How to Budget Using the Zero-Based Method: The Ultimate Guide to Giving Every Dollar a Job

Ever wonder where your money disappears to each month? You work hard, earn a decent paycheck, pay the obvious bills, and somehow still feel broke by month’s end.

I used to have that exact problem. Despite making good money, I couldn’t figure out why I never seemed to get ahead financially. Money would arrive in my account and somehow evaporate into thin air, leaving me with nothing to show for my hard work.

Everything changed when I discovered zero-based budgeting. This wasn’t just another budgeting technique. It was a complete mindset shift that forced me to become intentional with every single dollar I earned.

Within three months of implementing zero-based budgeting, I had more savings than I’d accumulated in the previous two years. Within a year, I was consistently hitting financial goals that had seemed impossible before.

Today, I’m sharing the complete zero-based budgeting system that transformed my finances and helped thousands of people take complete control of their money.

What Is Zero-Based Budgeting?

Zero-based budgeting is brilliantly simple: your income minus all planned expenses and savings equals zero. Every dollar that enters your account gets assigned a specific job before you spend it.

If you earn $4,000 monthly, then every penny of that $4,000 gets allocated to categories like housing, food, transportation, savings, debt payments, and entertainment until you’ve assigned all $4,000. Nothing is left unaccounted for.

The Core Principle: Every Dollar Has a Purpose

Traditional budgeting often leaves money unassigned, hoping you’ll “naturally” make good decisions with leftover funds. Zero-based budgeting eliminates leftover funds entirely by giving every dollar a predetermined purpose.

Example breakdown:

- Monthly income: $4,000

- Housing: $1,200

- Food: $400

- Transportation: $300

- Utilities: $200

- Insurance: $150

- Debt payments: $300

- Savings: $300

- Entertainment: $100

- Miscellaneous: $50

- Total allocated: $4,000

Result: Zero dollars left unassigned, zero confusion about where money should go.

Why “Zero-Based” Is the Perfect Name

The term comes from the business world, where departments start each budget cycle with zero allocated funds and must justify every expense from scratch. Personal zero-based budgeting works the same way. Each month, you start with zero allocations and consciously assign every dollar based on your current priorities.

This approach prevents autopilot spending and forces regular evaluation of your financial priorities.

Who Should Use Zero-Based Budgeting?

Zero-based budgeting works exceptionally well for specific personality types and financial situations:

Perfect Candidates

Detail-oriented people: If you like knowing exactly where every dollar goes and don’t mind tracking expenses closely.

Chronic overspenders: The system’s built-in constraints prevent spending money you haven’t specifically allocated.

Goal-focused individuals: When you have specific financial objectives, zero-based budgeting ensures consistent progress toward those goals.

People with steady income: Regular paychecks make the monthly planning process straightforward and predictable.

Those who’ve failed with other budgets: If loose budgeting approaches haven’t worked, zero-based budgeting’s structure might be exactly what you need.

Consider Other Methods If

You have highly variable income: Freelancers and commission-based workers might find the rigid structure challenging.

You prefer simplicity: Zero-based budgeting requires more detailed tracking than percentage-based or automated approaches.

You’re just starting with budgeting: The comprehensive nature might feel overwhelming for complete beginners.

You value spending flexibility: Some people prefer broader category limits rather than specific dollar assignments.

Why Zero-Based Budgets Transform Financial Lives

Understanding the deeper benefits helps maintain motivation when the system feels challenging:

Eliminates Financial Mystery

Before zero-based budgeting: “I made $4,000 this month, but I only have $200 left. Where did it all go?”

After zero-based budgeting: “I spent exactly what I planned in every category. My $200 remaining is my planned miscellaneous fund.”

Forces Intentional Decision-Making

Every spending decision becomes deliberate rather than reactive. Instead of wondering “Can I afford this?” you ask “What category does this come from, and do I have money left in that category?”

Prevents Lifestyle Inflation

When income increases, zero-based budgeting forces you to consciously decide where the extra money goes rather than automatically increasing all spending proportionally.

Example: $500 monthly raise can be deliberately allocated:

- $250 to savings acceleration

- $150 to debt elimination

- $100 to lifestyle improvements

Builds Wealth Systematically

Because savings and debt payments are treated like essential bills, wealth building happens automatically rather than accidentally.

Personal story: Using zero-based budgeting, I went from saving $0 monthly to saving $800 monthly within six months. The system forced me to “pay myself” before other expenses could consume the money.

Creates Financial Accountability

The system makes it impossible to ignore poor spending decisions. When you overspend in one category, you must consciously take money from another category or exceed your budget entirely.

