10 Best Budgeting Apps for Couples: Manage Money Together Without the Drama

Money fights are relationship killers. I’ve seen couples who were madly in love turn into financial enemies because they couldn’t get on the same page about spending, saving, and financial goals.

Here’s what I learned after coaching hundreds of couples through their money challenges: the problem isn’t usually income level or even spending habits. It’s the lack of a shared system for managing money together.

When my wife and I first got serious about our finances, we tried the “let’s talk about money once a month” approach. Spoiler alert: it was a disaster. Those conversations always turned into arguments about who spent what and why our financial goals felt impossible.

Everything changed when we discovered budgeting apps designed specifically for couples. Suddenly, we had transparency, shared goals, and automated systems that prevented most money conflicts before they started.

Today, I’m sharing the 10 best budgeting apps for couples, based on real-world testing, user reviews, and what actually works for maintaining financial harmony in relationships.

What Makes a Great Couples Budgeting App?

Not all budgeting apps work well for couples. Some are designed for individuals and become clunky when two people try to use them together. The best couples apps have specific features that make shared money management seamless.

Essential Features for Couple Success

Shared Access: Both partners can see the same information in real-time without passing phones back and forth or logging in and out of accounts.

Individual Privacy: Good apps balance transparency with personal autonomy, allowing some private spending categories while maintaining shared visibility on major expenses.

Goal Tracking: Couples need to see progress toward shared objectives like emergency funds, vacation savings, or debt payoff.

Expense Categorization: Clear spending categories help identify patterns and prevent the “where did all our money go?” conversations.

Bill Reminders: Automated alerts ensure nothing falls through the cracks when responsibilities are shared.

Communication Features: Some apps include messaging or commenting features that keep money conversations productive and documented.

What Doesn’t Work for Couples

Individual-focused apps: Apps designed for single users often lack sharing capabilities or make collaboration awkward.

Overly complex systems: Couples need apps that are intuitive for both partners, regardless of their tech comfort levels.

Expensive premium features: The best couple features should be available in free tiers, not locked behind expensive subscriptions.

Banking limitations: Apps that only work with certain banks create barriers when partners use different financial institutions.

Benefits of Using Budgeting Apps as a Couple

Before we dive into specific app recommendations, let’s talk about why digital tools transform couples’ financial relationships:

Eliminates Financial Secrets

The problem: Hidden spending creates trust issues and budget failures The solution: Shared apps provide automatic transparency without feeling like surveillance

Real example: Sarah discovered her husband was spending $300 monthly at convenience stores during his commute. Instead of fighting about it, they budgeted for commute expenses and found cheaper alternatives together.

Reduces Money Arguments

Traditional approach: Monthly budget meetings that turn into blame sessions App approach: Real-time information and automated tracking prevent most conflicts

The psychology: When both people can see the same data, arguments shift from “you spent too much” to “how can we adjust our plan?”

Automates Tedious Tasks

Manual method: Gathering receipts, updating spreadsheets, calculating balances App method: Automatic transaction importing, categorization, and progress tracking

Time savings: Couples report saving 2-4 hours monthly on financial administrative tasks.

Improves Goal Achievement

Shared visibility: Both partners see progress toward common goals in real-time Motivation boost: Watching savings grow or debt decrease creates momentum Accountability: Harder to ignore financial commitments when your partner can see the numbers

Prevents Duplicate Efforts

The problem: Both partners paying the same bill or neither paying it The solution: Shared calendars, bill reminders, and payment tracking

Enables Better Communication

Before apps: “I think we spent about $400 on groceries last month” With apps: “We spent exactly $387 on groceries, which is $37 under budget”

Specific data makes financial conversations more productive and less emotional.

