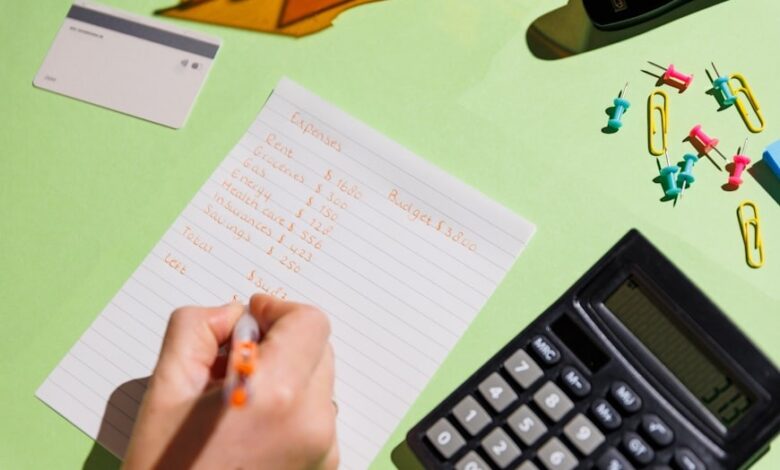

How to Stick to a Budget: 13 Proven Strategies That Actually Work

Creating a budget is the easy part. Sticking to it? That’s where most people crash and burn.

I’ve seen it happen countless times. Someone gets motivated about their finances, creates a detailed budget, feels excited about their financial future, and then abandons the whole thing within three weeks because “budgets don’t work for people like me.”

Here’s the uncomfortable truth: budgets don’t fail because they’re poorly designed. People fail when they rely on willpower instead of systems. Unrealistic restrictions often replace sustainable changes. And focusing on perfection instead of progress causes many to give up.

When I first started budgeting, I made every mistake in the book. I created impossible spending limits, tried to eliminate all fun from my finances, and gave up the moment I overspent in any category.

It took me three failed attempts to realize that successful budgeting isn’t about perfect discipline. It’s about building systems that work even when motivation disappears.

Today, I’m sharing the 13 strategies that transformed me from a serial budget-abandoner into someone who’s stuck to a budget consistently for over six years. These aren’t theoretical tips from finance textbooks. They’re battle-tested systems that work in real life.

What Makes Sticking to a Budget So Difficult?

Before diving into solutions, let’s understand why budget-sticking feels impossible for so many people:

The Willpower Myth

Most people believe budgeting is about having enough willpower to resist temptation. This is completely backwards. Willpower is a limited resource that gets depleted throughout the day. By evening, when you’re tired and stressed, your willpower tank is empty. That’s exactly when the budget-breaking decisions happen.

Successful budgeters don’t have superhuman willpower. They have systems that make good decisions automatic.

The Restriction Rebellion

When budgets feel like financial prison sentences, your brain rebels against them. Extreme restrictions trigger psychological reactance, where you want to spend money precisely because you’ve told yourself you can’t.

The Perfection Trap

Many people abandon their budgets entirely after one overspending incident. This all-or-nothing thinking treats budget “mistakes” as complete failures instead of learning opportunities.

Social and Environmental Pressures

Your environment constantly pushes you to spend money. Friends suggest expensive activities, social media shows you things to buy, and marketing messages trigger spending impulses. Without systems to handle these pressures, even the best intentions crumble.

Why Sticking to Your Budget Changes Everything

Understanding these benefits helps maintain motivation when budget discipline feels challenging:

Financial Control and Peace of Mind

Before budget consistency: Constant anxiety about money, checking account balances with dread, hoping you can afford upcoming expenses.

After budget mastery: Confidence about your financial situation, knowing exactly what you can spend without jeopardizing goals.

Personal transformation: I used to avoid checking my bank balance because I was afraid of what I’d find. Now I check it confidently because I know exactly what every dollar is supposed to be doing.

Accelerated Goal Achievement

Budget consistency multiplier effect: When you stick to your budget for six months, you don’t just reach your goals six times faster. You often reach them 10-12 times faster because compound consistency creates exponential results.

Real example: Client Jennifer wanted to save $10,000 for a house down payment. Her first attempt at budgeting lasted two months and she saved $400. Her second attempt, using systems instead of willpower, lasted two years and she saved $15,000.