This visibility prevents the gradual financial drift that destroys most budgets.

How Zero-Based Budgeting Works: Real Examples

Let’s break down exactly how this system works with concrete examples:

Example 1: Single Person, $3,500 Monthly Income

Monthly Income: $3,500 (after taxes)

Fixed Expenses:

- Rent: $900

- Car payment: $250

- Insurance (auto + renters): $120

- Phone: $60

- Utilities: $100

- Subtotal: $1,430

Variable Expenses:

- Groceries: $300

- Gas: $80

- Dining out: $150

- Entertainment: $100

- Personal care: $50

- Clothing: $70

- Subtotal: $750

Financial Goals:

- Emergency fund: $200

- Retirement (Roth IRA): $500

- Extra debt payment: $150

- Subtotal: $850

Miscellaneous: $470

Total Allocated: $3,500 Remaining: $0

Example 2: Family of Four, $6,000 Monthly Income

Monthly Income: $6,000 (after taxes)

Housing & Utilities:

- Mortgage: $1,400

- Property taxes/insurance: $300

- Utilities: $180

- Internet/cable: $80

- Subtotal: $1,960

Transportation:

- Car payments: $450

- Insurance: $180

- Gas: $200

- Maintenance fund: $70

- Subtotal: $900

Food & Personal:

- Groceries: $600

- Dining out: $200

- Personal care: $100

- Clothing: $150

- Subtotal: $1,050

Family Expenses:

- Childcare: $800

- School activities: $100

- Medical expenses: $150

- Subtotal: $1,050

Financial Goals:

- Emergency fund: $300

- Retirement: $500

- College savings: $200

- Subtotal: $1,000

Miscellaneous: $40

Total Allocated: $6,000 Remaining: $0

5-Step Process to Implement Zero-Based Budgeting

Follow this systematic approach to build your first zero-based budget:

Step 1: Calculate Your True Monthly Income

For salary earners: Use your after-tax, after-deduction take-home pay from your paystub.

For irregular income:

- Track income for 6-12 months

- Use the lowest monthly amount as your baseline

- Treat higher-income months as opportunities for extra savings/debt payments

Include all income sources:

- Primary job salary

- Side hustle earnings

- Investment dividends

- Regular support from family

- Any other predictable monthly income

Don’t include:

- Irregular bonuses or overtime

- Tax refunds

- One-time income sources

- Money from selling belongings

Example calculation:

- Gross monthly salary: $5,000

- Taxes and deductions: $1,200

- Side hustle (consistent): $300

- Net monthly income for budgeting: $4,100

Step 2: List Every Possible Expense

Create comprehensive categories that capture all your spending:

Fixed Monthly Expenses (same amount each month):

- Housing (rent/mortgage, property taxes, HOA fees)

- Insurance (health, auto, life, disability, renters/homeowners)

- Loan payments (student loans, car loans, personal loans)

- Subscriptions (phone, internet, streaming services, gym memberships)

Variable Monthly Expenses (amounts change but occur regularly):

- Utilities (electricity, gas, water, trash)

- Groceries and household supplies

- Transportation (gas, public transit, rideshare)

- Personal care (toiletries, haircuts, medical copays)

- Clothing and shoes

Periodic Expenses (don’t occur monthly but are predictable):

- Car maintenance and repairs

- Home maintenance and repairs

- Holiday and birthday gifts

- Annual fees (memberships, subscriptions, licenses)

- Seasonal expenses (holiday travel, summer activities)

Financial Goals (treat these like essential bills):

- Emergency fund contributions

- Retirement account contributions

- Debt payments beyond minimums

- Specific savings goals (house, car, vacation)

Pro tip: Review 3-6 months of bank and credit card statements to identify expenses you might forget about.