10 Best Budgeting Apps for Couples

Here are the top apps that make shared money management simple and effective:

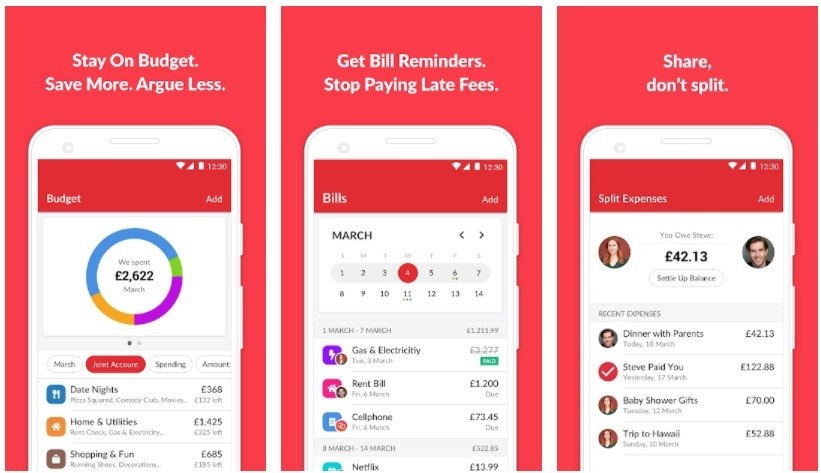

1. Honeydue (Best Overall for Couples)

Why it’s perfect for couples: Honeydue was built specifically for couples from the ground up. Every feature considers two-person financial management.

Key features:

- Shared account visibility with individual privacy controls

- Bill reminders that can be assigned to either partner

- Spending alerts that notify both people about large purchases

- In-app messaging for financial discussions

- Category-based budgeting with customizable limits

- Free to use with optional premium features

What makes it special:

- Privacy balance: You can choose which accounts to share and which to keep private

- Communication tools: Comment on transactions and send messages about spending

- Bill splitting: Easily divide expenses and track who owes what

Potential drawbacks:

- Limited investment tracking compared to more comprehensive apps

- Fewer advanced reporting features than some alternatives

Best for: Couples who want transparency without giving up all financial privacy, and those who value built-in communication features.

User experience: Clean, intuitive interface that doesn’t overwhelm non-tech-savvy partners. Setup takes about 15 minutes per person.

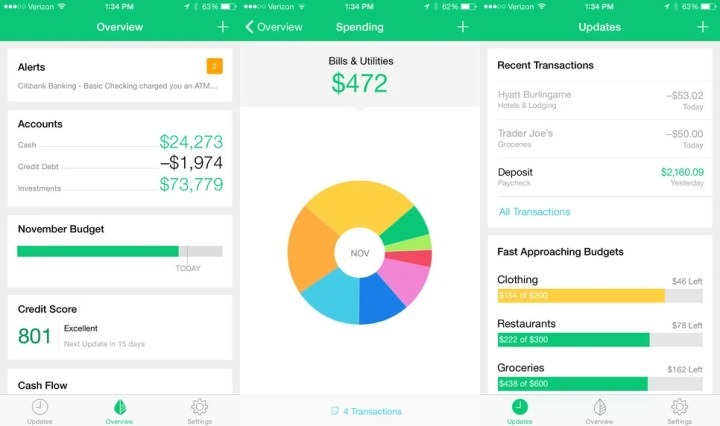

2. Mint (Best Free Comprehensive Option)

Why couples love it: Mint provides a complete financial picture at no cost, with excellent sharing capabilities.

Key features:

- Comprehensive expense tracking and categorization

- Bill reminders and due date alerts

- Credit score monitoring for both partners

- Goal setting and progress tracking

- Investment account integration

- Completely free with no premium tiers

Sharing capabilities:

- Create joint login credentials for shared access

- Set up alerts that notify both partners

- Track shared goals like emergency funds or vacation savings

Strengths:

- No cost: Full features available without subscription fees

- Comprehensive: Covers budgeting, bills, goals, investments, and credit scores

- Established platform: Owned by Intuit (makers of TurboTax and QuickBooks)

Considerations:

- Originally designed for individuals, so couple-specific features feel like additions rather than core functionality

- Some users report occasional syncing issues with bank accounts

- Ad-supported, which some couples find distracting

Best for: Couples who want comprehensive financial management without paying subscription fees, and those comfortable with individual apps that can be shared.