Habit Formation and Lifestyle Change

The automaticity advantage: After 3-6 months of consistent budgeting, good financial decisions become automatic. You naturally consider budget categories before purchases without conscious effort.

Identity shift: You stop seeing yourself as someone who’s “bad with money” and start identifying as someone who makes smart financial choices.

Freedom Through Structure

The counterintuitive truth: Strict budget adherence creates more freedom, not less. When you know your bills are covered and your goals are funded, you can spend your “fun money” categories completely guilt-free.

13 Proven Strategies to Stick to Your Budget

These systems make budget adherence sustainable and automatic:

1. Build Realistic Expectations From Day One

The biggest budget killer is unrealistic expectations that set you up for failure.

The honesty audit: Before creating your budget, track your actual spending for 2-3 months without changing behavior. This reveals your real spending patterns, not what you think you spend.

The 80% rule: When setting budget amounts, start with 80% of what you think you need. It’s easier to increase budget categories than to consistently overspend and feel like a failure.

Gradual improvement approach:

- Month 1: Reduce dining out by 25%

- Month 2: Lower grocery costs through meal planning

- Month 3: Optimize transportation expenses

- Month 4: Review and reduce subscription services

Realistic vs. fantasy budgeting:

Fantasy: “I’ll never eat out again and cook every meal at home.” Reality: “I’ll eat out twice per week instead of five times per week.”

Fantasy: “I’ll eliminate all entertainment spending.” Reality: “I’ll find three free activities per month and budget $50 for paid entertainment.”

The motivation mistake: Don’t create budgets when you’re feeling highly motivated (after reading finance books, watching debt payoff videos, etc.). Create them when you’re in a normal, realistic state of mind.

2. Automate Everything Possible

Automation eliminates the need for repeated decision-making and removes human error from budget execution.

Essential automation priorities:

Savings transfers: Set up automatic transfers to savings accounts immediately after payday, before you can spend the money.

Bill payments: Use autopay for all fixed expenses (rent, utilities, insurance, loan payments) to prevent late fees and missed payments.

Investment contributions: Automate retirement account contributions and investment transfers so wealth building happens without conscious decisions.

Debt payments: Set up automatic extra payments toward debt elimination goals.

Goal funding: Create automatic transfers for specific savings goals (vacation, emergency fund, car replacement).

Automation timeline example:

- Day 1 (payday): All automatic transfers occur

- Day 2: Review account balances to ensure transfers processed correctly

- Day 15: Mid-month budget check-in

- Day 30: Month-end review and next month planning

The psychology of automation: When savings and bill payments happen automatically, you mentally adjust to living on the remaining amount. This prevents the monthly willpower battle about whether to save money.

3. Think Weekly, Not Monthly

Monthly budgets can feel overwhelming and abstract. Weekly planning makes spending limits feel more immediate and manageable.

Weekly budget breakdown strategy:

Example monthly budget: $1,200 for groceries, dining out, and entertainment Weekly equivalent: $300 per week for food and fun Daily awareness: Roughly $43 per day for these categories

Benefits of weekly thinking:

- Easier to visualize and track

- Mistakes don’t derail entire months

- More frequent reset opportunities

- Better alignment with paycheck cycles

Weekly check-in process:

- Sunday: Plan upcoming week’s spending

- Wednesday: Mid-week budget review

- Saturday: Week-end assessment and adjustment

Weekly envelope system: Even if you don’t use physical cash, think in weekly “envelopes” for variable expenses like groceries, gas, and entertainment.

4. Master Meal Planning and Preparation

Food expenses are usually the largest variable category in most budgets, making meal planning one of the highest-impact budget-sticking strategies.

The meal planning advantage: Home cooking costs 60-70% less than restaurant meals and eliminates the temptation of expensive convenience food.

Simple meal planning system:

Sunday: Plan next week’s meals and create grocery list Monday: Grocery shopping with predetermined list and budget Sunday (again): Batch prep vegetables, grains, and proteins

Meal planning templates:

- Breakfast: 3-4 rotating options you enjoy

- Lunch: Leftover dinners plus 2-3 simple options

- Dinner: 7-10 go-to meals you can make without recipes

- Snacks: Planned options that prevent vending machine purchases

Budget-friendly meal strategies:

- Build meals around seasonal produce and sale items

- Cook large batches and freeze portions

- Use cheaper protein sources (beans, eggs, chicken thighs)

- Minimize food waste through proper storage and planned leftovers

Restaurant budget management:

- Choose specific restaurants and meal types for dining out

- Check menus and prices before going to restaurants

- Set maximum amounts you’ll spend per restaurant visit

- Consider dining out as entertainment, not regular nutrition

5. Embrace Strategic Under-Earning Living

This counterintuitive strategy involves intentionally living below your means to create financial breathing room.