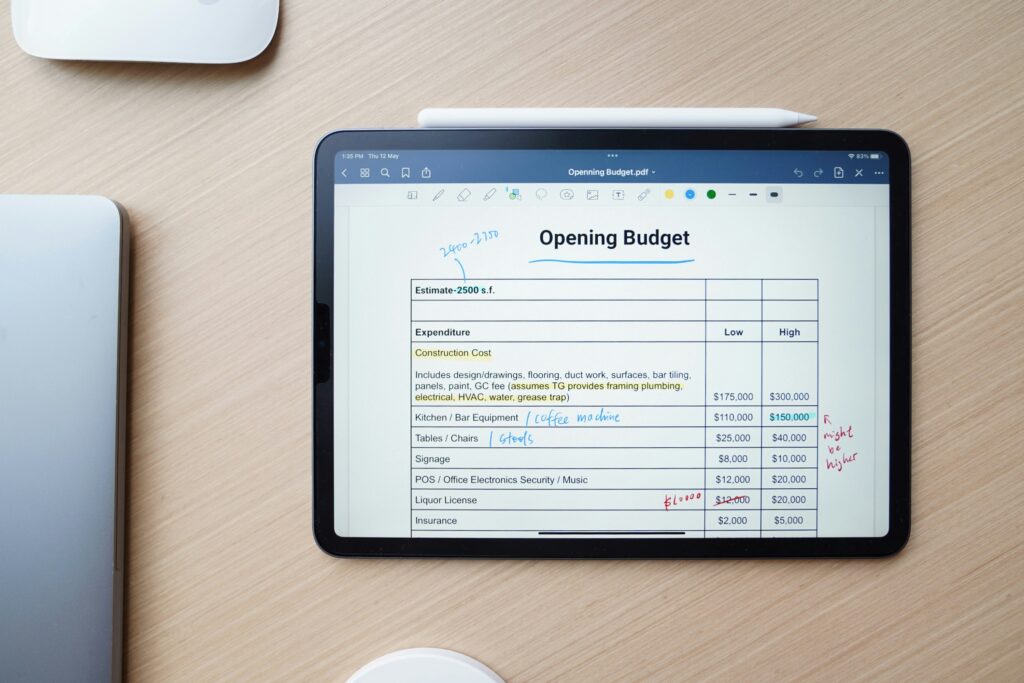

Step 3: Assign Dollar Amounts to Every Category

This is where zero-based budgeting gets specific. Instead of general limits, assign exact amounts.

Start with fixed expenses: These are easiest because the amounts don’t change.

Estimate variable expenses: Use recent spending history as your starting point, then adjust based on your priorities.

Prioritize financial goals: Treat savings and extra debt payments like essential bills that must be paid.

allocation strategies:

- Essential expenses first: Housing, utilities, food, transportation, insurance, minimum debt payments

- Financial goals second: Emergency fund, retirement, debt elimination

- Lifestyle expenses third: Entertainment, dining out, hobbies, personal purchases

- Miscellaneous last: Small buffer for unexpected expenses

Example allocation process:

- Income: $4,000

- Essential expenses: $2,400 (leaves $1,600)

- Financial goals: $600 (leaves $1,000)

- Lifestyle expenses: $800 (leaves $200)

- Miscellaneous buffer: $200 (leaves $0)

Step 4: Track Spending Against Your Plan

Zero-based budgeting only works if you monitor actual spending against planned spending.

Daily tracking methods:

- Budgeting apps: YNAB, EveryDollar, or Mint

- Spreadsheet tracking: Google Sheets or Excel with categories matching your budget

- Envelope system: Physical cash for variable categories, digital tracking for fixed expenses

- Receipt collection: Save everything and input weekly or daily

What to track:

- Amount spent in each category

- Remaining balance in each category

- Categories that are over or under budget

- Patterns of overspending or underspending

Weekly review questions:

- Which categories are on track?

- Which categories need adjustment?

- Do I need to move money between categories?

- What unexpected expenses occurred?

Monthly adjustment process:

- Analyze which categories consistently go over or under budget

- Adjust future budgets based on actual spending patterns

- Celebrate categories where you stayed within budget

- Problem-solve categories where you consistently overspend

Step 5: Create Next Month’s Budget

Zero-based budgeting requires monthly planning because life changes regularly.

Pre-month planning process (do this 2-3 days before the new month):

- Review current month’s performance

- Identify known changes for next month (travel, special events, seasonal expenses)

- Adjust category amounts based on learning from current month

- Ensure income minus all allocations equals zero

Common monthly adjustments:

- Seasonal variations: Higher utilities in summer/winter, different entertainment spending

- Special occasions: Birthdays, anniversaries, holidays require temporary budget shifts

- Income changes: Bonuses, raises, or reduced hours affect available allocations

- Goal achievement: When you reach savings targets, reallocate that money to new goals

automation opportunities:

- Set up automatic transfers for savings goals and debt payments

- Use autopay for fixed expenses to reduce tracking burden

- Schedule bill payments to align with your budget timeline

- Set up alerts when categories approach their limits

Advantages of Zero-Based Budgeting

Understanding these benefits helps you stick with the system when it feels challenging:

Complete Financial Transparency

The advantage: You always know exactly where your money goes because every dollar has been consciously assigned.

Real-world impact: No more end-of-month confusion about missing money. No more surprise discoveries of forgotten subscriptions or unexplained spending.