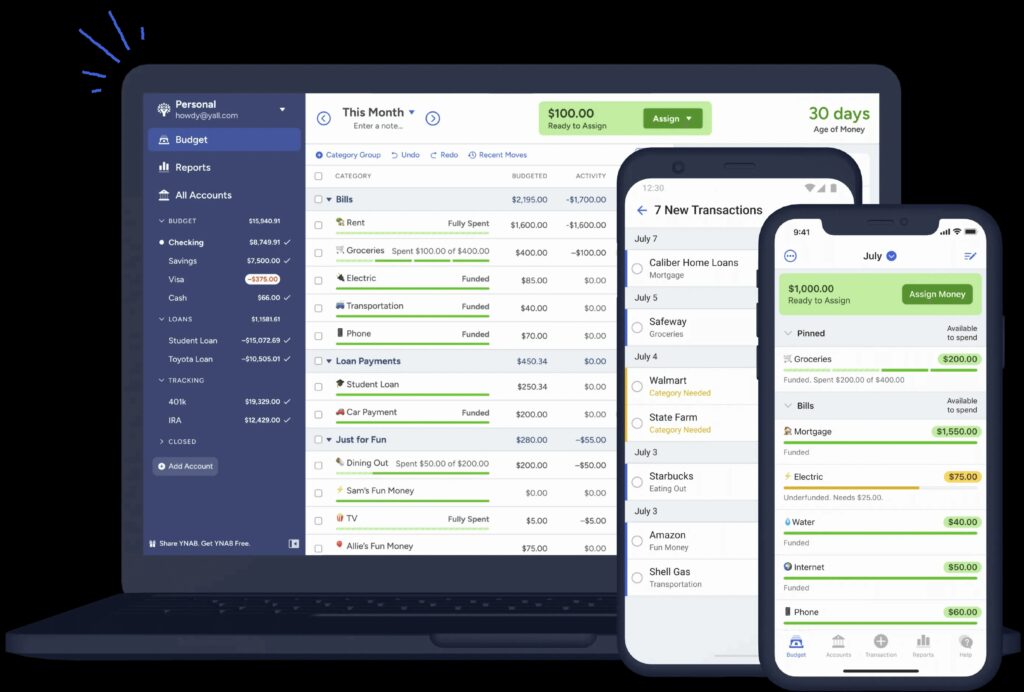

3. YNAB – You Need A Budget (Best for Serious Budgeters)

Why it works for couples: YNAB teaches a specific budgeting philosophy that, when both partners embrace it, creates incredible financial discipline.

The YNAB approach:

- Give every dollar a job before you spend it

- Embrace your true expenses (plan for irregular costs)

- Roll with the punches (adjust budgets when life happens)

- Age your money (break the paycheck-to-paycheck cycle)

Couple-specific benefits:

- Both partners can access the same budget simultaneously

- Changes sync in real-time across devices

- Excellent educational resources help couples learn together

- Goal tracking keeps both partners motivated

Investment required:

- $14.99 monthly or $99 annually

- Free trial available

- 34-day money-back guarantee

Why the cost is worth it:

- Users report saving their subscription fee within the first month

- Comprehensive education program included

- Active community of users sharing tips and success stories

- Regular webinars and educational content

Best for: Couples committed to learning proper budgeting principles, those struggling with overspending, and partners who want to build long-term wealth together.

4. Personal Capital (Best for Investment Tracking)

Couples with assets love it: Personal Capital provides comprehensive wealth tracking that’s perfect for couples building long-term financial security.

Key features:

- Net worth tracking across all accounts

- Investment performance analysis and fee tracking

- Retirement planning tools and projections

- Cash flow analysis and budgeting tools

- Free financial advisory consultations available

Why couples choose it:

- Complete picture: See all assets, debts, and investments in one place

- Retirement planning: Plan for shared retirement goals with specific projections

- Investment optimization: Identify high-fee investments and suggest alternatives

- Free tier: Comprehensive features available without paying

Couple workflow:

- Link all shared accounts (checking, savings, investments, retirement)

- Set up shared financial goals (retirement, house down payment, etc.)