The principle: Live as if you earn 10-15% less than your actual income. This creates automatic savings and prevents lifestyle inflation.

Implementation methods:

Separate account strategy: Direct deposit paychecks into a savings account, then transfer your “allowed” amount to checking for monthly expenses.

Percentage-based living: If you earn $4,000 monthly, live on $3,500 and automatically save the $500 difference.

Pay increase discipline: When you get raises, bank 50% and use 50% for lifestyle improvements.

Benefits of strategic under-earning:

- Built-in emergency buffer for unexpected expenses

- Automatic wealth building without conscious saving decisions

- Reduced financial stress and increased security

- Protection against income fluctuations

Mindset shift: Instead of seeing this as deprivation, frame it as buying financial security and future options.

6. Plan for Social and Seasonal Expenses

Unexpected social expenses destroy budgets faster than almost anything else. Planning for them eliminates surprise spending.

Social spending categories to budget for:

Regular social activities: Monthly dinners with friends, weekend entertainment, coffee dates

Seasonal events: Holiday gifts, summer activities, back-to-school expenses

Life celebrations: Birthdays, weddings, baby showers, graduations

Professional networking: Work events, conferences, professional development

Calendar-based budgeting process:

- Review your calendar at the beginning of each month

- Identify social events and seasonal expenses

- Add these expenses to your monthly budget

- Set aside money throughout the year for predictable annual expenses

Gift planning strategy:

- Create an annual gift budget and divide by 12

- Save gift money monthly instead of scrambling during holiday seasons

- Keep a running list of gift ideas throughout the year

- Take advantage of sales and off-season pricing

Social spending without budget guilt:

- Be honest with friends about your budget limitations

- Suggest lower-cost alternatives when appropriate

- Budget specific amounts for social activities so you can participate guilt-free

7. Eliminate Credit Card Temptation

Credit cards make overspending effortless and hide the true impact of purchases. Removing this temptation is crucial for budget success.

Why credit cards sabotage budgets:

- Spending doesn’t feel “real” when you’re not using actual money

- The pain of payment is delayed until the bill arrives

- Minimum payments hide the true cost of purchases

- Available credit creates false sense of spending ability

Credit card elimination strategies:

Physical removal: Take credit cards out of your wallet and keep them at home

Digital detox: Remove saved credit card information from online shopping sites

Debit card transition: Use debit cards for all purchases so spending comes directly from your budget

Cash system: Use physical cash for categories where you tend to overspend

What about credit scores: You can maintain good credit by keeping credit card accounts open with zero balances. You don’t need to actively use credit cards to build credit history.

Emergency protocol: If you must keep one credit card for true emergencies, freeze it in a block of ice. This creates a cooling-off period before you can use it.

8. Create Powerful Accountability Systems

External accountability dramatically increases budget adherence rates because it leverages social psychology and peer pressure.

Accountability partner selection:

Ideal characteristics: Someone who supports your financial goals, won’t enable bad spending decisions, and is willing to have honest conversations about money.

Partner types:

- Spouse or romantic partner: Natural choice if you share finances

- Close friend: Someone who knows your goals and values

- Family member: Parent, sibling, or relative who wants to see you succeed

- Professional: Financial counselor, coach, or advisor

Accountability systems that work:

Weekly check-ins: 15-minute conversations about budget performance and upcoming challenges

Shared tracking: Both partners track their budgets and share progress regularly

Goal celebrations: Acknowledge budget successes and milestone achievements together

Problem-solving sessions: When you overspend or face challenges, brainstorm solutions together instead of making excuses

Text message accountability: Daily or weekly texts about spending decisions and budget adherence

Public commitment: Share your budget goals with friends or on social media to create social pressure for success

9. Use Strategic Spending Freezes

Temporary spending freezes reset your financial habits and create dramatic budget improvements quickly.

