12 Essential Budget Questions That’ll Transform Your Financial Life

Let’s be honest, budgeting isn’t exactly the most exciting topic to discuss at dinner parties. But here’s the thing: asking yourself the right questions when creating a budget can be the difference between living paycheck to paycheck and actually building wealth.

I’ve been helping people with their finances for years, and I’ve noticed something interesting. The folks who succeed with budgeting aren’t necessarily the ones who use fancy spreadsheets or expensive apps. They’re the ones who take time to ask themselves tough, honest questions before diving into the numbers.

Today, I’m sharing the 12 most important questions you need to ask yourself when building a budget. These aren’t your typical “how much do you make” questions – we’re going deeper than that.

Why Your Budget Needs More Than Just Numbers

Before we jump into those game-changing questions, let’s talk about why most budgets fail. Spoiler alert: it’s not because people are bad at math.

Most budgets fail because they’re built on assumptions rather than reality. People create these perfect little spreadsheets that look amazing on paper but completely ignore their actual spending habits, goals, and lifestyle.

A successful budget serves three main purposes:

- Organizes your financial chaos – No more wondering where your money went

- Prevents overspending disasters – When you have a plan, you stick to it

- Tracks your financial progress – You can actually see if you’re moving forward or backward

Think of budgeting like GPS for your money. You wouldn’t start a road trip without knowing your destination, right? Same principle applies to your finances.

The Foundation: Building Your Budget the Smart Way

Here’s my no-nonsense approach to creating a budget that actually works:

Calculate Your Real Take-Home Pay

Forget about your gross salary – that number is basically useless for budgeting. What matters is what actually lands in your bank account after Uncle Sam takes his cut.

Include everything that gets deducted: taxes, health insurance, retirement contributions, parking fees – the whole nine yards. This is your actual spending money.

Track Every Single Expense (Yes, Even That Daily Coffee)

I know, I know – tracking expenses sounds about as fun as watching paint dry. But here’s the reality: you can’t manage what you don’t measure.

Start with your fixed expenses:

- Rent or mortgage

- Insurance payments

- Loan payments

- Utilities

Then tackle your variable expenses:

- Groceries

- Entertainment

- Dining out

- Shopping

Pro tip: Use your bank statements from the last 3 months. They don’t lie, unlike our memories about spending.

Set Goals That Don’t Suck

Your budget should connect to goals that actually matter to you. Saving money just to save money is boring and unsustainable.

Whether it’s building an emergency fund, paying off credit cards, or saving for a vacation that doesn’t require you to eat ramen for months afterward – make sure your budget supports what you truly want.

Create Your Spending Plan

This is where the magic happens. Take your income, subtract your fixed expenses, then allocate what’s left based on your priorities.

Remember: if your expenses exceed your income, you have two options – make more money or spend less. There’s no secret third option (despite what credit card companies want you to believe).

Make Adjustments Like a Boss

Your budget isn’t set in stone. Life happens, circumstances change, and your budget should be flexible enough to adapt without completely falling apart.

Review and adjust monthly. If you consistently overspend in one category, either increase the budget for that category or figure out why you’re overspending.

The 12 Budget Questions That Change Everything

Now for the main event, the questions that separate successful budgeters from chronic financial strugglers.

1. What’s My REAL Monthly Income?

This seems obvious, but you’d be surprised how many people get this wrong. We’re not talking about your gross pay or what you think you make.

Calculate your actual take-home pay after all deductions. If your income varies (hello, freelancers and commission-based workers), use your lowest monthly income as your baseline.

Why this matters: You can’t build a realistic budget on fantasy numbers. If you budget based on gross income, you’re setting yourself up for failure before you even start.

2. What Debts Are Haunting My Financial Life?

Debt is like that annoying relative who overstays their welcome – it affects everything and makes financial progress nearly impossible.

List all your debts: credit cards, student loans, car payments, personal loans, money you owe your brother-in-law. Include the balance, minimum payment, and interest rate for each.

Personal insight: I once worked with a client who was “broke” despite making six figures. Turns out, debt payments were eating up 60% of their income. Once we tackled the debt systematically, their entire financial picture transformed.

3. Where Does Every Dollar Actually Go?

This is where most people experience what I call “spending amnesia” – they genuinely have no idea where their money goes each month.

Break down your expenses into fixed (same amount monthly) and variable (fluctuating amounts). Be brutally honest here. That $200 monthly on dining out counts, even if you swear it’s “only occasionally.”

4. What Did I Spend Last Quarter?

Look back at your last 3-6 months of spending. This historical data reveals patterns you might not notice day-to-day.

Were you overspending? Undersaving? Buying things you forgot you purchased? This backwards look helps you build a forward-looking budget based on reality, not wishful thinking.

5. Which Expenses Are Non-Negotiable?

Your fixed expenses are like the foundation of a house – everything else gets built around them. These typically include:

- Housing (rent/mortgage)

- Transportation

- Insurance

- Minimum debt payments

- Basic utilities

These get priority in your budget. Everything else is negotiable.

6. Am I Ready for Life’s Curveballs?

Emergency funds aren’t just for other people – they’re for you. Job loss, medical bills, car repairs, and other financial surprises don’t care about your budget.

Aim for 3-6 months of basic expenses in a separate savings account. If that sounds impossible, start with $1,000. Something is better than nothing.

Reality check: Most Americans can’t handle a $400 emergency without borrowing money. Don’t be most Americans.

7. What Financial Dreams Keep Me Up at Night?

Your budget should fund your goals, not just your bills. Whether it’s retirement, starting a business, buying a house, or taking that European vacation – your money should work toward what matters to you.