- Review monthly progress together using detailed reports

- Use cash flow tools to optimize spending and saving

Considerations:

- More focused on wealth tracking than day-to-day budgeting

- May feel overwhelming for couples just starting their financial journey

- Free advisory consultations come with sales pitches for paid services

Best for: Couples with significant assets, those focused on investment optimization, and partners planning for retirement together.

5. EveryDollar (Best for Dave Ramsey Fans)

The Dave Ramsey approach: EveryDollar implements Dave Ramsey’s zero-based budgeting philosophy in an app designed for couples.

Core philosophy:

- Income minus expenses equals zero (every dollar gets assigned)

- Focus on debt elimination using the debt snowball method

- Build emergency funds before investing

- Use cash envelopes for discretionary spending

Couple features:

- Shared budget creation and editing

- Progress tracking for debt elimination goals

- Built-in educational content from Dave Ramsey

- Integration with Financial Peace University curriculum

Free vs. Premium:

- Free version: Manual transaction entry, basic budgeting tools

- Premium ($129/year): Automatic bank syncing, expense tracking, premium customer support

Why couples choose it:

- Proven system: Dave Ramsey’s methods have helped millions of couples

- Debt focus: Excellent tools for couples paying off credit cards, student loans, etc.

- Educational content: Learn proper financial principles together

- Community support: Access to like-minded couples on similar journeys

Best for: Couples following Dave Ramsey’s Financial Peace program, those focused on debt elimination, and partners who want a structured approach to budgeting.

6. Goodbudget (Best Envelope Method App)

Digital envelope system: Goodbudget brings the classic envelope budgeting method into the digital age, perfect for couples who want tactile spending control.

How envelope budgeting works:

- Divide monthly income into category “envelopes”

- Spend only what’s allocated to each envelope

- When an envelope is empty, stop spending in that category

- Roll over unused amounts to next month or reallocate

Couple benefits:

- Both partners can see envelope balances in real-time

- Spending in one envelope immediately updates for both people

- Prevents overspending because limits are visual and clear

- Works without connecting to bank accounts (privacy for those who want it)

Free vs. Premium:

- Free: 10 envelopes, 1 account, limited device sync

- Plus ($7/month or $60/year): Unlimited envelopes, 5 accounts, full sync, email support

Why couples love it:

- Visual spending limits: Easy to see exactly how much is left in each category

- No overspending: Built-in guardrails prevent budget busting

- Simple concept: Easy for both partners to understand and use

- Privacy option: Can be used without linking bank accounts

Best for: Couples who struggle with overspending, those who like visual budget management, and partners who want spending limits that can’t be accidentally exceeded.

7. PocketGuard (Best for Overspending Prevention)

Spending control focus: PocketGuard answers the question “How much can I spend?” in real-time, perfect for couples who struggle with overspending.

Key concept: After accounting for bills, savings goals, and necessities, PocketGuard shows your “In My Pocket” amount available for discretionary spending.

Couple features:

- Both partners see the same “safe to spend” amounts

- Shared spending goals and progress tracking

- Bill tracking to prevent double payments

- Spending alerts when approaching limits

Unique advantages:

- Simplicity: Focuses on one key question rather than complex budgeting

- Real-time updates: Spending limits adjust immediately after purchases

- Automatic categorization: Uses AI to categorize expenses without manual input

- Goal integration: Spending limits automatically adjust based on savings commitments

Free vs. Premium:

- Free: Basic spending tracking, bill reminders, simple goals

- Plus ($7.95/month): Debt payoff planning, export capabilities, custom categories

Best for: Couples who find traditional budgeting too complex, those who primarily need spending control, and partners who want immediate feedback on purchase decisions.

8. Zeta (Best for Joint Account Management)

Built for couples: Zeta combines budgeting apps with actual banking services designed specifically for couples.

