Planning for Families

Family Investment Account Structure

Retirement accounts (prioritize tax advantages):

- Maximize employer 401(k) matches for both parents

- Contribute to Roth IRAs for tax diversification

- Consider backdoor Roth strategies for high-income families

Taxable investment accounts:

- Build wealth beyond retirement account limits

- Provide flexibility for pre-retirement goals

- Teach children about investing through family investment accounts

Educational investing:

- Balance 529 contributions with retirement savings

- Consider Roth IRA strategies for education flexibility

- Explore state-specific education tax benefits

Use low-cost providers like Vanguard, Fidelity, or Schwab to minimize investment fees and maximize family wealth building.

Building Long-Term Family Financial Success

The 5-Year Family Financial Plan

Year-by-Year Family Goals

1: Foundation Building

- Establish emergency fund (start with $1,000, build to one month of expenses)

- Create and stick to basic family budget

- Eliminate high-interest consumer debt

- Start or increase retirement contributions

2: Stability and Growth

- Build emergency fund to 3 months of expenses

- Begin or increase college savings contributions

- Optimize insurance coverage for family protection

- Establish family financial education routines

3: Acceleration

- Complete emergency fund (3-6 months of expenses)

- Increase retirement savings rate

- Consider mortgage prepayment vs. investment decisions

- Expand children’s financial education and responsibility

4: Optimization

- Review and optimize all financial systems

- Consider tax-loss harvesting and advanced tax strategies

- Increase college savings contributions

- Evaluate family financial goals and adjust as needed

5: Advanced Planning

- Focus on wealth building and advanced investment strategies

- Consider estate planning for family protection

- Evaluate early retirement possibilities

- Prepare older children for financial independence

Teaching Financial Independence

Age-Appropriate Independence Building

Elementary school (ages 6-11):

- Manage small amounts of personal spending money

- Save for personal goals with family support

- Understand the connection between work and money

Middle school (ages 12-14):

- Budget for personal entertainment and discretionary spending

- Earn money through age-appropriate work

- Begin learning about banking and saving

High school (ages 15-18):

- Manage clothing and activity budgets independently

- Understand college costs and funding options

- Learn about credit, debt, and basic investing

- Take responsibility for earning spending money

Preparing Children for Financial Independence

Financial skills checklist for 18-year-olds:

- Understand budgeting and expense tracking

- Know how to open and manage bank accounts

- Understand credit cards, student loans, and debt risks

- Basic knowledge of investing and retirement planning

- Ability to research and make informed financial decisions

Resources like National Endowment for Financial Education provide excellent materials for teaching age-appropriate financial skills.

Your Family Budget Implementation Plan

Week 1: Assessment and Preparation

Family financial assessment:

- Calculate total family income from all sources

- Gather 3-6 months of family expenses

- Identify current family financial goals and priorities

- Choose budgeting tools and apps for your family

Family communication:

- Schedule family budget meeting with all appropriate family members

- Discuss family financial values and goals

- Explain budgeting process to children at their level

Week 2: Budget Creation

Build your first family budget:

- Use zero-based budgeting principles

- Include all family members’ needs and reasonable wants

- Set up separate categories for each family member’s discretionary spending

- Plan for irregular and seasonal family expenses

Account setup:

- Open additional savings accounts for emergency funds and family goals

- Set up automatic transfers for savings priorities

- Organize banking for easy family money management

Week 3: Implementation and Tracking

Begin budget execution:

- Start expense tracking for all family spending

- Hold family check-ins to address questions and challenges

- Adjust category amounts based on actual family spending patterns

- Celebrate early successes and problem-solve challenges

Week 4: Optimization and Planning

Review and improve:

- Analyze first month results with family

- Adjust budget categories that were consistently over or under target

- Plan for next month’s family-specific expenses

- Set up systems for ongoing family financial success

Month 2 and Beyond: Mastery Building

Establish routines:

- Monthly family budget meetings become regular occurrences

- Children take on age-appropriate financial responsibilities

- Budget adjustments become routine rather than overwhelming

- Family financial goals progress measurably

Advanced strategies:

- Implement seasonal budgeting for family activities

- Begin college savings and investment strategies

- Teach older children advanced financial concepts

- Plan for major family financial milestones

Final Thoughts

Creating a successful family budget isn’t about restricting your family’s lifestyle, it’s about making intentional choices that support your family’s values and goals. The most successful family budgets bring families together rather than creating conflict, and they adapt to your family’s changing needs while maintaining financial stability.

Remember that family budgeting is a skill that improves with practice. Your first family budget won’t be perfect, and that’s completely normal. Each month you’ll get better at estimating family expenses, involving family members appropriately, and making financial decisions that benefit everyone.

The key to long-term success is creating systems that work for your unique family situation, not trying to copy someone else’s approach. Your family budget should reflect your values, accommodate your lifestyle, and help you achieve your dreams together.

Start with the basics: calculate your family income, identify your essential family expenses, and begin having regular conversations about money. Build from there as your confidence and skills develop.

Your children are watching how you handle money, and your family budget becomes their first financial education. Make it a positive experience that teaches them money management skills they’ll use for the rest of their lives.

The time you invest in creating and maintaining a family budget will pay dividends in reduced financial stress, improved family communication, and progress toward your family’s most important goals. Your future family will thank you for taking this important step today.