Types of spending freezes:

No-spend weekends: Don’t spend money on anything except pre-planned essentials for 48 hours

Weekly spending freeze: One week per month where you only spend on necessities

Category-specific freezes: No restaurant meals for 30 days, no clothing purchases for 90 days

Complete spending freeze: Only essentials (housing, utilities, groceries, transportation) for 30-90 days

Spending freeze benefits:

- Breaks unconscious spending habits

- Creates awareness of spending triggers

- Generates extra money for debt payoff or savings goals

- Builds confidence in your ability to control spending

Making freezes successful:

Clear rules: Define exactly what counts as “essential” spending before starting

Preparation: Stock up on necessities before the freeze begins

Alternative activities: Plan free entertainment and activities to replace paid options

Support system: Tell friends and family about your freeze so they can support you

Reward planning: Plan a reasonable reward for completing the freeze successfully

10. Implement the 24-Hour Purchase Rule

This simple system eliminates most impulse purchases while still allowing for thoughtful spending decisions.

How it works: For any unplanned purchase over $25-50, wait 24 hours before buying. For larger purchases ($200+), wait 72 hours or a week.

The psychology: Most purchase impulses fade within 24 hours. The waiting period allows rational thinking to override emotional spending triggers.

Advanced variations:

The list method: Instead of buying items immediately, add them to a “want list” and review monthly

The savings requirement: For every non-essential purchase, save an equal amount toward your financial goals

The substitute game: Before buying anything, identify what you’d have to give up from your budget to afford it

Digital implementation:

- Screenshot items you want to buy instead of purchasing immediately

- Use shopping cart “save for later” features

- Set phone reminders to reconsider purchases after waiting periods

Exceptions to the rule: True emergencies, limited-time opportunities that align with planned purchases, and items already budgeted for.

11. Optimize Your Subscription Spending

Subscription services create “subscription creep” where small monthly charges add up to significant budget drains.

Subscription audit process:

Discovery phase: Review 3-6 months of credit card and bank statements to identify all recurring charges

Evaluation criteria: For each subscription, ask:

- Have I used this service in the past 30 days?

- Does this service provide value equal to or greater than its cost?

- Would I sign up for this service again today?

- Can I get similar value from free alternatives?

Cancellation strategies:

- Cancel unused subscriptions immediately

- Downgrade premium services to basic plans

- Share family plans with relatives when appropriate

- Set calendar reminders to review subscriptions quarterly

Smart subscription management:

- Use annual plans for services you definitely use (often 15-20% cheaper)

- Rotate subscriptions instead of maintaining multiple similar services

- Take advantage of free trial periods before committing to paid plans

- Use subscription tracking apps to monitor recurring charges

Common subscription traps:

- Gym memberships used less than twice monthly

- Multiple streaming services when you actively watch one

- Magazine or app subscriptions you’ve forgotten about

- Premium features on services where basic plans meet your needs

12. Apply the Pay-Yourself-First Philosophy

This approach ensures your financial goals get funded before discretionary spending can interfere.

Traditional budgeting: Pay bills → buy necessities → save whatever’s left (usually nothing)

Pay-yourself-first: Save for goals → pay essential bills → spend remaining money freely

Implementation steps:

Calculate total savings goals: Emergency fund, retirement, specific goals (vacation, car, house)

Set up immediate transfers: Automatic transfers that happen on payday, before you can spend the money

Live on the remainder: Build your lifestyle around what’s left after savings and essential bills

Example pay-yourself-first budget:

- Income: $4,000

- Immediate savings transfer: $600 (15%)

- Essential bills: $2,400

- Available for discretionary spending: $1,000

The psychology: When money is already moved to savings, you don’t feel deprived spending the remainder because you know your future is secure.

Benefits over traditional budgeting:

- Guaranteed progress toward financial goals

- Automatic lifestyle scaling to available money

- Reduced guilt about discretionary purchases

- Simplified decision-making process

13. Become a Strategic Comparison Shopper

Smart shopping strategies can dramatically reduce expenses without reducing life satisfaction.