Unique offering:

- FDIC-insured joint checking account with two debit cards

- Integrated budgeting and expense tracking

- Shared financial goals and savings tracking

- Bill pay and money management tools

How it works:

- Open a joint Zeta account for shared expenses

- Each partner gets a debit card connected to the same account

- Set spending limits and categories within the app

- Track expenses automatically as they occur

Advantages:

- Integrated banking: Budgeting app and bank account in one platform

- Real-time tracking: Expenses appear immediately when either partner spends

- Spending controls: Set limits that apply to both debit cards

- Goal savings: Automatically save toward shared objectives

Considerations:

- Requires opening a new bank account (may not want to switch banks)

- Newer platform with fewer features than established apps

- Limited investment tracking compared to comprehensive apps

Best for: Couples starting fresh with shared finances, those who want integrated banking and budgeting, and partners comfortable with newer fintech platforms.

9. Tiller (Best for Spreadsheet Lovers)

Automated spreadsheets: Tiller automatically populates Google Sheets or Excel with your financial data, perfect for couples who want customization with automation.

How it works:

- Connects to your bank accounts and credit cards

- Automatically imports transactions into spreadsheet templates

- Provides pre-built budgeting and tracking templates

- Allows complete customization of categories and reporting

Why couples choose it:

- Customization: Create budgets and reports that match your specific needs

- Familiar tools: Uses Google Sheets or Excel that many couples already know

- Data control: Your data stays in your own spreadsheets, not on third-party servers

- Advanced reporting: Create detailed analysis beyond what apps typically offer

Pricing: $6.58 monthly (billed annually at $79) with 30-day free trial

Learning curve: Requires spreadsheet comfort and setup time, but provides unlimited flexibility once configured.

Best for: Couples comfortable with spreadsheets, those who want detailed financial analysis, and partners who prefer data control over convenience.

10. Simplifi by Quicken (Best for Comprehensive Management)

Professional-grade features: Simplifi provides comprehensive financial management with couple-friendly features at a reasonable price.

Key features:

- Comprehensive expense tracking and budgeting

- Bill management and payment reminders

- Goal setting and progress monitoring

- Investment tracking and performance analysis

- Cash flow forecasting and planning tools

Couple advantages:

- Shared access: Both partners can use the same account simultaneously

- Complete picture: Integrates banking, investments, bills, and goals

- Professional tools: Features typically found in expensive software

- Reliable syncing: Consistently updates from bank accounts

Pricing: $3.99 monthly or $35.88 annually (often promotional pricing available)

Why it’s worth considering:

- More comprehensive than free apps

- Less expensive than premium alternatives

- Reliable platform backed by established company

- Good balance of features and simplicity

Best for: Couples who want comprehensive features without premium pricing, those who need reliable bank syncing, and partners who want professional-grade tools with simple interfaces.

How to Choose the Right App for Your Relationship

With so many great options, how do you pick the best budgeting app for your specific situation?

Consider Your Financial Situation

Just starting out: Mint or Honeydue provide good basic features without overwhelming complexity

Paying off debt: EveryDollar or YNAB focus specifically on debt elimination and financial discipline

Building wealth: Personal Capital or Simplifi offer comprehensive investment tracking and planning

Chronic overspenders: PocketGuard or Goodbudget provide built-in spending controls

Evaluate Your Tech Comfort Levels

Both partners tech-savvy: YNAB or Tiller offer advanced features and customization

One partner prefers simplicity: Honeydue or PocketGuard focus on ease of use

Different comfort levels: Mint or Simplifi balance comprehensive features with intuitive interfaces

Assess Your Privacy Preferences

Complete transparency: Mint, YNAB, or Personal Capital with shared logins

Some privacy: Honeydue allows selective sharing of accounts and information

Traditional approach: Goodbudget can work without linking bank accounts

Factor in Your Budget for Apps

Free options: Mint, Personal Capital, or free tiers of other apps

Worth paying for: YNAB ($99/year) or Simplifi ($36/year) offer significant value

Premium features: Consider whether advanced features justify subscription costs

Setting Up Your Chosen App for Couple Success

Once you’ve selected an app, follow these steps to ensure both partners get maximum benefit:

Initial Setup Strategy

Do it together: Both partners should be involved in initial account setup and configuration

Start simple: Begin with basic categories and features, then add complexity gradually