Personal example: Client Jennifer discovered she was spending $380 monthly on “small purchases” that added up to significant money. Zero-based budgeting made these expenses visible and controllable.

Forced Priority Setting

The advantage: Limited money forces you to choose what matters most rather than trying to fund everything.

Real-world impact: Instead of wondering why you never reach financial goals, you make deliberate trade-offs between competing priorities.

Decision-making example: Want to increase dining out budget? You must consciously reduce entertainment budget or find the money elsewhere. Every choice is visible and intentional.

Prevents Budget Creep

The advantage: Because every dollar is allocated, lifestyle inflation requires conscious decisions rather than happening accidentally.

Real-world impact: Salary increases and windfalls get directed toward priorities instead of disappearing into general spending.

Builds Financial Discipline

The advantage: The system naturally develops spending awareness and impulse control.

Real-world impact: Over time, you become naturally more conscious of spending decisions even outside the formal budget process.

Accelerates Goal Achievement

The advantage: Financial goals get treated like essential bills, ensuring consistent progress.

Real-world impact: People using zero-based budgeting typically reach savings and debt elimination goals 30-50% faster than those using looser budgeting methods.

Disadvantages of Zero-Based Budgeting

Every system has limitations. Understanding these helps you decide if zero-based budgeting fits your situation:

Time Investment Required

The challenge: Zero-based budgeting requires more setup time and ongoing tracking than simpler methods.

Time breakdown:

- Initial setup: 2-3 hours to create first budget

- Monthly planning: 30-60 minutes each month

- Weekly tracking: 15-30 minutes each week

- Daily awareness: 2-5 minutes for expense logging

Mitigation strategies:

- Use apps that automate transaction importing and categorization

- Start with broader categories and add detail gradually

- Focus on high-impact categories rather than tracking every penny perfectly

Less Flexibility for Spontaneous Spending

The challenge: The system can feel restrictive when opportunities for unplanned purchases arise.

Real-world scenario: Friends invite you to an expensive dinner, but your dining out category is already spent for the month.

Mitigation strategies:

- Include a “miscellaneous” or “unexpected opportunities” category in your budget

- Build flexibility by slightly underspending in some categories to create room for adjustments

- Remember that discipline in small areas creates freedom for bigger priorities

Challenging with Variable Income

The challenge: Irregular income makes it difficult to assign specific dollar amounts to categories.

Who this affects: Freelancers, commission-based salespeople, seasonal workers, small business owners.

Alternative approaches for variable income:

- Use your lowest monthly income as the baseline for zero-based budgeting

- Create multiple budget versions for different income levels

- Focus on percentage-based allocations rather than fixed dollar amounts

- Build larger emergency funds to smooth income variations

May Discourage Long-Term Thinking

The challenge: Monthly focus can sometimes conflict with long-term financial planning.

Example: Focusing intensely on monthly categories might cause you to underfund retirement savings or other long-term goals.

Prevention strategies:

- Include long-term goals as non-negotiable “bills” in your monthly budget

- Regularly review annual and multi-year financial objectives

- Use goal-tracking tools that connect monthly actions to long-term outcomes

Potential for Rigidity

The challenge: Some people become so focused on staying within categories that they make poor overall financial decisions.

Example: Refusing to pay for car maintenance because the transportation category is “spent,” then facing a major repair bill later.

Balance strategies:

- Include buffer categories for truly unexpected expenses

- Remember that budgets serve you, not the other way around

- Be willing to adjust category amounts when life circumstances change

Advanced Zero-Based Budgeting Strategies

Once you’ve mastered the basics, these advanced techniques can optimize your system:

The Rolling Categories Method

How it works: Instead of starting each category from zero each month, allow unused amounts to roll over to the next month.

Best for: Categories with irregular timing like car maintenance, gifts, or clothing.

Example: Budget $100 monthly for car maintenance. If you spend $50 in January, you have $150 available in February.

Priority-Based Zero Budgeting

How it works: Rank all expenses by priority, then fund categories in order until money runs out.

Process:

- List all expenses and goals in priority order

- Allocate money to highest priorities first

- Continue until all income is allocated

- Lower-priority items get funded only after higher priorities are covered

Advantage: Ensures your most important financial objectives always get funded first.

The Percentage Hybrid Approach

How it works: Use percentages for major categories, then zero-based budgeting within those categories.

Example:

- 50% for needs ($2,000)

- 30% for wants ($1,200)

- 20% for savings/debt ($800)

- Then create zero-based allocations within each major category

Seasonal Zero-Based Budgeting

How it works: Create different zero-based budgets for different seasons or life periods.