Price comparison systems:

Grocery strategies:

- Compare prices between different stores in your area

- Use store apps to find sales and digital coupons

- Buy generic brands for staple items (often 30-50% cheaper)

- Shop seasonal sales and stock up on non-perishables

Major purchase research:

- Compare prices across multiple retailers

- Read reviews to avoid buying poor quality items that need replacement

- Time purchases around sale seasons (electronics in January, appliances in September)

- Consider buying quality used items for expensive purchases

Service comparison:

- Get quotes from multiple providers for insurance, internet, phone service

- Negotiate with current providers using competitor quotes

- Review service contracts annually and switch when beneficial

Tools for comparison shopping:

- Browser extensions that find coupon codes automatically

- Price tracking apps that alert you to sales

- Cashback credit cards and shopping portals

- Wholesale clubs for bulk purchases of items you use regularly

The time investment rule: Spend comparison shopping time proportional to the purchase amount. Don’t spend two hours researching a $20 purchase, but do spend several hours researching major purchases like cars or appliances.

Advanced Budget-Sticking Strategies

Once you’ve mastered the fundamentals, these advanced techniques can optimize your budget adherence:

The Seasonal Budget Adjustment

Create different budget versions for different times of year to account for seasonal expense variations:

Summer budget: Higher utilities, vacation expenses, outdoor activities Winter budget: Holiday spending, higher heating costs, different entertainment Back-to-school budget: Education expenses, clothing needs, schedule changes

The Envelope System Evolution

Start with cash envelopes for problem categories, then graduate to digital envelope systems:

Physical cash: For categories where you consistently overspend Separate checking accounts: Digital envelopes for different budget categories App-based envelopes: Use budgeting apps that create virtual envelopes

The 50/30/20 Integration

Combine percentage-based budgeting with detailed category tracking:

- 50% for needs (detailed tracking)

- 30% for wants (loose tracking)

- 20% for savings and debt (automated)

The Budget Buffer Strategy

Build small buffers into each category to accommodate natural spending variation:

- Budget 10% more than you think you need

- Use unspent buffer money for extra debt payments or savings acceleration

- Gradually reduce buffers as your spending becomes more predictable

Common Budget-Sticking Mistakes (And How to Avoid Them)

Learn from these frequent errors to accelerate your success:

The Perfectionism Trap

The mistake: Abandoning your budget entirely after overspending in one category The solution: Focus on overall budget performance, not perfect category adherence

The Deprivation Extreme

The mistake: Eliminating all discretionary spending to maximize savings The solution: Include reasonable amounts for entertainment and personal purchases

The Social Isolation

The mistake: Avoiding all social activities because they cost money The solution: Budget for social activities and find lower-cost alternatives

The Comparison Game

The mistake: Trying to copy someone else’s budget instead of creating your own The solution: Customize your budget to your specific income, expenses, and values

The Set-and-Forget Approach

The mistake: Creating a budget once and never adjusting it The solution: Review and adjust your budget monthly based on actual spending patterns

Building Long-Term Budget Success

Sustainable budget adherence requires ongoing attention and refinement:

Monthly Budget Reviews

Performance analysis: Which categories stayed on track and which didn’t? Pattern identification: Are there consistent overspending areas or triggers? Adjustment planning: How will you modify next month’s budget based on this month’s learnings? Goal progress: Are you making expected progress toward financial objectives?

Quarterly Deep Dives

System evaluation: Are your budget-sticking strategies still working? Life change assessment: Do major life changes require budget restructuring? Goal recalibration: Are your financial goals still realistic and motivating? Celebration and reward: Acknowledge your consistency and progress

Annual Budget Overhauls

Complete system review: Evaluate the effectiveness of your entire budgeting approach Major goal setting: Establish new financial objectives for the coming year Income and expense projection: Plan for expected changes in income or major expenses Strategy refinement: Implement lessons learned from a full year of budgeting

Final Thoughts

Sticking to a budget isn’t about having perfect willpower or eliminating all spending enjoyment from your life. It’s about building systems that make good financial decisions automatic and sustainable.

The most successful budgeters aren’t the ones who never overspend. They’re the ones who get back on track quickly when they do overspend, and who continuously refine their systems to work better over time.

Your budget isn’t a restriction on your freedom. It’s the foundation that creates true financial freedom. When you know your bills are covered, your goals are funded, and your future is secure, you can spend your designated fun money completely guilt-free.

The strategies in this guide work, but only if you implement them consistently. Start with one or two techniques that resonate most strongly with you, master those, then gradually add additional strategies as your budget-sticking muscles get stronger.