Agree on categories: Discuss spending categories that make sense for your lifestyle

Set shared goals: Input common objectives like emergency funds, vacations, or debt payoff

Establish App Usage Rules

Regular check-ins: Schedule weekly or monthly app reviews together

Communication protocols: Decide when to discuss large purchases or budget adjustments

Responsibility division: Determine who handles which aspects of financial management

Privacy boundaries: Agree on what information to share and what to keep individual

Integration with Existing Systems

Bank account strategy: Decide whether to maintain separate accounts, combine everything, or use hybrid approach

Bill payment coordination: Use app features to prevent duplicate payments or missed bills

Goal alignment: Ensure app goals match your actual financial priorities

Troubleshooting Common Issues

Syncing problems: Most apps have occasional bank connection issues – plan for manual updates when needed

Category disagreements: Start broad and refine categories based on actual usage patterns

Motivation differences: Find app features that engage both partners, even if they prefer different aspects

Advanced Tips for Couples Using Budget Apps

Once you’re comfortable with basic app usage, these strategies can enhance your success:

Automation Strategies

Automatic transfers: Set up recurring transfers to savings goals directly from your banking app

Bill payment automation: Use your bank’s bill pay features in conjunction with app tracking

Alert customization: Configure app notifications to prevent information overload while catching important issues

Goal Setting Techniques

SMART goals: Make app goals Specific, Measurable, Achievable, Relevant, and Time-bound

Progress celebrations: Use app milestones to celebrate financial wins together

Goal prioritization: Use app features to focus on most important objectives first

Communication Enhancement

Monthly app dates: Schedule regular times to review app data and discuss financial progress

Data-driven discussions: Use app reports to have objective conversations about spending patterns

Problem-solving focus: When issues arise, use app data to find solutions rather than assign blame

Common Mistakes Couples Make with Budgeting Apps

Avoid these pitfalls to maximize your app success:

Setup Mistakes

Perfectionism: Trying to categorize everything perfectly from day one instead of starting simple

Over-complexity: Adding too many categories, goals, or features initially

Unequal involvement: One partner doing all setup while the other remains disengaged

Usage Mistakes

Inconsistent checking: Apps only work when both partners use them regularly

Ignoring alerts: Dismissing app notifications without addressing underlying issues

Fighting over data: Using app information to blame rather than problem-solve

Goal-Setting Mistakes

Unrealistic expectations: Setting savings or debt payoff goals that are impossible to achieve

Too many goals: Spreading focus across so many objectives that none get adequate attention

Static goals: Never adjusting goals as life circumstances change

Integrating Apps with Your Overall Financial Strategy

Budgeting apps are tools, not complete financial solutions. Here’s how to integrate them with comprehensive financial planning:

Beyond Basic Budgeting

Emergency fund building: Use apps to track emergency savings progress, but also understand how much you need

Debt elimination: Apps can track progress, but you need strategies for payment prioritization and acceleration

Investment planning: Some apps track investments, but you need broader retirement and wealth-building strategies

Insurance planning: Apps may track insurance premiums but won’t help you determine appropriate coverage levels

Professional Financial Advice

When apps aren’t enough: Complex financial situations may require professional guidance beyond app capabilities

Using apps with advisors: Many financial planners can work with app data to provide better advice

DIY vs. professional help: Apps enable self-directed financial management but don’t replace professional expertise for complex situations

Final Thoughts

The right budgeting app can transform your relationship with money and each other. Instead of money being a source of stress and conflict, it becomes a tool for achieving shared dreams and building security together.

The key isn’t finding the “perfect” app. It’s finding the right app for your specific situation and actually using it consistently. Any of the apps on this list can dramatically improve couples’ financial management when both partners commit to the process.

Start with the app that feels most comfortable and addresses your biggest challenges. You can always switch later as your needs evolve or your financial situation changes.

Remember, the goal isn’t perfect budgeting. It’s better communication, shared progress toward common goals, and reduced financial stress in your relationship.

Your financial future together starts with the tools you choose today. Pick an app, set it up together, and start building the financial partnership you both deserve.