Examples:

- Summer budget (higher utilities, vacation expenses)

- Winter budget (holiday spending, heating costs)

- School year budget (education expenses, different schedules)

Goal-Focused Zero Budgeting

How it works: Organize your entire budget around achieving specific financial goals.

Process:

- Identify your top 3-5 financial goals

- Calculate monthly amounts needed for each goal

- Build the rest of your budget around funding these goals

- Treat goal funding as non-negotiable “bills”

Technology Tools for Zero-Based Budgeting

The right tools make zero-based budgeting much easier to implement and maintain:

Specialized Zero-Based Budgeting Apps

- Designed specifically for zero-based budgeting

- Excellent educational resources and community

- Real-time syncing across devices

- $14.99 monthly but most users save much more than the cost

- Dave Ramsey’s zero-based budgeting app

- Free version available with manual entry

- Premium version ($129/year) includes bank syncing

- Simple interface focused on giving every dollar a job

General Budgeting Apps with Zero-Based Features

Mint:

- Free comprehensive financial tracking

- Can be adapted for zero-based budgeting

- Automatic transaction categorization

- Not specifically designed for zero-based budgeting but functional

- Better for investment tracking and net worth monitoring

- Can supplement zero-based budgeting for overall financial picture

- Free to use with optional paid advisory services

Spreadsheet Solutions

Google Sheets or Excel:

- Complete customization control

- Can create complex zero-based budgeting systems

- Free (Google Sheets) or low cost (Excel)

- Requires more setup but offers unlimited flexibility

Pre-built templates:

- Many free zero-based budgeting templates available online

- Can be customized to match your specific categories and goals

- Good starting point for people comfortable with spreadsheets

Banking Integration

High-yield savings accounts:

- Ally Bank for emergency funds and goal savings

- Marcus by Goldman Sachs for competitive rates

- Multiple accounts for different budget categories

Investment accounts:

- Vanguard for retirement and long-term investing

- Fidelity for zero-fee funds and comprehensive options

Common Zero-Based Budgeting Mistakes

Avoid these pitfalls to accelerate your success:

Over-Complicating the Initial Setup

The mistake: Creating too many detailed categories and trying to track every penny perfectly from day one. The solution: Start with 8-12 broad categories and add detail gradually as you learn your spending patterns.

Unrealistic Category Amounts

The mistake: Setting category amounts based on wishful thinking rather than actual spending history. The solution: Review 2-3 months of actual spending to set realistic initial category amounts, then adjust based on your priorities.

Perfectionism Paralysis

The mistake: Abandoning zero-based budgeting after overspending in one category during one month. The solution: Expect a 2-3 month learning curve and focus on improvement rather than perfection.

Ignoring the Need for Buffers

The mistake: Allocating every penny with no room for truly unexpected expenses. The solution: Include a 5-10% buffer category for miscellaneous expenses and genuine surprises.

Neglecting to Adjust for Life Changes

The mistake: Using the same budget month after month without considering changing circumstances. The solution: Review and adjust your budget monthly, considering seasonal changes, life events, and shifting priorities.

Zero-Based Budgeting Success Tips

These strategies increase your chances of long-term success:

Start with High-Impact Categories

Focus your initial efforts on the categories that have the biggest financial impact: housing, food, and transportation typically account for 60-70% of most budgets.

Use the Envelope System for Problem Categories

If you consistently overspend in certain categories, use physical cash or separate checking accounts to create natural spending limits.

Celebrate Small Wins

Acknowledge months when you successfully stick to your budget, even if you’re not perfect in every category. Positive reinforcement strengthens budgeting habits.

Find Your Accountability System

Share your budgeting goals with supportive friends or family members, or join online communities focused on zero-based budgeting.

Automate What You Can

Set up automatic transfers for savings goals and automatic payments for fixed expenses to reduce the daily decision-making burden.

Final Thoughts

Zero-based budgeting isn’t just a money management technique. It’s a mindset shift that transforms you from a passive money spender into an active money director.

The system works because it eliminates the financial mystery that keeps most people stuck. Instead of wondering where your money goes, you tell it where to go before you spend it.

The most successful zero-based budgeters aren’t the ones who track every penny perfectly. They’re the ones who consistently give every dollar a job, even if they have to adjust those jobs along the way.

Your financial transformation starts with the decision to make every dollar intentional. Whether you’re trying to pay off debt, build an emergency fund, save for a house, or just stop wondering where your money goes, zero-based budgeting provides the structure and accountability you need.