Without clear goals, budgeting becomes a joyless exercise in deprivation rather than a tool for achieving what you want.

8. What Should I Do With Leftover Money?

Here’s where people often go wrong – they treat leftover money like found cash and blow it on random stuff.

If you have money left after covering expenses, you have options:

- Boost your emergency fund

- Pay extra on debts

- Increase retirement contributions

- Save for specific goals

- Invest for the future

The worst option? Spending it just because it’s there.

9. How Do I Rank My Financial Priorities?

You can’t pursue every financial goal simultaneously without stretching your money too thin. Prioritization is crucial.

For example: Should you save for a vacation or pay off credit card debt? The answer depends on interest rates, your timeline, and your values – but there’s usually a financially optimal choice.

My rule of thumb: High-interest debt comes before most other goals. That credit card charging 24% interest is costing you more than you’ll likely earn investing that money.

10. Where Can My Budget Get Better?

Your first budget won’t be perfect – and that’s okay. The key is continuous improvement.

Look for categories where you consistently overspend or underspend. Are your grocery estimates realistic? Do you need more in your entertainment category? Less in your clothing budget?

Adjust based on actual spending patterns, not what you think you should spend.

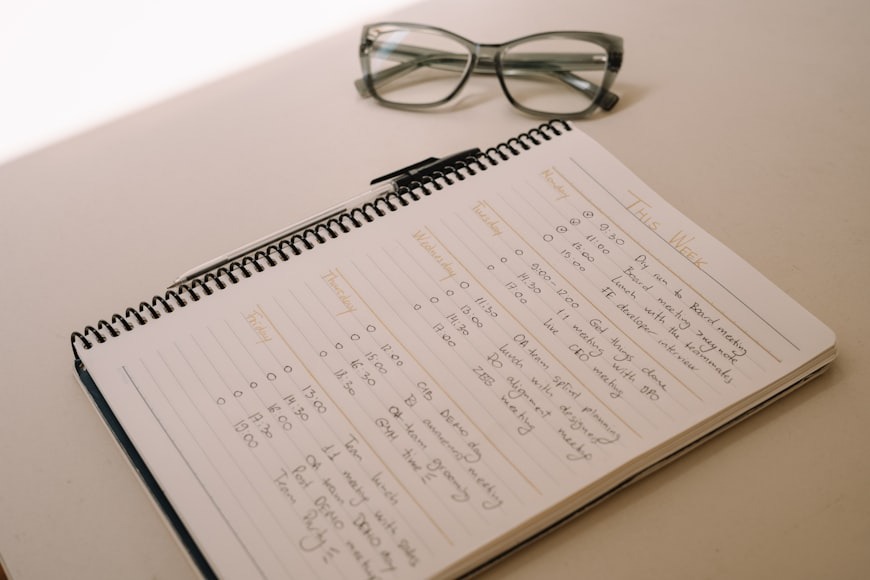

11. What Worked (and Failed) in My Last Budget?

If you’ve budgeted before, analyze what happened. Did you stick to it? Where did you go off track? What made it easy or difficult to follow?

Learning from past budgeting attempts helps you avoid repeating mistakes and build on what actually worked for your lifestyle.

12. How Can I Make This Budget Stick?

The best budget is the one you’ll actually follow long-term. This means finding systems and tools that fit your personality and habits.

Some people love detailed spreadsheets. Others prefer simple apps. Some need weekly check-ins, while others do monthly reviews. Find what works for you, not what works for your neighbor.

Tool suggestions:

- Digital natives: Try apps like Mint, YNAB, or PocketGuard

- Spreadsheet lovers: Create custom Excel or Google Sheets templates

- Cash people: Use the envelope method with actual cash

- Visual types: Try budgeting apps with charts and graphs

Making Your Budget Bulletproof

Here’s what I’ve learned after years of helping people with their money: the most successful budgeters aren’t the ones with perfect self-control. They’re the ones who build systems that work even when motivation is low.

Key strategies that work:

Automate what you can: Set up automatic transfers to savings and automatic bill payments. This removes temptation and human error from the equation.

Use the 24-hour rule: For non-essential purchases over $50, wait 24 hours before buying. This simple pause prevents most impulse purchases.

Plan for fun: If your budget is all sacrifice and no enjoyment, you won’t stick to it. Build in money for entertainment, hobbies, and small splurges.

Review weekly: Spend 15 minutes each week checking in on your budget. Small course corrections prevent major derailments.

Final Thoughts

Let me share something that might surprise you: most people don’t fail at budgeting because they can’t do math or lack willpower. They fail because they create budgets that fight against their natural tendencies instead of working with them.

If you’re not naturally disciplined with money, don’t create a budget that requires monk-like self-control. If you love dining out, don’t budget $50 per month for restaurants – you’ll blow that in a week and feel like a failure.

Instead, build a budget that accommodates who you are while gently pushing you toward who you want to become.

Your Next Steps

Ready to put these questions to work? Here’s your action plan:

- This week: Calculate your real take-home income and list all debts

- Next week: Track every expense (yes, every coffee and snack)

- Week three: Analyze your spending patterns from the past 3 months

- Week four: Create your first budget using insights from the 12 questions

Remember, budgeting is a skill, not a talent. You get better with practice, so don’t expect perfection on your first try.

The goal isn’t to create the perfect budget, it’s to create a budget that works for your real life and helps you achieve your actual goals. These 12 questions will help you build something sustainable rather than just another financial plan that looks good on paper but fails in practice.